- United States

- /

- Capital Markets

- /

- NasdaqGS:VCTR

Do Victory Capital Holdings' (NASDAQ:VCTR) Earnings Warrant Your Attention?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Victory Capital Holdings (NASDAQ:VCTR). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Victory Capital Holdings

How Fast Is Victory Capital Holdings Growing Its Earnings Per Share?

Victory Capital Holdings has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Victory Capital Holdings boosted its trailing twelve month EPS from US$3.62 to US$4.30, in the last year. There's little doubt shareholders would be happy with that 19% gain.

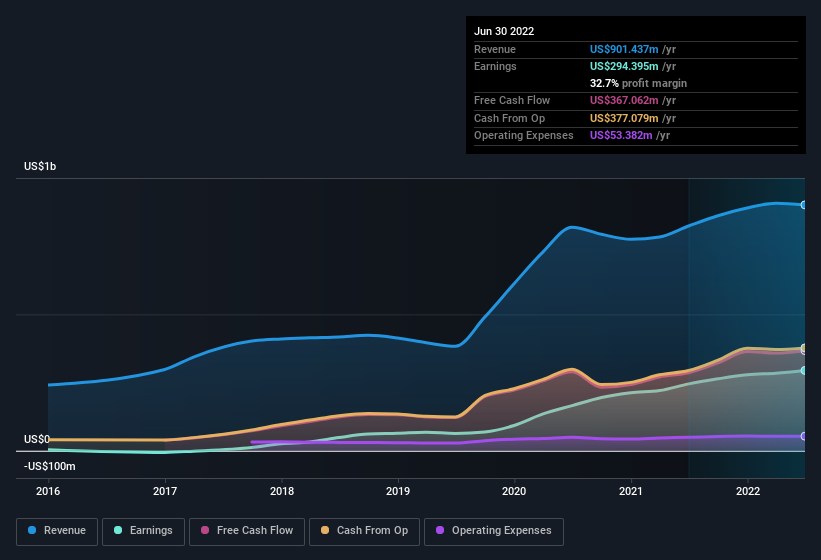

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Victory Capital Holdings maintained stable EBIT margins over the last year, all while growing revenue 9.4% to US$901m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Victory Capital Holdings' forecast profits?

Are Victory Capital Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news is that Victory Capital Holdings insiders spent a whopping US$2.7m on stock in just one year, without so much as a single sale. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. It is also worth noting that it was Chairman of the Board of Directors & CEO David Brown who made the biggest single purchase, worth US$1.0m, paying US$34.62 per share.

On top of the insider buying, it's good to see that Victory Capital Holdings insiders have a valuable investment in the business. Notably, they have an enviable stake in the company, worth US$161m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Does Victory Capital Holdings Deserve A Spot On Your Watchlist?

As previously touched on, Victory Capital Holdings is a growing business, which is encouraging. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for your watchlist - and arguably a research priority. However, before you get too excited we've discovered 2 warning signs for Victory Capital Holdings that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Victory Capital Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VCTR

Victory Capital Holdings

Operates as an asset management company in the United States and internationally.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives