- United States

- /

- Consumer Finance

- /

- NYSE:ALLY

Will Enterprise-Wide Adoption of Ally.ai Transform Ally Financial's (ALLY) Efficiency and Digital Leadership?

Reviewed by Simply Wall St

- In July 2025, Ally Financial granted over 10,000 employees access to its proprietary Ally.ai generative AI platform, aiming to enhance staff productivity through smarter automation, while reinforcing its leadership in responsible AI deployment across banking operations.

- This internal rollout underscores how Ally's commitment to employee education, strong risk controls, and technology adoption shapes its reputation as a forward-focused digital financial institution.

- We'll examine how Ally's enterprise-wide generative AI integration further supports its investment narrative centered on efficiency and disciplined digital transformation.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Ally Financial Investment Narrative Recap

To be a shareholder in Ally Financial, you need to believe in the company's ability to drive efficiency and growth as a digital-first lender, particularly through disciplined technology adoption and cost control. While the expansion of the Ally.ai platform reinforces Ally's tech leadership and may improve short-term productivity metrics, it does not materially change the most important short-term catalyst: maintaining origination yields and loan growth in a changing auto finance market. The largest risk remains Ally’s dependence on traditional auto lending amid rising competition and evolving consumer trends.

The recent announcement of Ally’s Q2 2025 earnings, with net income increasing to US$352 million from US$219 million a year prior, is especially relevant as operational efficiency initiatives, like wider Ally.ai adoption, may help control noninterest expenses and support margin stability. As Ally’s investment in AI-driven productivity gains momentum, investors should continue to watch for evidence that these efforts can insulate profitability against industry pressure and cyclicality.

Still, with intensifying competition from fintechs and established banks returning to auto lending, one ongoing risk every investor should understand is...

Read the full narrative on Ally Financial (it's free!)

Ally Financial's narrative projects $9.6 billion revenue and $1.8 billion earnings by 2028. This requires 12.0% yearly revenue growth and a $1.55 billion earnings increase from current earnings of $249.0 million.

Uncover how Ally Financial's forecasts yield a $45.88 fair value, a 18% upside to its current price.

Exploring Other Perspectives

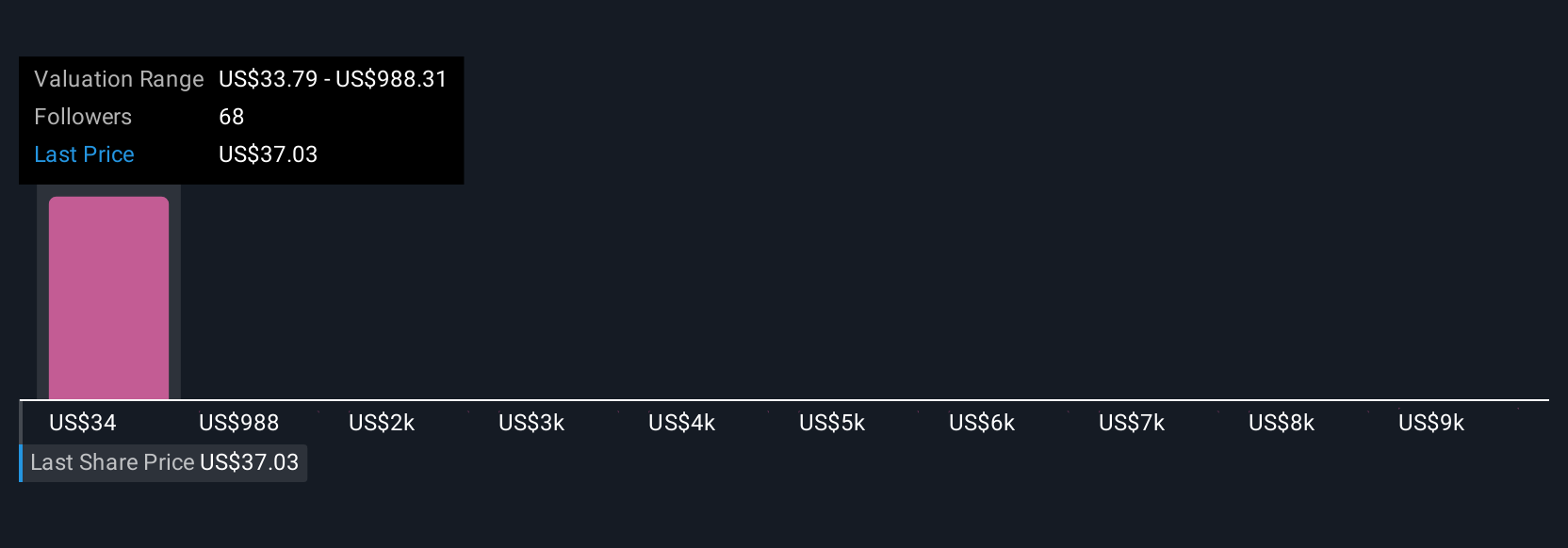

Simply Wall St Community members have published 11 fair value estimates for Ally Financial, ranging from US$33.79 up to a striking US$9,578.94. As you weigh these diverse assessments, remember that escalating competition in auto lending could influence the company's ability to grow and defend its earnings over time.

Explore 11 other fair value estimates on Ally Financial - why the stock might be worth 13% less than the current price!

Build Your Own Ally Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ally Financial research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ally Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ally Financial's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALLY

Ally Financial

A digital financial-services company, provides various digital financial products and services in the United States, Canada, and Bermuda.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives