- United States

- /

- Insurance

- /

- NasdaqCM:ACIC

Discovering US Market's Hidden Stock Gems

Reviewed by Simply Wall St

As the United States market experiences a slight rebound from recent sell-offs, with major indices like the Dow Jones and S&P 500 showing modest gains, investors are keeping a close eye on economic developments such as bond yields and fiscal policies. In this dynamic environment, identifying promising stocks often involves looking beyond well-known names to uncover hidden gems that may offer unique opportunities amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -25.87% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Innovex International | 1.49% | 42.69% | 44.34% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

American Coastal Insurance (NasdaqCM:ACIC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: American Coastal Insurance Corporation operates in the United States, focusing on commercial and personal property and casualty insurance, with a market cap of $540.59 million.

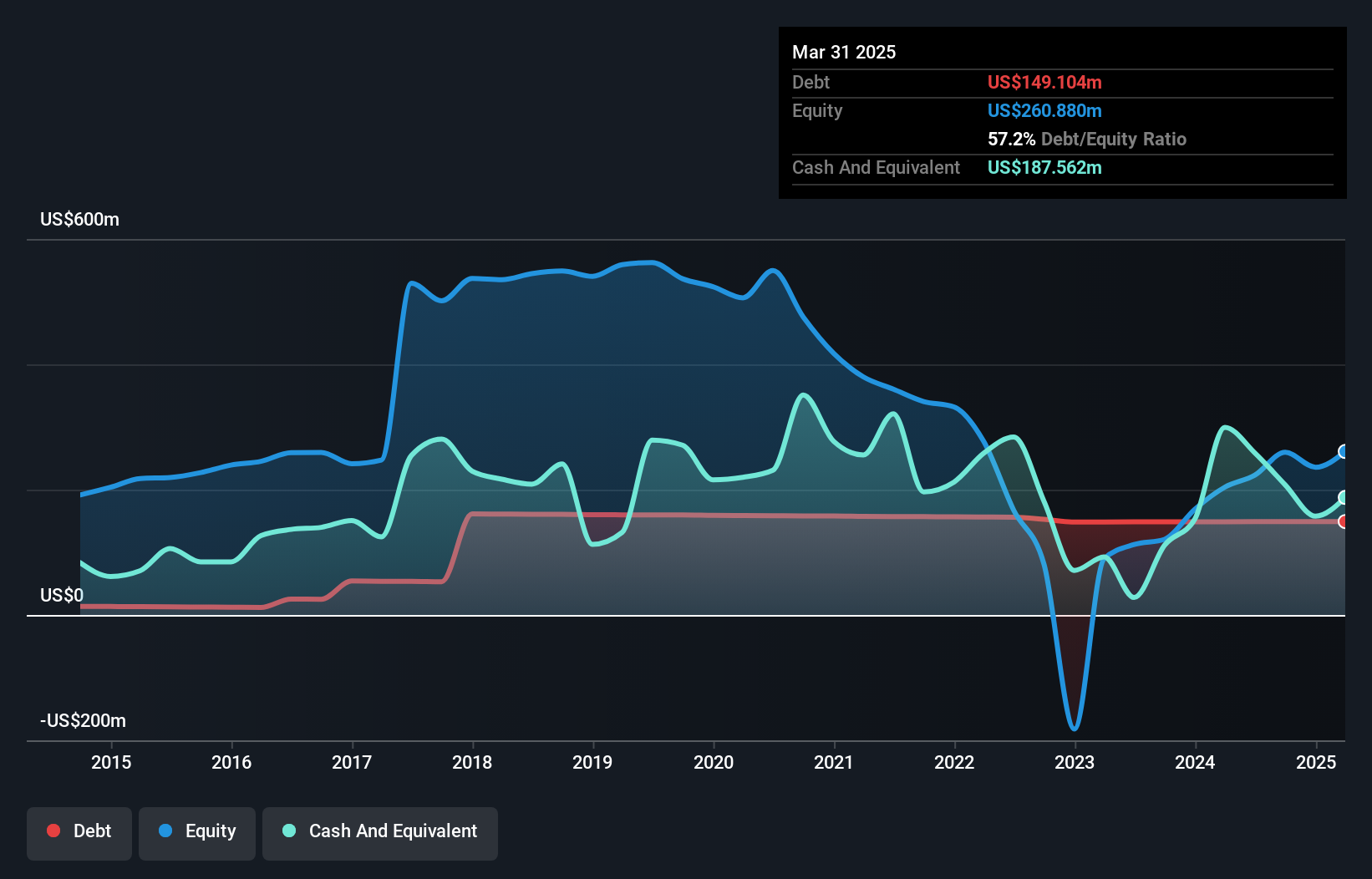

Operations: American Coastal Insurance generates revenue primarily from its commercial lines business, which accounts for $302.26 million.

American Coastal Insurance, a smaller player in the insurance sector, has been navigating a challenging landscape. Despite negative earnings growth of 6.5% over the past year, its interest payments are well covered by EBIT at 8.9 times coverage. The company's debt to equity ratio has risen from 31.3% to 57.2% over five years, indicating increased leverage but also financial agility with more cash than total debt on hand. Recent insider selling might raise eyebrows; however, trading at roughly 74% below estimated fair value suggests potential upside if market conditions align favorably with strategic initiatives like enhanced reinsurance protections and premium growth strategies.

Value Line (NasdaqCM:VALU)

Simply Wall St Value Rating: ★★★★★★

Overview: Value Line, Inc. focuses on producing and selling investment periodicals and related publications, with a market cap of $374.19 million.

Operations: The company generates revenue primarily through its publishing segment, which reported $35.70 million. The net profit margin is noted at 43.52%.

Value Line, a small player in the financial sector, is trading slightly below its estimated fair value. Earnings jumped 17.8% last year, outpacing the Capital Markets industry. Despite a dip in third-quarter revenue to US$8.97 million from US$9.13 million and net income of US$5.16 million down from US$5.89 million year-over-year, nine-month figures show improvement with net income rising to US$16.74 million from US$14.23 million previously reported for the same period last year. The company has consistently increased dividends for 11 years, now offering an annualized dividend of $1.30 per share after an 8% increase this April.

- Click here to discover the nuances of Value Line with our detailed analytical health report.

Examine Value Line's past performance report to understand how it has performed in the past.

Materialise (NasdaqGS:MTLS)

Simply Wall St Value Rating: ★★★★★★

Overview: Materialise NV is a company that offers additive manufacturing and medical software tools, along with 3D printing services across the Americas, Europe and Africa, and the Asia-Pacific, with a market cap of approximately $305.38 million.

Operations: Materialise generates revenue from three main segments: Materialise Medical (€121.25 million), Materialise Software (€43.24 million), and Materialise Manufacturing (€105.02 million).

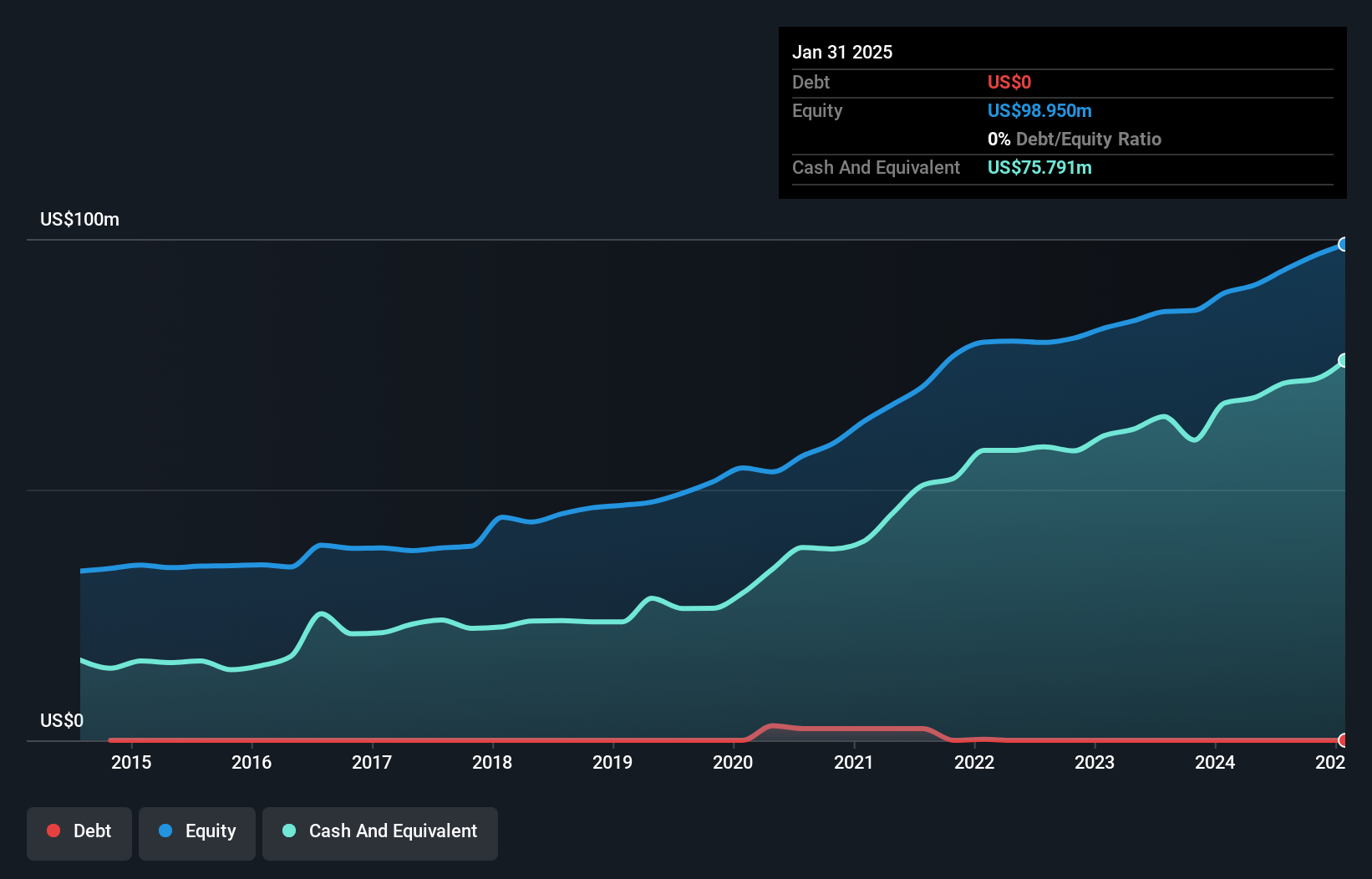

Materialise, known for its role in additive manufacturing and medical software, has seen its debt-to-equity ratio drop from 84.6% to 11.6% over five years, showcasing improved financial stability. The company is trading at a price-to-earnings ratio of 28.7x, undercutting the industry average of 36.1x, indicating potential value for investors. Despite a net loss of €0.53 million in Q1 2025 compared to a profit last year, earnings grew by an impressive 41% over the past year and are expected to grow by about 30% annually moving forward, driven by recurring revenue streams and expansion into new sectors like aerospace and defense.

Summing It All Up

- Click through to start exploring the rest of the 277 US Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ACIC

American Coastal Insurance

Through its subsidiaries, primarily engages in the commercial and personal property and casualty insurance business in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives