- United States

- /

- Capital Markets

- /

- NasdaqCM:VALU

Undiscovered Gems In The US Featuring 3 Promising Small Caps

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 2.0%, contributing to a remarkable 32% climb over the past year, with earnings anticipated to grow by 15% per annum in the coming years. In this vibrant environment, uncovering promising small-cap stocks can offer unique opportunities for investors seeking growth potential beyond well-known large-cap names.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

ChoiceOne Financial Services (NasdaqCM:COFS)

Simply Wall St Value Rating: ★★★★★★

Overview: ChoiceOne Financial Services, Inc. is a bank holding company for ChoiceOne Bank, offering banking services to corporations, partnerships, and individuals in Michigan with a market capitalization of $328.83 million.

Operations: ChoiceOne Financial Services generates revenue primarily from its banking segment, amounting to $87.90 million.

With total assets of US$2.7 billion, ChoiceOne Financial Services stands out with a robust balance sheet featuring US$247.7 million in equity and US$1.5 billion in loans backed by a low-risk funding structure, as 89% of liabilities are customer deposits. The bank's allowance for bad loans is notably sufficient at 0.2% of total loans, showcasing prudent risk management. Despite shareholder dilution over the past year, earnings grew by 9.8%, surpassing industry benchmarks and highlighting its growth potential amidst challenging sector conditions where peers saw a -12.2%. This positions ChoiceOne as an intriguing player in the financial landscape.

- Click here and access our complete health analysis report to understand the dynamics of ChoiceOne Financial Services.

Gain insights into ChoiceOne Financial Services' past trends and performance with our Past report.

Value Line (NasdaqCM:VALU)

Simply Wall St Value Rating: ★★★★★★

Overview: Value Line, Inc. is involved in producing and selling investment periodicals and related publications, with a market cap of $491.15 million.

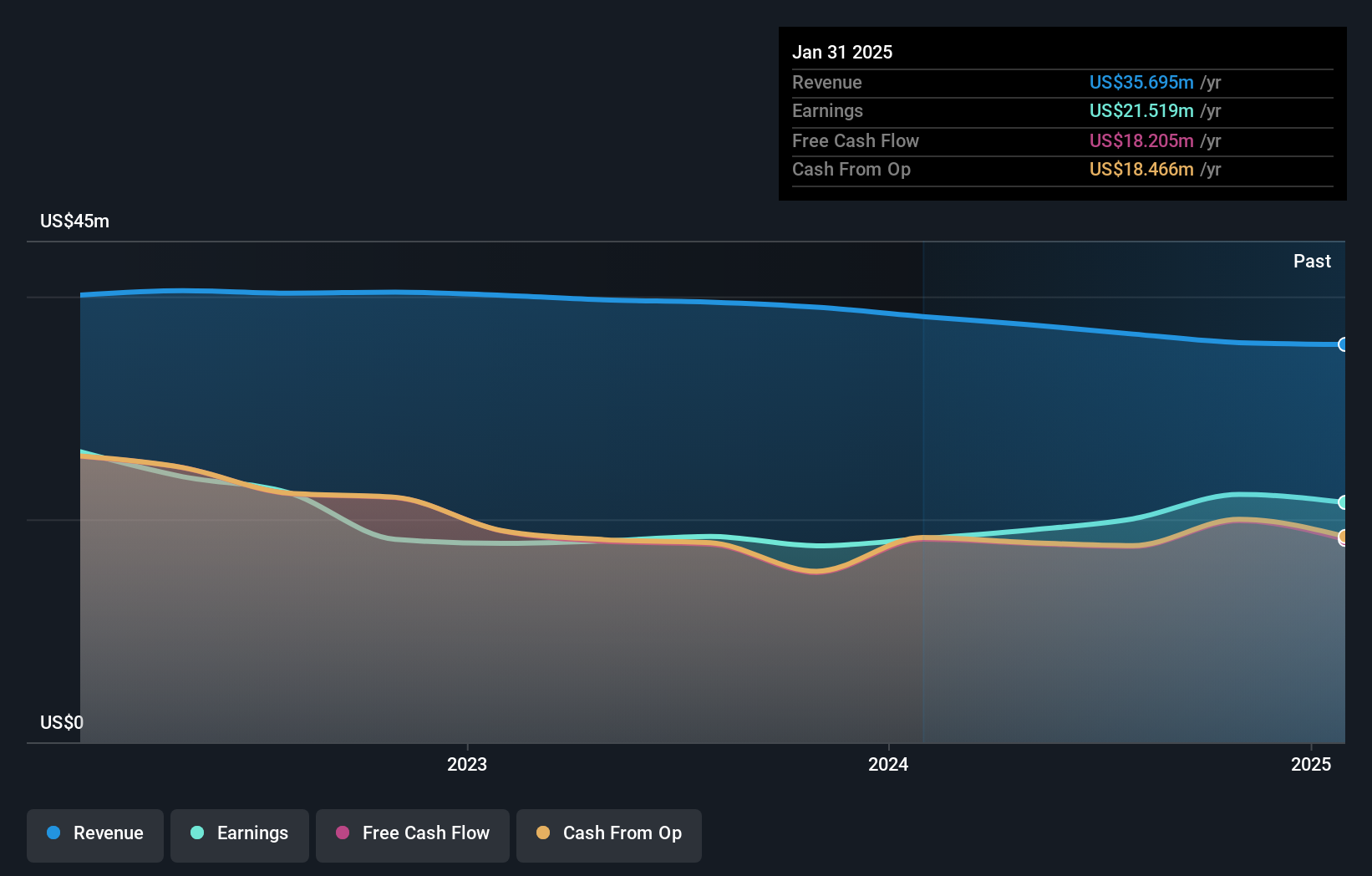

Operations: The primary revenue stream for Value Line, Inc. is its publishing segment, generating $36.63 million.

Value Line, a debt-free company, showcases high-quality earnings with a steady annual growth of 4.7% over the past five years. Despite not matching the Capital Markets industry's 13.4% growth last year, its earnings rose by 8.5%. The recent dividend announcement of $0.30 per share and a completed buyback of 47,014 shares for $2.4 million reflect robust shareholder returns strategies. For Q1 ending July 2024, net income increased to US$5.89 million from US$4.86 million the previous year, although revenue dipped slightly to US$8.88 million from US$9.74 million in the same period last year.

- Click here to discover the nuances of Value Line with our detailed analytical health report.

Explore historical data to track Value Line's performance over time in our Past section.

Third Coast Bancshares (NasdaqGS:TCBX)

Simply Wall St Value Rating: ★★★★★★

Overview: Third Coast Bancshares, Inc. is a bank holding company for Third Coast Bank, SSB, offering commercial banking solutions to small and medium-sized businesses and professionals, with a market cap of $495.32 million.

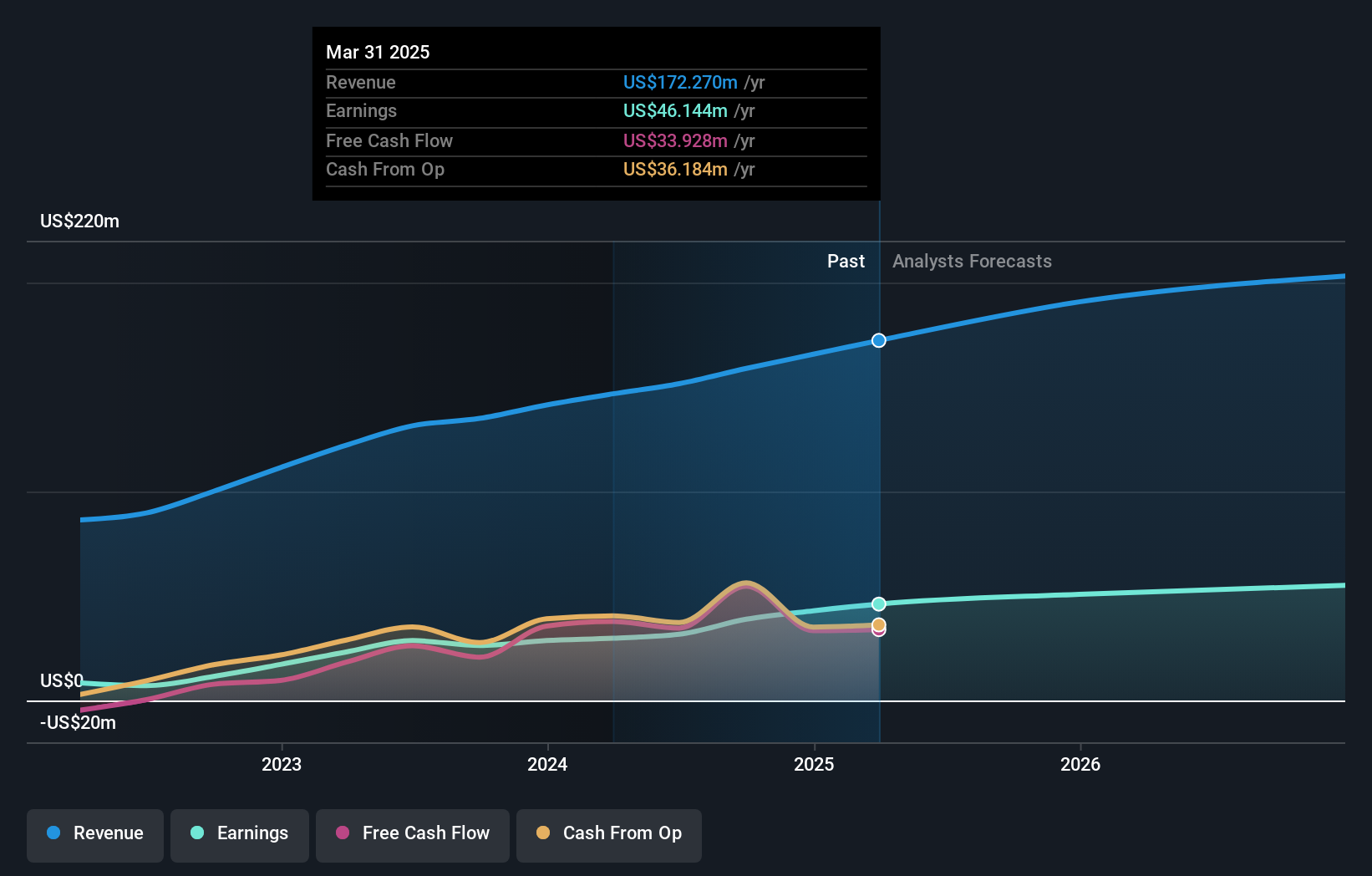

Operations: Third Coast Bancshares generates revenue primarily from its community banking segment, amounting to $158.91 million. The company has a market capitalization of approximately $495.32 million, reflecting its valuation in the financial markets.

Third Coast Bancshares, with total assets of US$4.6 billion and equity at US$450.5 million, showcases robust growth in the banking sector. The bank's earnings surged by 47.9% over the past year, outpacing its industry peers who saw a -12.2% change, indicating strong operational performance and high-quality earnings. A solid allowance for bad loans at 0.6% of total loans underscores sound risk management practices, while 96% of liabilities are funded through low-risk customer deposits, enhancing stability. Trading below fair value by 9.4%, it presents potential value for investors eyeing strategic expansion in Texas’s thriving economic landscape.

Next Steps

- Investigate our full lineup of 231 US Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VALU

Value Line

Engages in the production and sale of investment periodicals and related publications.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives