Last Update 17 Sep 25

Fair value Increased 5.88%The upward revision in Worthington Steel’s price target is primarily driven by an increase in its forward P/E multiple, raising the consensus fair value from $34.00 to $36.00.

Valuation Changes

Summary of Valuation Changes for Worthington Steel

- The Consensus Analyst Price Target has risen from $34.00 to $36.00.

- The Future P/E for Worthington Steel has risen from 12.75x to 13.50x.

- The Discount Rate for Worthington Steel remained effectively unchanged, moving only marginally from 7.69% to 7.68%.

Key Takeaways

- Strategic growth through acquisitions and market expansion in North America and Europe is expected to boost revenue and market share.

- Efficiency-driven transformation strategies and favorable market conditions could enhance operational margins and earnings.

- Economic uncertainties and declining shipments in key markets are challenging Worthington Steel's revenue growth and profitability.

Catalysts

About Worthington Steel- Operates as a steel processor in North America.

- Worthington Steel is poised to benefit from increased demand in the electrical steel market due to AI initiatives, more data centers, and an anticipated annual power demand growth of more than 6% over the next 15 years, which should lead to higher revenues.

- Strategic investments and acquisitions, such as the expansion of electrical steel capabilities in Canada and Mexico and the expected closing on a 52% stake in the European company Sitem, are set to enhance market share and drive revenue growth.

- New automotive business wins, particularly in electrified vehicles, are expected to ramp up in the coming months, which can contribute to higher revenues and improved volume.

- The implementation of a transformation strategy aimed at improving business efficiency by reducing costs, streamlining processes, and optimizing efficiencies could lead to improved net margins.

- Anticipated market conditions, such as easing supply chains and expected reductions in interest rates, could bolster demand and operational margins in key markets like construction and automotive, potentially improving overall earnings.

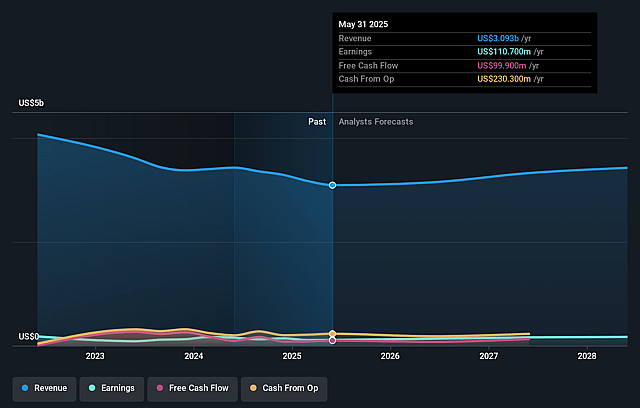

Worthington Steel Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Worthington Steel's revenue will grow by 3.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.6% today to 5.0% in 3 years time.

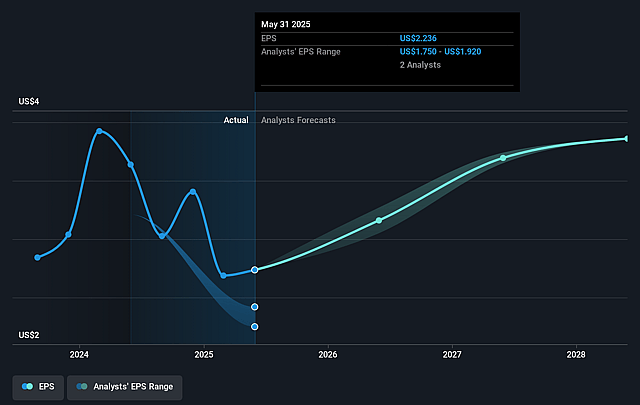

- Analysts expect earnings to reach $169.8 million (and earnings per share of $3.36) by about September 2028, up from $110.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.8x on those 2028 earnings, down from 14.2x today. This future PE is lower than the current PE for the US Metals and Mining industry at 22.5x.

- Analysts expect the number of shares outstanding to grow by 0.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.69%, as per the Simply Wall St company report.

Worthington Steel Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Earnings and adjusted EBITDA significantly decreased compared to the previous year due to lower volumes and average selling prices, indicating potential challenges in maintaining revenue and overall profitability.

- Various markets, including automotive and construction, experienced shipment declines, impacted by uncertain macroeconomic conditions, which could hinder future revenue growth.

- The agriculture and heavy truck markets remain weak, further constraining revenue and earnings contributions from these sectors.

- Inventory holding losses and increased SG&A expenses negatively impacted earnings, affecting net margins and cash flow.

- Economic uncertainties, such as fluctuating demand in key markets and variable steel pricing, pose risks to future revenue consistency and market stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $34.0 for Worthington Steel based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.4 billion, earnings will come to $169.8 million, and it would be trading on a PE ratio of 12.8x, assuming you use a discount rate of 7.7%.

- Given the current share price of $30.95, the analyst price target of $34.0 is 9.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.