- United States

- /

- Health Care REITs

- /

- NYSE:CTRE

Top Dividend Stocks To Watch In July 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a mix of record highs and slight retreats, investor optimism is buoyed by strong corporate earnings and resilient economic data, despite ongoing tariff concerns. In such a dynamic environment, dividend stocks can offer stability and income potential, making them an attractive option for those looking to balance growth with consistent returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 5.91% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.17% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.65% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.11% | ★★★★★★ |

| Ennis (EBF) | 5.61% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 4.06% | ★★★★★☆ |

| Dillard's (DDS) | 5.63% | ★★★★★★ |

| Credicorp (BAP) | 4.86% | ★★★★★☆ |

| CompX International (CIX) | 4.71% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.91% | ★★★★★★ |

Click here to see the full list of 138 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Value Line (VALU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Value Line, Inc. is involved in the production and sale of investment periodicals and related publications, with a market cap of approximately $366 million.

Operations: Value Line, Inc. generates revenue primarily from its publishing segment, amounting to $35.70 million.

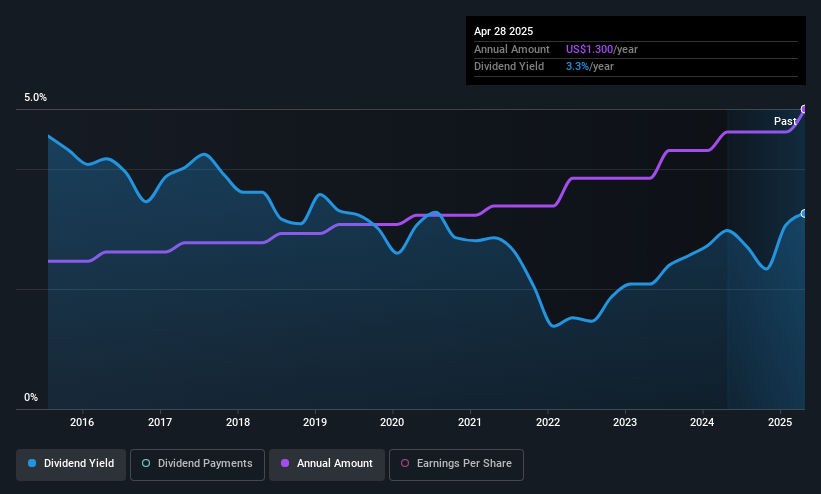

Dividend Yield: 3.3%

Value Line, Inc. recently increased its quarterly dividend to $0.325 per share, marking the 11th consecutive annual increase, though it was dropped from the Russell 2000 Dynamic Index in June 2025. Its dividend yield of 3.29% is lower than top-tier US dividend payers but offers stability and growth over a decade. With a payout ratio of 52.5% and cash payout ratio of 67.2%, dividends are sustainably covered by earnings and cash flows despite modest valuation metrics like its P/E ratio of 17.3x.

- Delve into the full analysis dividend report here for a deeper understanding of Value Line.

- In light of our recent valuation report, it seems possible that Value Line is trading beyond its estimated value.

CareTrust REIT (CTRE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CareTrust REIT is a self-administered, publicly-traded real estate investment trust focused on owning, acquiring, developing, and leasing seniors housing and healthcare-related properties with a market cap of approximately $5.83 billion.

Operations: CareTrust REIT generates revenue primarily from its investments in healthcare-related real estate assets, amounting to $329.84 million.

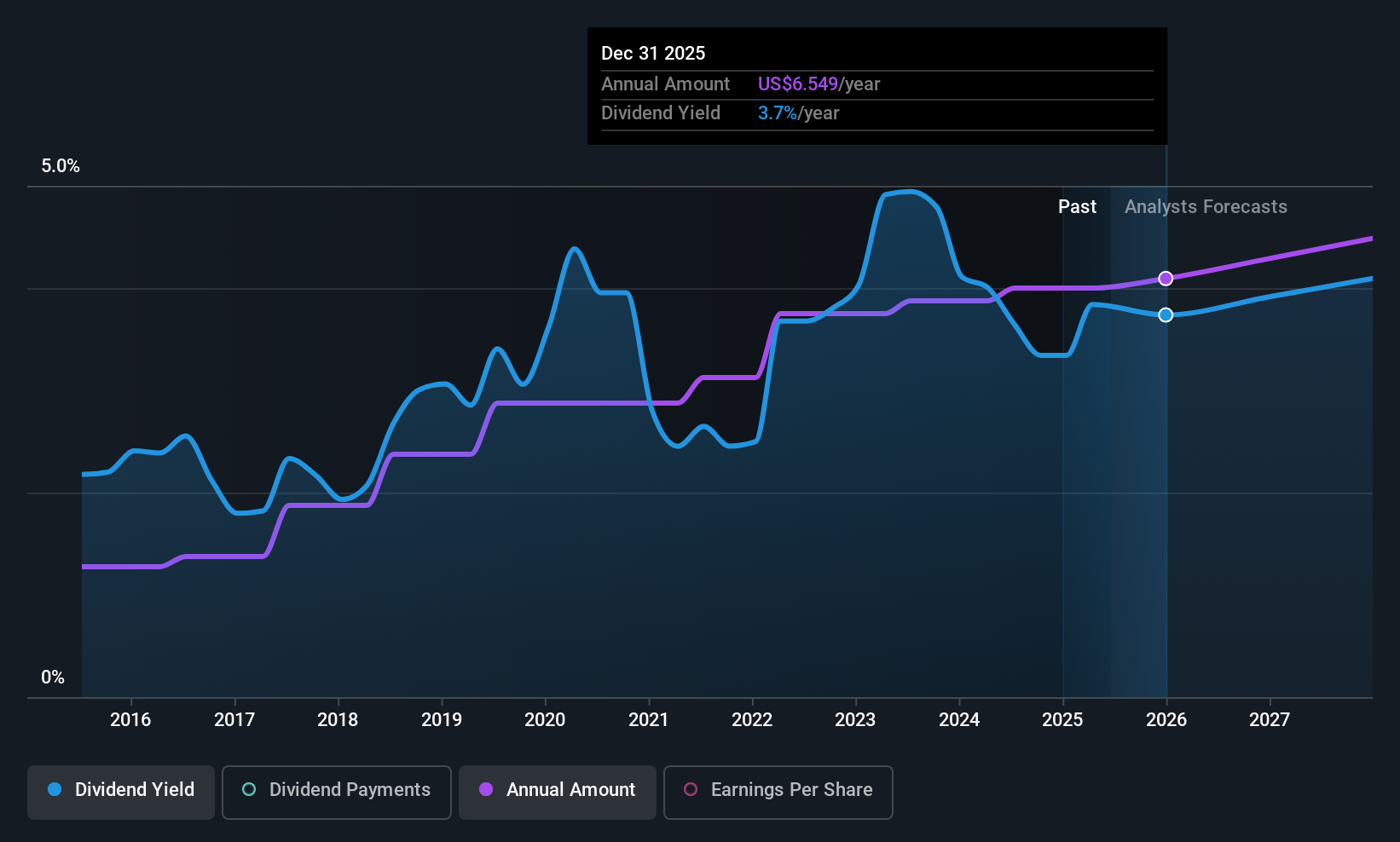

Dividend Yield: 4.4%

CareTrust REIT recently declared a quarterly dividend of $0.335 per share, though its 4.42% yield is slightly below top-tier US payers. Despite stable and growing dividends over the past decade, the high payout ratio (582.6%) suggests limited coverage by earnings, though cash flows cover it at a 100% cash payout ratio. Recent executive hires and a new $500 million term loan aim to support growth through acquisitions in both the US and UK markets.

- Dive into the specifics of CareTrust REIT here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that CareTrust REIT is trading behind its estimated value.

PNC Financial Services Group (PNC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The PNC Financial Services Group, Inc. is a diversified financial services company operating in the United States with a market cap of approximately $76.41 billion.

Operations: PNC Financial Services Group generates revenue through its Asset Management Group ($1.69 billion), Corporate & Institutional Banking ($10.23 billion), and Retail Banking including Residential Mortgage ($13.83 billion) segments.

Dividend Yield: 3.5%

PNC Financial Services Group offers a reliable dividend yield of 3.47%, with dividends well-covered by earnings at a payout ratio of 43.6%. Recent earnings growth and a strategic buyback program, which repurchased shares worth US$9.80 billion, indicate financial robustness. Although the dividend yield is below top-tier levels, consistent increases over the past decade highlight commitment to shareholder returns. Recent quarterly results showed increased net income and interest income compared to last year, reinforcing its stable financial position.

- Click here to discover the nuances of PNC Financial Services Group with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of PNC Financial Services Group shares in the market.

Seize The Opportunity

- Dive into all 138 of the Top US Dividend Stocks we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRE

CareTrust REIT

CareTrust REIT is a self-administered, publicly-traded real estate investment trust engaged in the ownership, acquisition, development and leasing of seniors housing and healthcare-related properties.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives