Stock Analysis

- United States

- /

- Insurance

- /

- NYSE:WDH

Victory Capital Holdings And 2 Other US Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market continues to hit record highs, driven by robust performances in sectors like technology, investors are keenly observing market dynamics and company fundamentals. In this context, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often signal confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

| Celsius Holdings (NasdaqCM:CELH) | 10.5% | 21.5% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 15% | 84.1% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

We're going to check out a few of the best picks from our screener tool.

Victory Capital Holdings (NasdaqGS:VCTR)

Simply Wall St Growth Rating: ★★★★☆☆

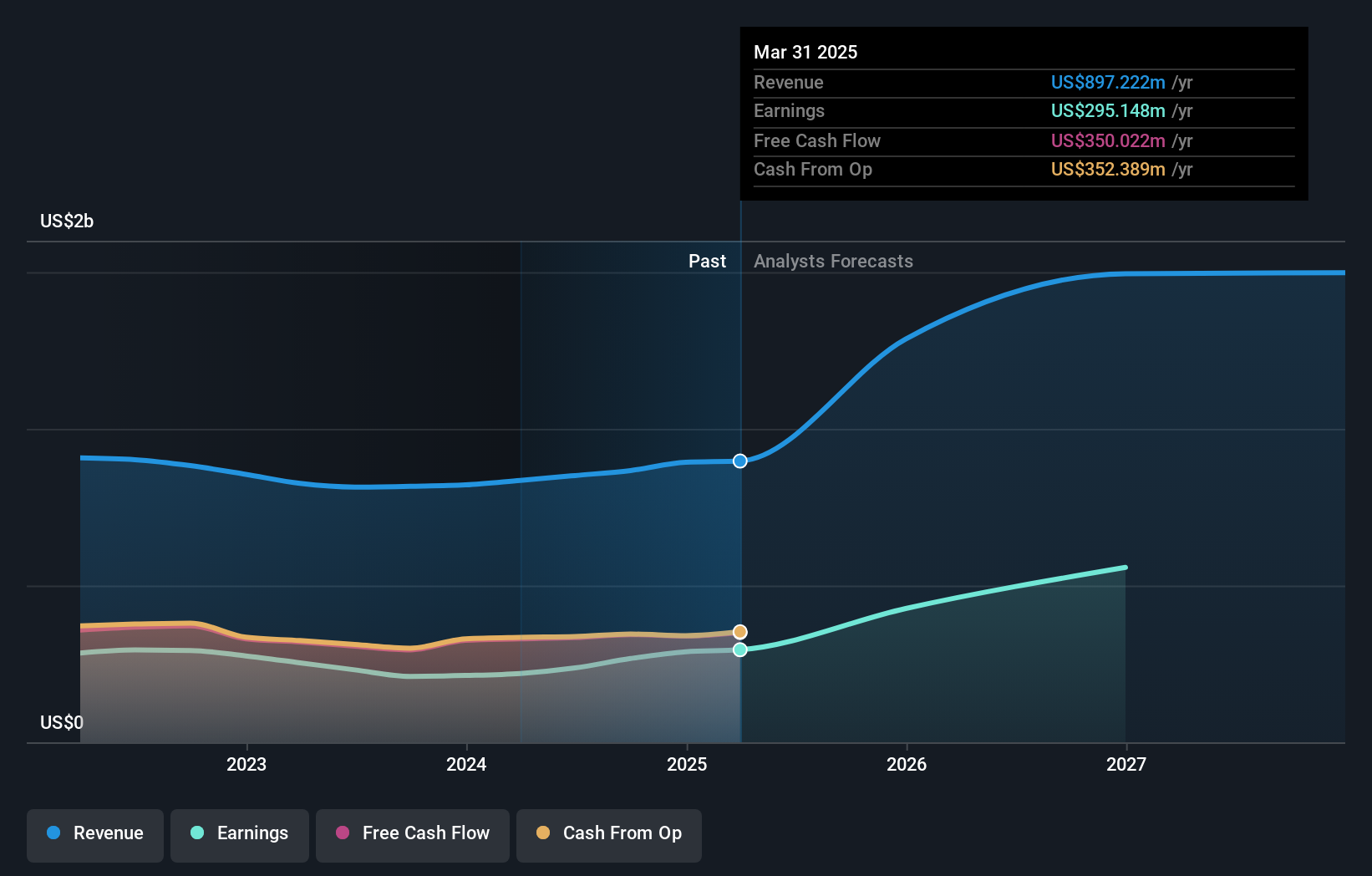

Overview: Victory Capital Holdings, Inc. is an asset management firm operating both in the United States and internationally, with a market capitalization of approximately $3.14 billion.

Operations: The firm generates $835.57 million in revenue from providing investment management services and products.

Insider Ownership: 12.1%

Earnings Growth Forecast: 33.5% p.a.

Victory Capital Holdings, notable for its high insider ownership, is poised for substantial growth with earnings expected to increase significantly over the next three years. Recently, the firm secured a strategic alliance by integrating Amundi US into its operations, enhancing its investment capabilities and global reach. This move coincides with healthy quarterly earnings growth and a strategic debt refinancing that extends financial flexibility. However, it's worth noting the company's high debt levels and unstable dividend track record which could concern conservative investors.

- Click here to discover the nuances of Victory Capital Holdings with our detailed analytical future growth report.

- Our expertly prepared valuation report Victory Capital Holdings implies its share price may be lower than expected.

Waterdrop (NYSE:WDH)

Simply Wall St Growth Rating: ★★★★☆☆

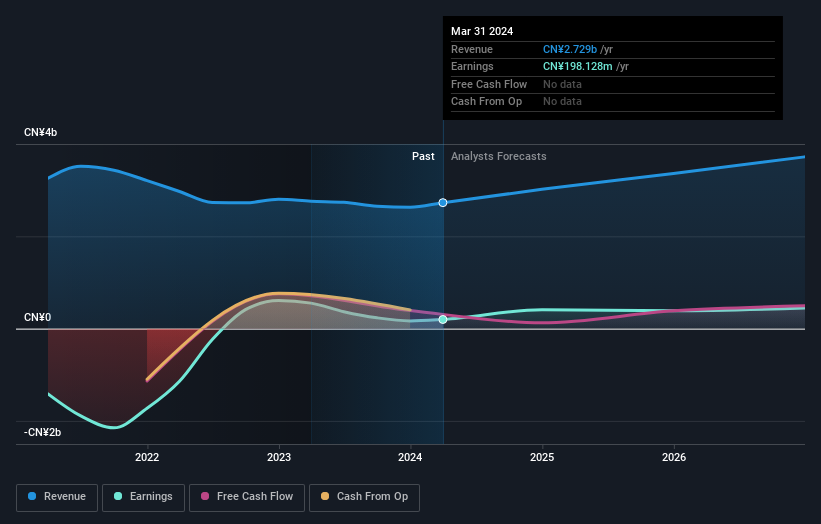

Overview: Waterdrop Inc. operates as an online insurance brokerage in the People's Republic of China, connecting users with insurance products underwritten by various companies, with a market capitalization of approximately $453.80 million.

Operations: Waterdrop Inc. generates revenue primarily from its insurance brokerage services, totaling CN¥2.41 billion, and also earns CN¥188.01 million from its crowdfunding activities.

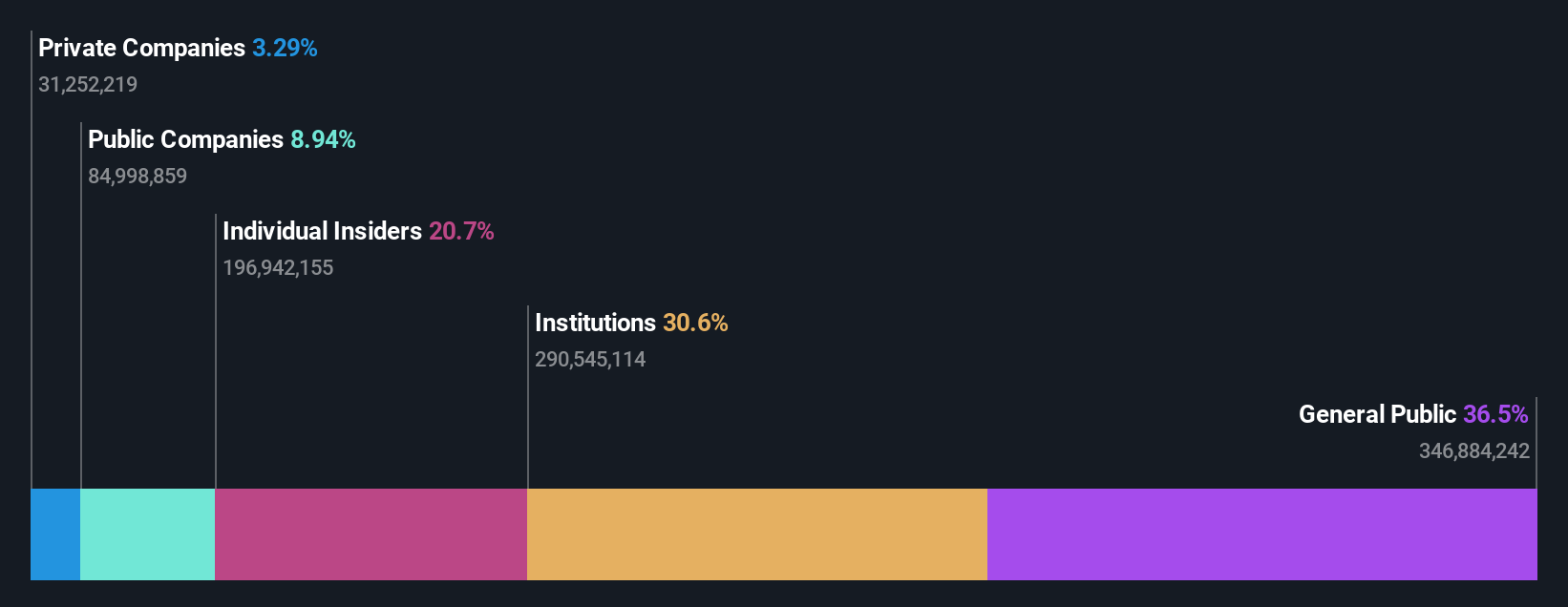

Insider Ownership: 21.7%

Earnings Growth Forecast: 24% p.a.

Waterdrop, a company with high insider ownership, reported a robust first quarter in 2024 with sales increasing to CNY 704.7 million from CNY 606.17 million year-over-year and net income rising to CNY 80.63 million from CNY 49.73 million. Despite this growth, the company's revenue forecast is slower compared to the broader market expectations but its earnings are expected to grow faster than the US market average at an impressive rate of approximately 24% per year. Additionally, Waterdrop recently launched an innovative Skin Care Face Washer, potentially expanding its market reach and enhancing its product portfolio in health-related sectors. However, analysts suggest that while the stock price is anticipated to rise significantly, Waterdrop's return on equity might remain low over the next three years at around 7.6%.

- Dive into the specifics of Waterdrop here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Waterdrop is priced higher than what may be justified by its financials.

XPeng (NYSE:XPEV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: XPeng Inc. is a company based in the People's Republic of China that focuses on designing, developing, manufacturing, and marketing smart electric vehicles, with a market capitalization of approximately $7.06 billion.

Operations: The company generates its revenue primarily from the auto manufacturing segment, totaling CN¥33.19 billion.

Insider Ownership: 23.4%

Earnings Growth Forecast: 59.2% p.a.

XPeng, a growth-oriented company with significant insider ownership, reported a substantial year-over-year revenue increase to CNY 6.55 billion in Q1 2024 from CNY 4.03 billion, alongside reducing its net loss significantly. Despite this progress and a robust delivery growth of Smart EVs, the company's share price has been highly volatile over the past three months. XPeng is expected to become profitable within three years with forecasted revenue growth outpacing the US market average significantly at 26.9% annually. However, shareholder dilution occurred over the past year, and its return on equity is projected to remain low at 0.9% in three years' time.

- Click here and access our complete growth analysis report to understand the dynamics of XPeng.

- Upon reviewing our latest valuation report, XPeng's share price might be too pessimistic.

Summing It All Up

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 179 more companies for you to explore.Click here to unveil our expertly curated list of 182 Fast Growing US Companies With High Insider Ownership.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Waterdrop is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WDH

Waterdrop

Through its subsidiaries, provides online insurance brokerage services to match and connect users with related insurance products underwritten by insurance companies in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.