- United States

- /

- Consumer Finance

- /

- NYSE:ALLY

Assessing Ally Financial’s 2025 Value After Recent 17% Rally

Reviewed by Bailey Pemberton

If you are wondering what to do next with Ally Financial stock, you are in good company. The past year has brought steady gains, with the share price up nearly 17% over the last twelve months and over 11% already this year. While the short-term numbers have seen minor dips, down just under 4% for the month and flat over the last week, the bigger picture reflects healthy long-term growth. Since 2019, Ally shares have surged more than 68%, and over three years the stock has advanced an impressive 54%.

Some of this momentum is fueled by ongoing optimism around the U.S. consumer finance sector. Lower-than-expected credit losses across the industry and continued loan demand have helped ease investor concerns, supporting a broader upward trend for established lenders like Ally. Of course, shifting interest rates and macroeconomic uncertainties mean the story is not just about unbroken growth, and the stock’s modest valuation movement lately shows investors are carefully weighing both potential risk and opportunity.

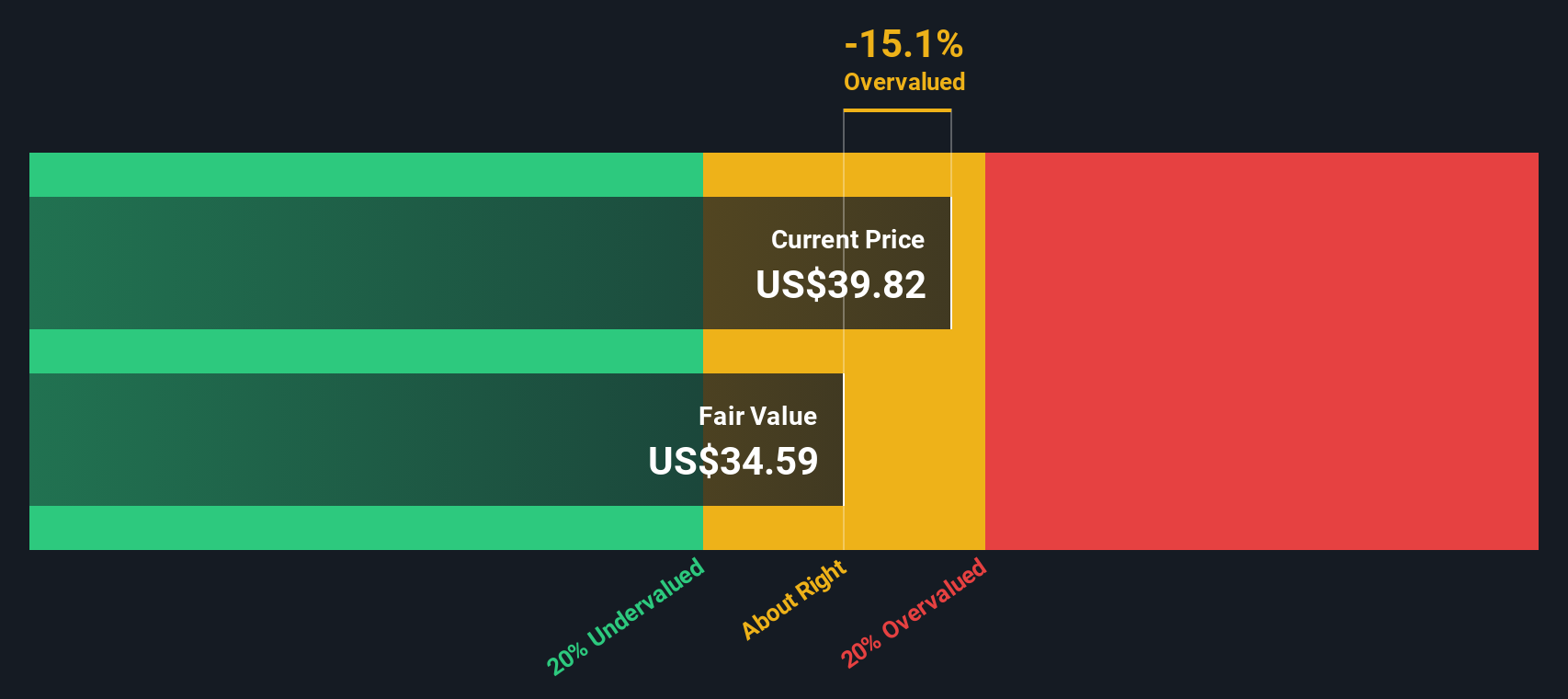

From a valuation perspective, Ally Financial currently scores a 1 out of 6 on our undervaluation checklist, meaning it is undervalued on just one key method. Does that make it a bargain or a pass at today’s price of $39.79? That question deserves a closer look. In the next sections, we will break down the valuation methods used, discuss where Ally does and does not look cheap, and reveal a better way to judge value that goes beyond checklists alone.

Ally Financial scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ally Financial Excess Returns Analysis

The Excess Returns valuation model helps determine whether a company's investments are generating returns greater than the cost to fund them. In other words, it measures if Ally Financial is producing economic profits above what shareholders could earn elsewhere with similar risk.

For Ally Financial, the model uses several key inputs. Its Book Value per share stands at $39.71. Analysts forecast a stable, long-term earnings per share (EPS) of $4.70, based on consensus estimates from ten analysts. The calculated Cost of Equity is $5.25 per share, which means the expected annual return shareholders require is slightly higher than what Ally is forecast to generate in sustainable earnings. This results in a small negative Excess Return of $-0.54 per share. The average Return on Equity over the long run is projected at 10.56%. Additionally, the Stable Book Value is expected to rise to $44.54 according to weighted estimates from nine analysts.

Considering all of these factors, the Excess Returns model arrives at an intrinsic value of $38.28 per share. Given the current share price of $39.79, this model suggests the stock is about 3.9% overvalued.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Ally Financial's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Ally Financial Price vs Earnings

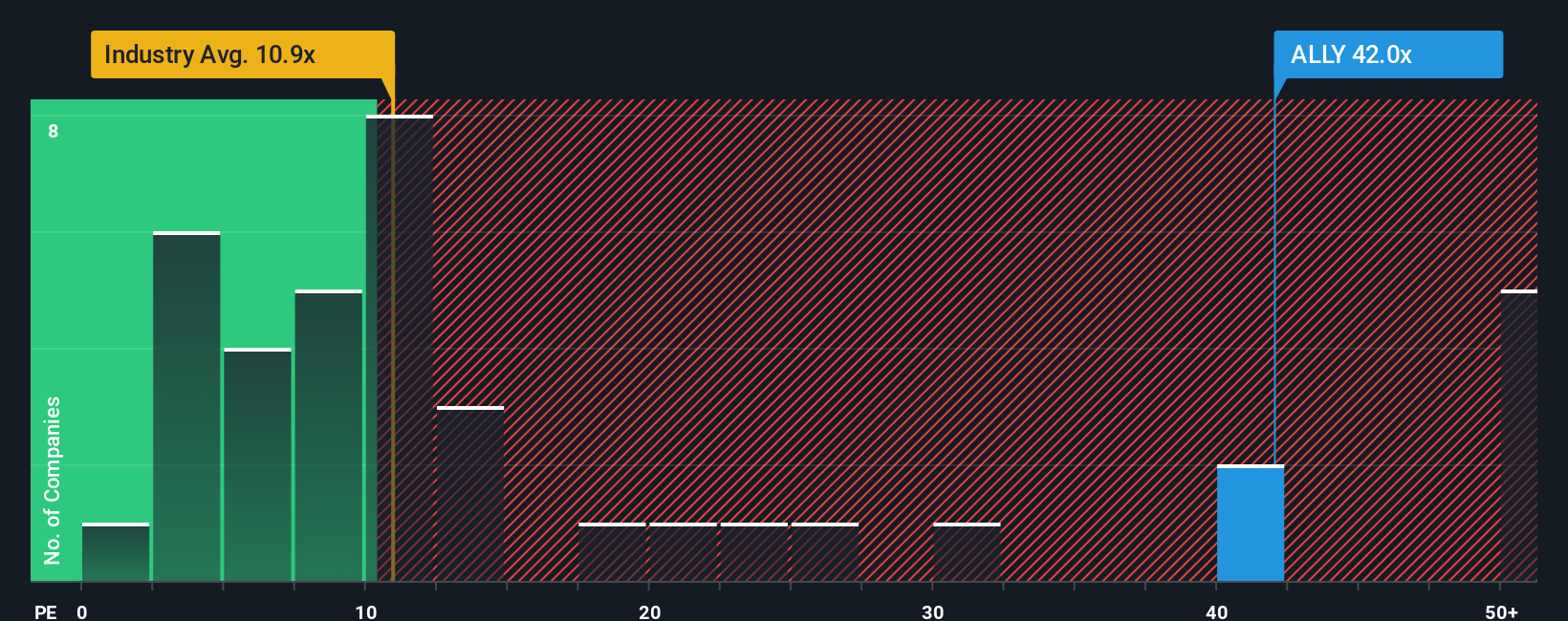

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies because it directly connects the stock price to a company’s bottom-line earnings. This makes it especially relevant for lenders like Ally Financial, whose profits provide a clear signal about performance and underlying business health.

Growth expectations and risk are crucial in determining what a “fair” PE ratio should be. Companies with stronger growth or lower perceived risk generally command higher PE multiples, while slower-growing or riskier firms are valued more conservatively. It is helpful to look beyond simple averages to get a clear read on value.

Currently, Ally Financial trades at a PE ratio of 37.8x. For context, the Consumer Finance industry average PE is 10.3x, and Ally’s peer group averages 50.7x. While these benchmarks say something about the broader sector landscape, they can miss company-specific factors. That is where Simply Wall St’s proprietary “Fair Ratio” comes in. This method calculates the PE multiple Ally deserves, factoring its earnings growth, risk profile, margins, industry, and size. For Ally, the Fair Ratio is 23.1x, considerably below the current market valuation.

The Fair Ratio approach gives a more tailored perspective than blanket peer or industry comparisons. It shows that much of the optimism priced into Ally’s shares could already be reflected in today’s market price.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

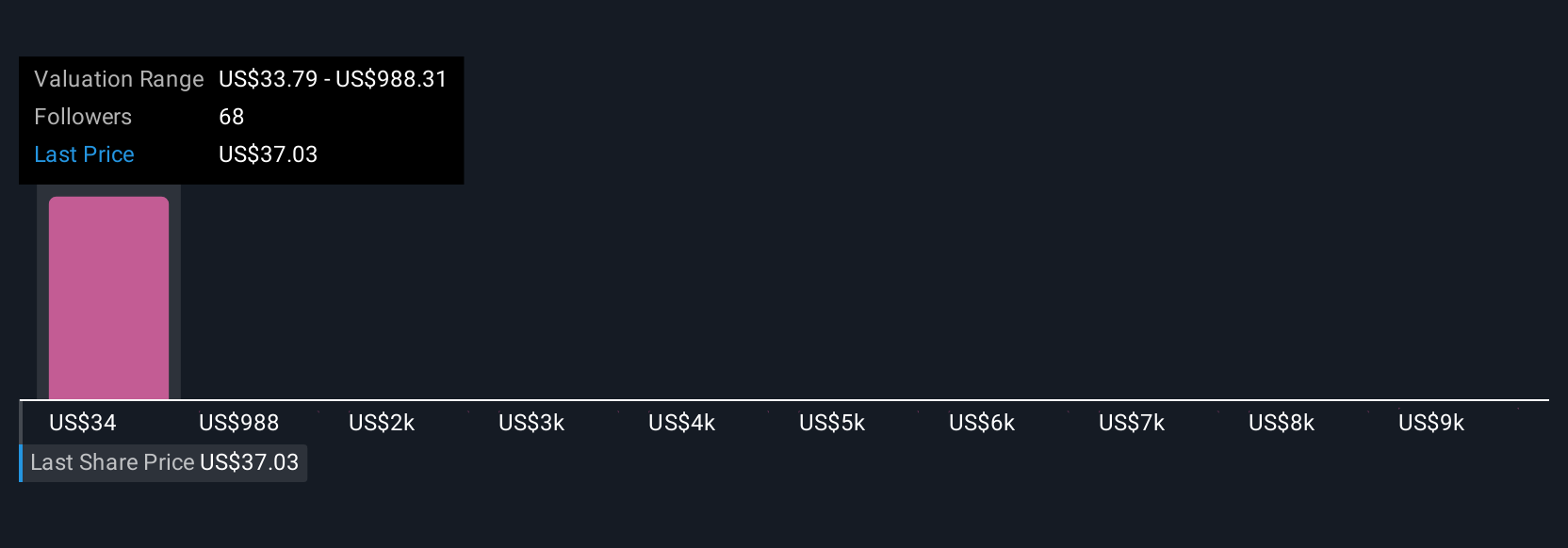

Upgrade Your Decision Making: Choose your Ally Financial Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is an investor’s way of linking Ally Financial’s business story to their own expectations for the company’s future financials and fair value. Instead of just relying on checklists or ratios, you can outline your perspective such as how you see Ally’s strategy, key risks, and market position, then forecast your own numbers for revenue, earnings, and profit margins. The Simply Wall St platform instantly translates these numbers into a fair value. Narratives make it easy for any investor, whether new or experienced, to organize their view and test what “makes sense” given Ally’s outlook. You can easily access and update Narratives in the Community page, where millions of investors track and compare viewpoints. This tool helps you confidently decide when to buy or sell by clearly showing your fair value compared to the latest share price. Narratives update automatically as new news, results, or company events come in. For example, based on different Narratives, one investor might expect Ally’s earnings to rebound strongly and set a fair value north of $59. Another, expecting more hurdles ahead, might set theirs near $39, so your investment decision becomes driven by your own story, not just consensus numbers.

Do you think there's more to the story for Ally Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALLY

Ally Financial

A digital financial-services company, provides various digital financial products and services in the United States, Canada, and Bermuda.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives