- United States

- /

- Capital Markets

- /

- NasdaqCM:VALU

Exploring Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

The United States market has shown a robust performance, with a 1.2% increase over the last week and a notable 24% rise over the past year, while earnings are forecast to grow by 15% annually. In this thriving environment, identifying stocks with strong fundamentals and growth potential can be key to uncovering hidden opportunities that align with these positive trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Value Line (NasdaqCM:VALU)

Simply Wall St Value Rating: ★★★★★★

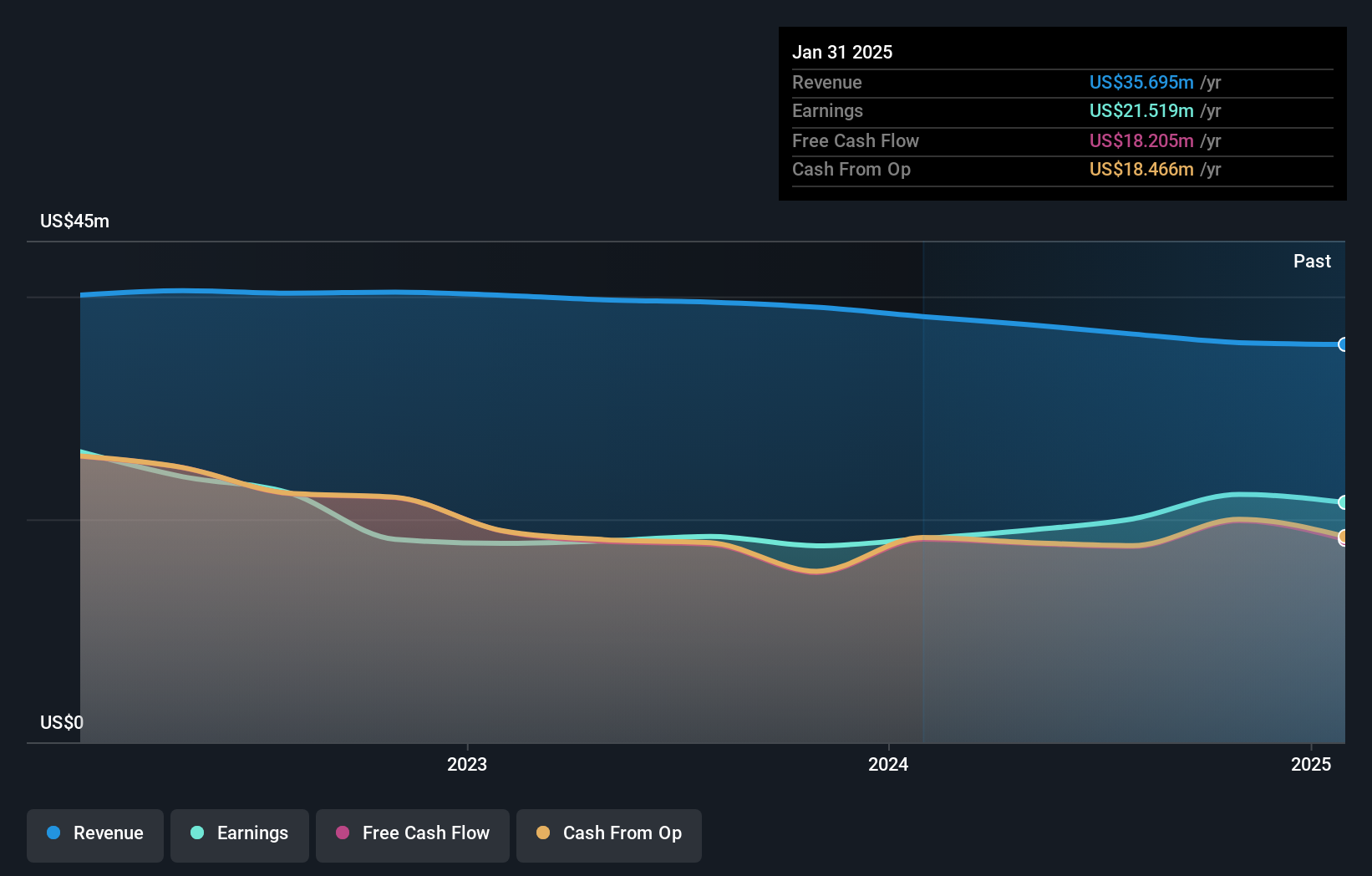

Overview: Value Line, Inc. is involved in the production and sale of investment periodicals and related publications with a market cap of $323.59 million.

Operations: Value Line generates revenue primarily through its publishing segment, which reported $35.86 million in sales.

Value Line, a nimble player in the financial sector, showcases robust growth with earnings climbing 26.2% last year, outpacing the Capital Markets industry at 17.2%. This debt-free company ensures no worries about interest coverage and enjoys high-quality past earnings. Trading at 6.5% below its fair value estimate suggests potential undervaluation. Recent reports show net income rising to US$5.69 million from US$3.49 million a year ago for Q2, while basic EPS improved to US$0.6 from US$0.37 over the same period, indicating strong performance despite revenue slipping slightly to US$8.84 million from US$9.61 million annually.

Hyster-Yale (NYSE:HY)

Simply Wall St Value Rating: ★★★★☆☆

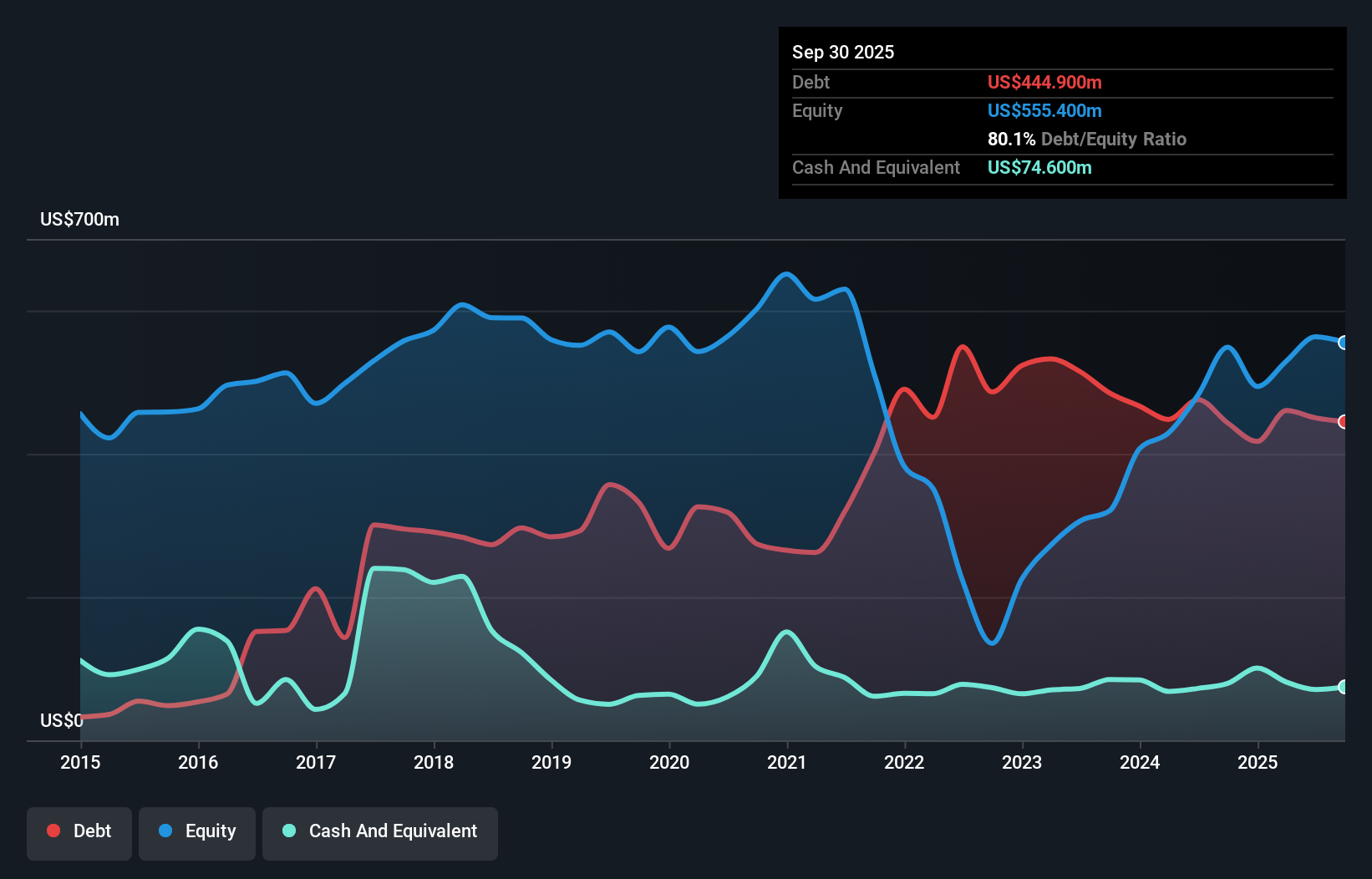

Overview: Hyster-Yale, Inc. is a global company that designs, engineers, manufactures, sells, and services lift trucks and related products through its subsidiaries, with a market cap of $923.76 million.

Operations: The company's primary revenue streams include the Lift Truck Business in the Americas, EMEA, and JAPIC regions, with the Americas contributing $3.13 billion. Bolzoni adds $383.50 million to revenues while Nuvera contributes $1.20 million.

Hyster-Yale, a niche player in the machinery sector, has seen its earnings grow by 45% over the past year, outpacing the industry average of 14%. Despite this impressive growth and trading at a significant discount of 64.5% below estimated fair value, challenges remain. The company's debt-to-equity ratio rose from 61% to 81% over five years, indicating increased leverage. However, interest payments are well-covered with EBIT at 7.3 times coverage. Recent strategic moves include aligning with the Build America, Buy America Act to expand domestic manufacturing and electric options for infrastructure projects—potentially boosting long-term prospects despite projected short-term earnings declines.

Worthington Steel (NYSE:WS)

Simply Wall St Value Rating: ★★★★★☆

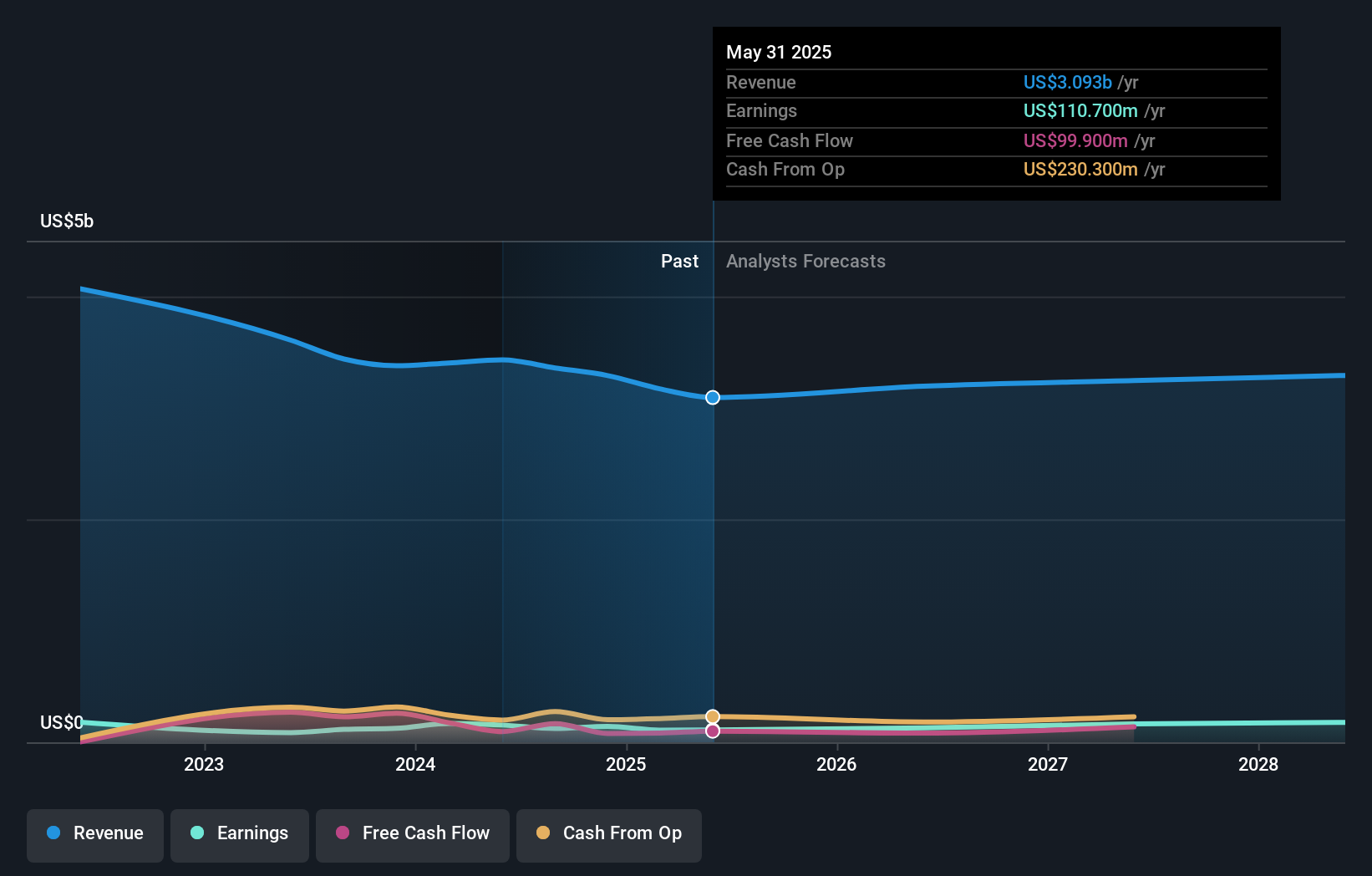

Overview: Worthington Steel, Inc. operates as a steel processor in North America with a market capitalization of approximately $1.46 billion.

Operations: With revenue of $3.29 billion from its Metal Processors and Fabrication segment, Worthington Steel's financial focus is centered on this primary revenue stream.

Worthington Steel, a nimble player in the metals industry, recently reported a net income of US$12.8 million for its second quarter, bouncing back from a US$6 million loss the previous year. The company's strategic acquisition of Sitem Group is set to bolster its European footprint and tap into the burgeoning electric vehicle market. Despite facing challenges like pricing pressures and increased acquisition costs, Worthington's EBIT covers interest payments 19.7 times over, indicating strong financial health. With shares trading at US$30.08 and analysts targeting US$41, there's potential upside amidst evolving market dynamics.

Taking Advantage

- Embark on your investment journey to our 279 US Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VALU

Value Line

Engages in the production and sale of investment periodicals and related publications.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives