- United States

- /

- Consumer Finance

- /

- NasdaqGS:UPST

Will Upstart (UPST) Redefined Underwriting Standards Sustain Its Long-Term Edge in Consumer Lending?

Reviewed by Sasha Jovanovic

- Earlier this week, Upstart Holdings saw renewed optimism after analysts revised delinquency rate estimates downward and highlighted improvements in underwriting quality, alleviating prior credit concerns.

- A key insight from this update is that Upstart's focus on moving toward super-prime borrowers and improved underwriting data have reassured investors about the resilience of its credit model.

- We'll examine how the normalization of delinquency rates affects Upstart's investment narrative and ongoing growth prospects in consumer lending.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

Upstart Holdings Investment Narrative Recap

To be a shareholder in Upstart Holdings, an investor must believe in the company's ability to leverage AI-powered underwriting to outperform traditional lenders, especially as delinquency rates stabilize and investor confidence returns. The recent downward revision in delinquency rate estimates directly reduces the biggest short-term risk, model accuracy amid credit volatility, while supporting the near-term catalyst of higher lending volumes, making these developments material for Upstart's investment case.

Among recent announcements, the launch of Model 19 with enhanced Payment Transition Model (PTM) technology is particularly relevant given the renewed focus on underwriting quality. This product update coincides with the latest analyst commentary and bolsters the narrative that improved data and AI models are helping Upstart reduce default risks, reinforcing key earnings growth catalysts as delinquency fears recede.

Yet, on the other side, investors should be aware that even with stronger model performance, future macroeconomic shifts...

Read the full narrative on Upstart Holdings (it's free!)

Upstart Holdings' narrative projects $1.8 billion revenue and $337.2 million earnings by 2028. This requires 27.2% yearly revenue growth and a $343.6 million increase in earnings from -$6.4 million today.

Uncover how Upstart Holdings' forecasts yield a $80.85 fair value, a 53% upside to its current price.

Exploring Other Perspectives

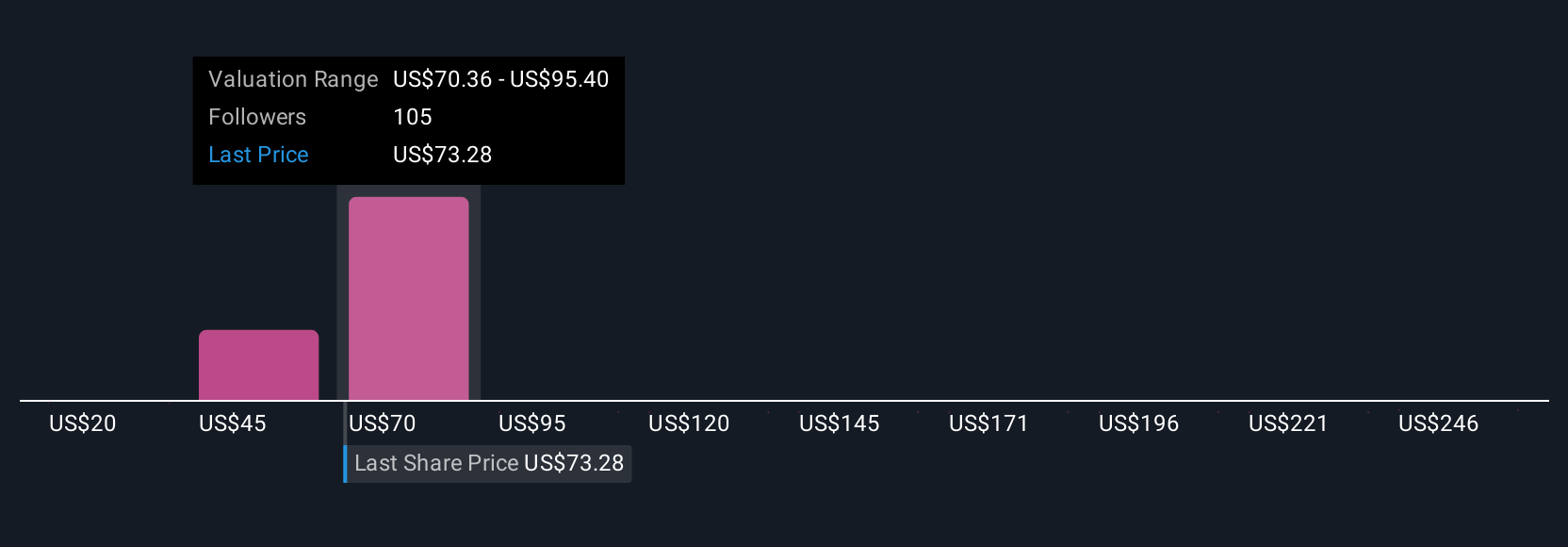

Sixteen individual fair value estimates from the Simply Wall St Community range from US$21.91 to US$85, underlining wide differences in outlook. While beliefs about future loan performance vary, many still see model accuracy as central to Upstart’s potential, so weighing this against your own expectations could reshape how you think about its performance.

Explore 16 other fair value estimates on Upstart Holdings - why the stock might be worth less than half the current price!

Build Your Own Upstart Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Upstart Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Upstart Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Upstart Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPST

Upstart Holdings

Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives