- United States

- /

- Capital Markets

- /

- NYSE:AMP

Ameriprise Financial (NYSE:AMP) Issues US$750M 5.2 Percent Senior Notes Due 2035

Reviewed by Simply Wall St

Ameriprise Financial (NYSE: AMP) recently secured $750 million through the issuance of 5.2% senior notes due in 2035, a move likely reflecting strategic financial planning to support growth or manage existing obligations. This development coincided with the company's share price rising 1.3% over the past week, a performance noteworthy against a broader market decline of 1.4%. The timing of this capital raising could correlate with a positive investor sentiment given the broader economic context, where recent benign inflation data helped lift market spirits. Overall, Ameriprise Financial's share price movement illustrates resilience in a fluctuating market environment that was still absorbing volatility from global economic challenges and domestic policy uncertainties. Such factors include recent tech sector volatility, which dominated headlines following Nvidia's earnings-related share movements.

Unlock comprehensive insights into our analysis of Ameriprise Financial stock here.

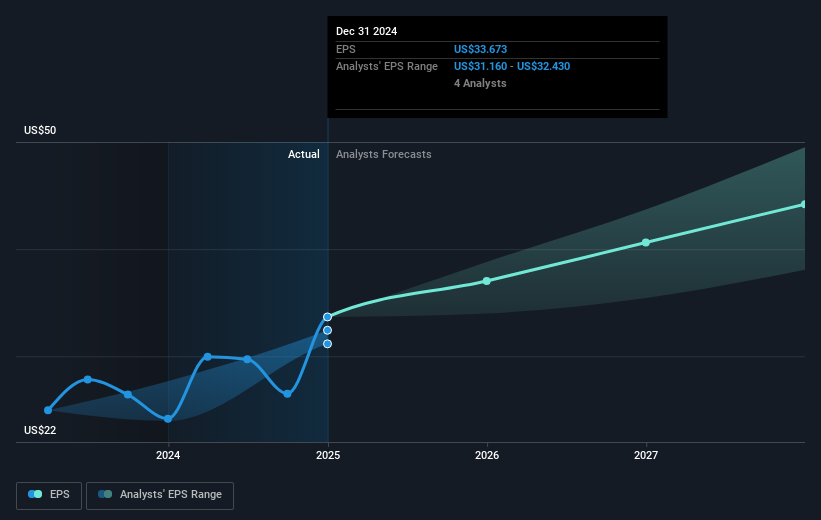

The past five years have seen Ameriprise Financial achieve a substantial total shareholder return of 363.42%, reflecting both share price appreciation and dividends. This performance stands out against various market conditions, including recent tech volatility, as mentioned earlier. Over the past year, Ameriprise matched the US Capital Markets industry's return of 31.7%, outperforming the overall US market's 15.3% return. Consistent dividend affirmations, like the increased quarterly cash dividend declared throughout 2024, play a critical role in shareholder returns.

Furthermore, Ameriprise Financial's proactive approach to share repurchases, notably the completion of 11.04 million shares repurchased since the program's initiation, has also contributed to its robust performance. Additionally, strategic client announcements, such as transitioning Kinecta Federal Credit Union's wealth management services, have reinforced the company's growth trajectory. These efforts, combined with strong earnings reports, underscore the upward trajectory of Ameriprise's share performance over the period.

- Understand the fair market value of Ameriprise Financial with insights from our valuation analysis—click here to learn more.

- Discover the key vulnerabilities in Ameriprise Financial's business with our detailed risk assessment.

- Is Ameriprise Financial part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Ameriprise Financial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMP

Ameriprise Financial

Operates as a diversified financial services company in the United States and internationally.

Outstanding track record, undervalued and pays a dividend.