- United States

- /

- Semiconductors

- /

- NasdaqGS:PLAB

Discovering November 2024's Hidden Stock Gems in the United States

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.6%, contributing to a remarkable 32% increase over the past year, with earnings anticipated to grow by 15% annually. In this thriving environment, discovering stocks that combine strong fundamentals with growth potential can be key to identifying hidden gems in November 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

We'll examine a selection from our screener results.

John Marshall Bancorp (NasdaqCM:JMSB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: John Marshall Bancorp, Inc. is the bank holding company for John Marshall Bank, offering banking products and financial services, with a market capitalization of $329.17 million.

Operations: John Marshall Bancorp generates revenue primarily from its banking segment, totaling $53.07 million.

John Marshall Bancorp, with total assets of US$2.3 billion and equity of US$243.1 million, has demonstrated robust performance recently. The company reported a significant earnings growth of 90.3% over the past year, outpacing the industry average decline of 12.3%. Its liabilities are primarily low-risk customer deposits, accounting for 95%, which adds stability to its financial structure. Despite insufficient data on bad loans allowance, JMSB boasts high-quality earnings and trades at a substantial discount to fair value estimates by 45.7%. Recent quarterly results show net income rebounding to US$4.24 million from a loss last year, highlighting strong recovery dynamics.

Photronics (NasdaqGS:PLAB)

Simply Wall St Value Rating: ★★★★★★

Overview: Photronics, Inc. is a company that manufactures and sells photomask products and services across the United States, Taiwan, China, Korea, Europe, and other international markets with a market capitalization of approximately $1.61 billion.

Operations: Photronics generates revenue primarily from the manufacture of photomasks, amounting to $871.79 million. The company's market capitalization is approximately $1.61 billion.

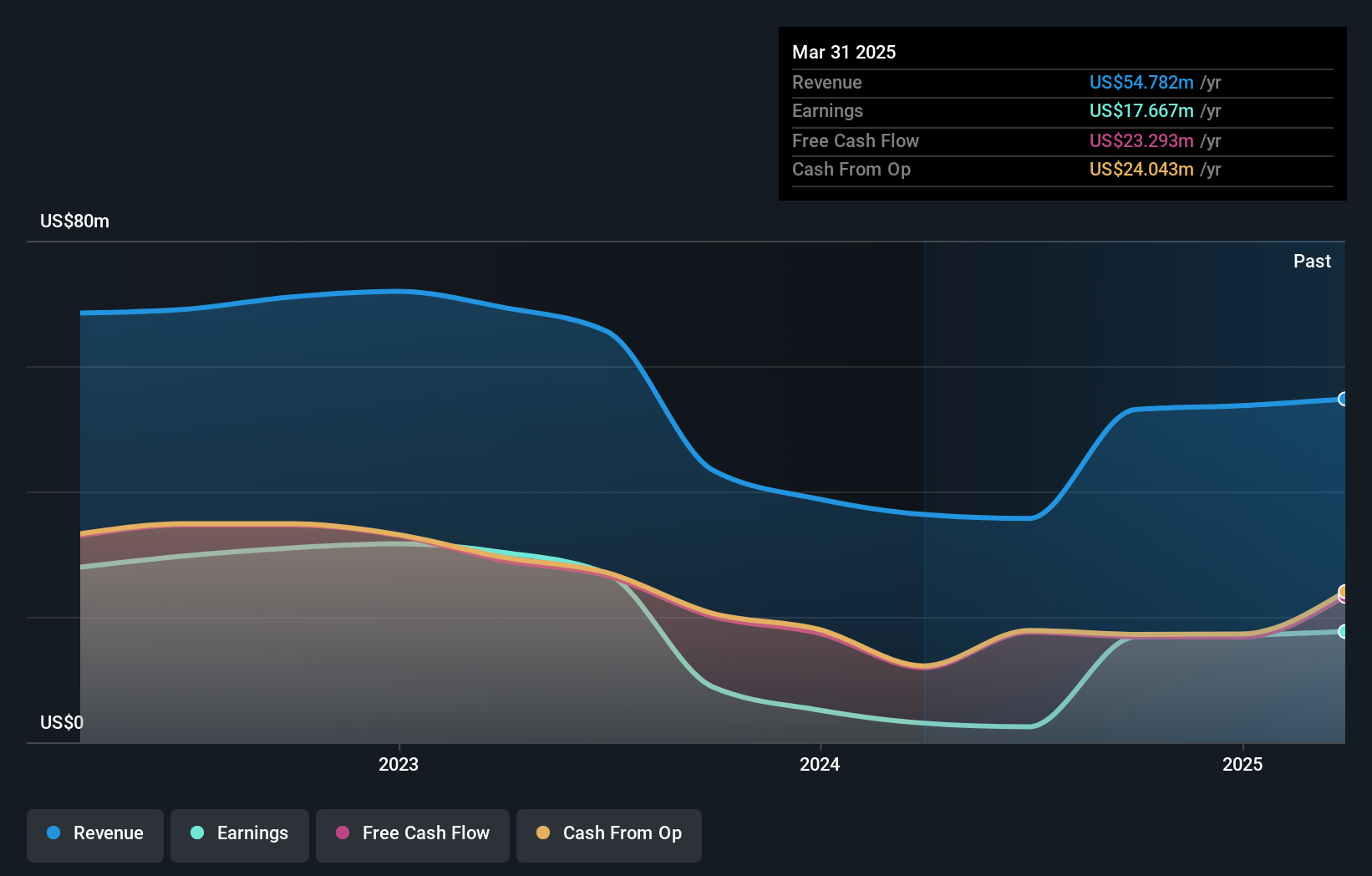

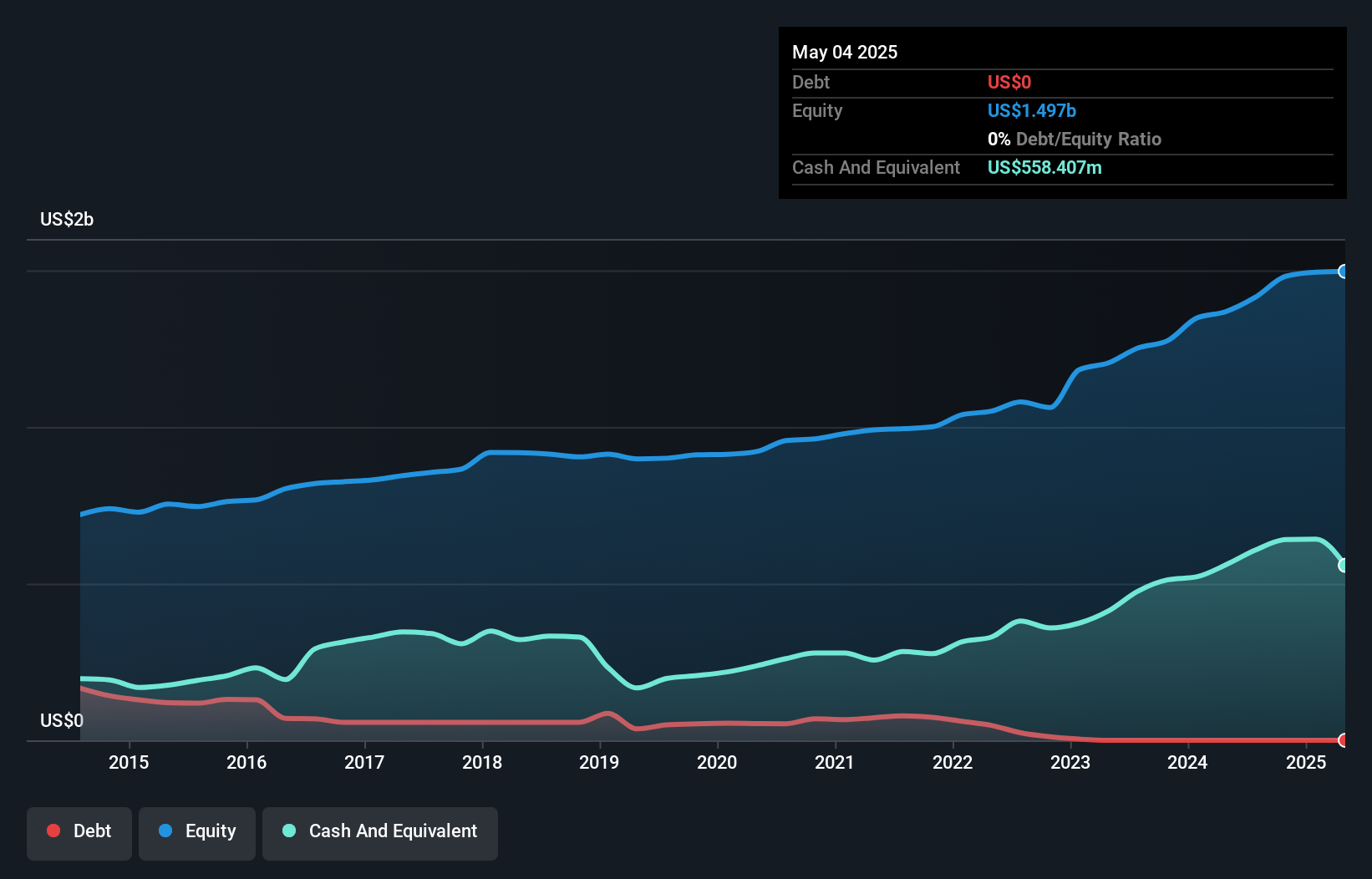

Photronics, a notable player in the semiconductor industry, has shown resilience with a 19.8% earnings growth over the past year, outpacing the industry's -3.6%. The company is debt-free and trades at 63.7% below its estimated fair value, indicating potential for value investors. Recent leadership changes include Christopher J. Lutzo joining as Vice President and General Counsel to bolster corporate governance and compliance efforts. Despite a slight dip in sales from $224 million to $211 million year-over-year for Q3 2024, net income rose from $27 million to $34 million, reflecting improved profitability amidst challenging market conditions.

Waterstone Financial (NasdaqGS:WSBF)

Simply Wall St Value Rating: ★★★★★☆

Overview: Waterstone Financial, Inc. is a bank holding company for WaterStone Bank SSB, offering a range of financial services in southeastern Wisconsin, with a market cap of $277.77 million.

Operations: Waterstone Financial generates revenue primarily through its Mortgage Banking and Community Banking segments, with contributions of $80.55 million and $52.77 million, respectively.

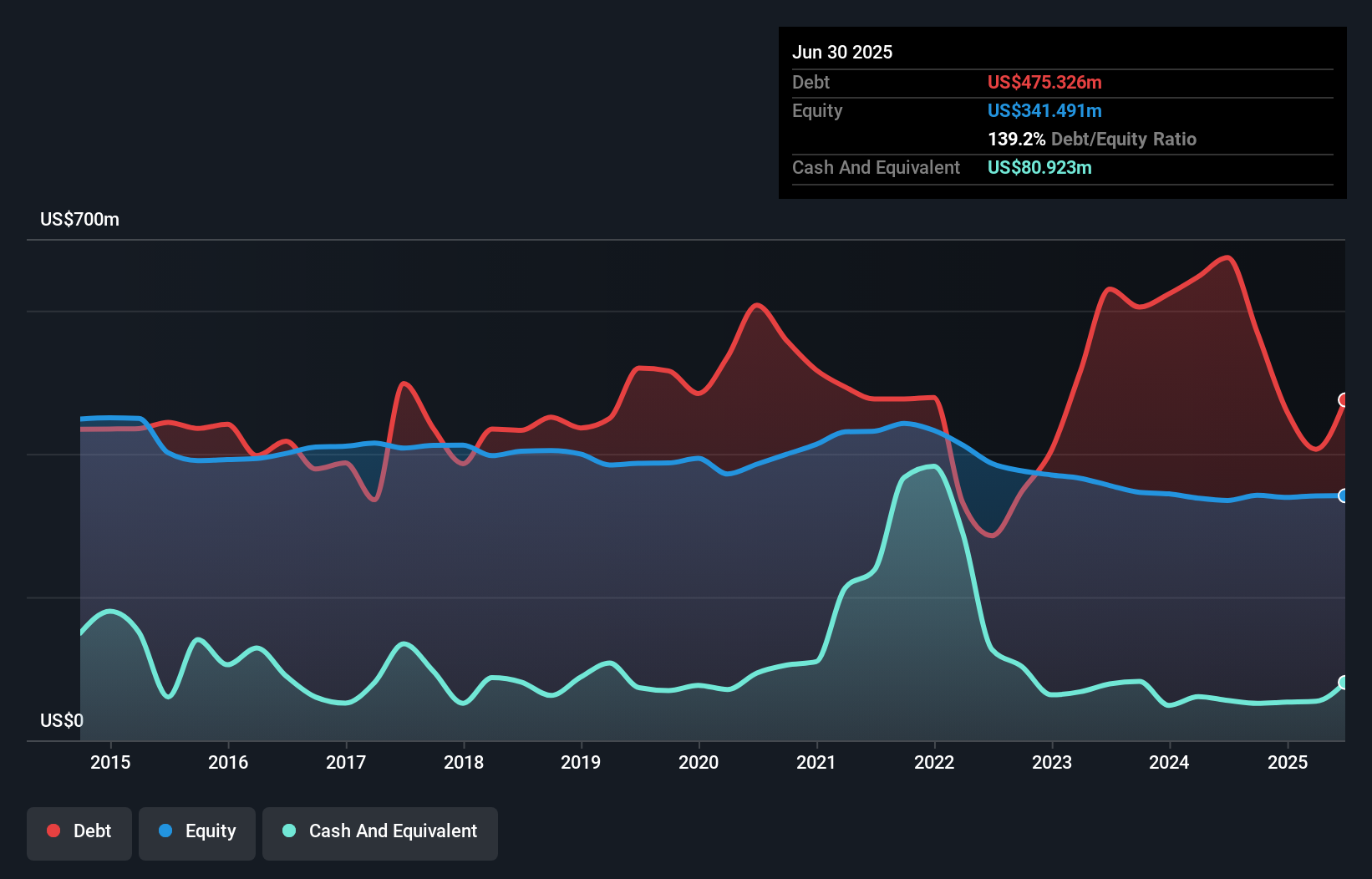

With assets totaling US$2.2 billion and equity of US$342 million, Waterstone Financial stands out for its robust financial footing. The bank's total loans amount to US$1.7 billion, backed by a sufficient allowance for bad loans at 339%, ensuring stability against potential defaults. Deposits are solid at US$1.3 billion, with 66% of liabilities sourced from low-risk funding like customer deposits. Recent earnings growth of 29.8% surpasses industry averages, highlighting its competitive edge despite a past five-year earnings decrease of 27.5%. Additionally, the company repurchased over 2 million shares recently, reflecting confidence in its value proposition.

- Click to explore a detailed breakdown of our findings in Waterstone Financial's health report.

Gain insights into Waterstone Financial's past trends and performance with our Past report.

Where To Now?

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 230 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLAB

Photronics

Engages in the manufacture and sale of photomask products and services in the United States, Taiwan, China, Korea, Europe, and internationally.

Flawless balance sheet and undervalued.