- United States

- /

- Consumer Finance

- /

- NasdaqGS:UPST

Why Upstart Holdings (UPST) Is Surging After Analysts Lift Earnings Forecasts Amid AI Platform Recovery

Reviewed by Sasha Jovanovic

- In the past few days, Upstart Holdings has drawn significant investor attention as analysts revised earnings estimates upward, anticipating a very large increase in quarterly earnings per share and substantial revenue growth compared to last year.

- Despite ongoing volatility in the fintech sector, Upstart Holdings’ recovery in its AI-driven lending platform and return to profitability has made it a focal point for optimism among analysts and investors.

- We’ll explore how renewed confidence in Upstart’s platform recovery and earnings estimates could shape its investment narrative going forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Upstart Holdings Investment Narrative Recap

To own shares in Upstart Holdings, an investor must believe in its AI-powered lending platform’s potential to sustainably outperform traditional credit models and drive above-market revenue growth. Recent upward earnings revisions have positioned the Q3 report as a central short-term catalyst, reflecting renewed optimism; however, persistent share price volatility and questions around model reliability suggest that risks remain elevated and the immediate impact of this news event on underlying business fundamentals appears limited.

Among recent company updates, Upstart’s August 2025 Q2 earnings announcement revealed an impressive year-over-year revenue jump to US$257.29 million and a return to profitability, underlining the importance of accurate underwriting and demonstrated improvements in risk management. This progress ties closely to analysts’ optimism for the upcoming earnings report, as consistency in performance could further solidify confidence in Upstart’s growth outlook.

In contrast, it is crucial for investors to understand how fluctuations in default rates and macroeconomic conditions could quickly alter...

Read the full narrative on Upstart Holdings (it's free!)

Upstart Holdings' outlook projects $1.8 billion in revenue and $337.2 million in earnings by 2028. This is based on a 27.2% annual revenue growth rate and a $343.6 million increase in earnings from the current -$6.4 million.

Uncover how Upstart Holdings' forecasts yield a $80.85 fair value, a 53% upside to its current price.

Exploring Other Perspectives

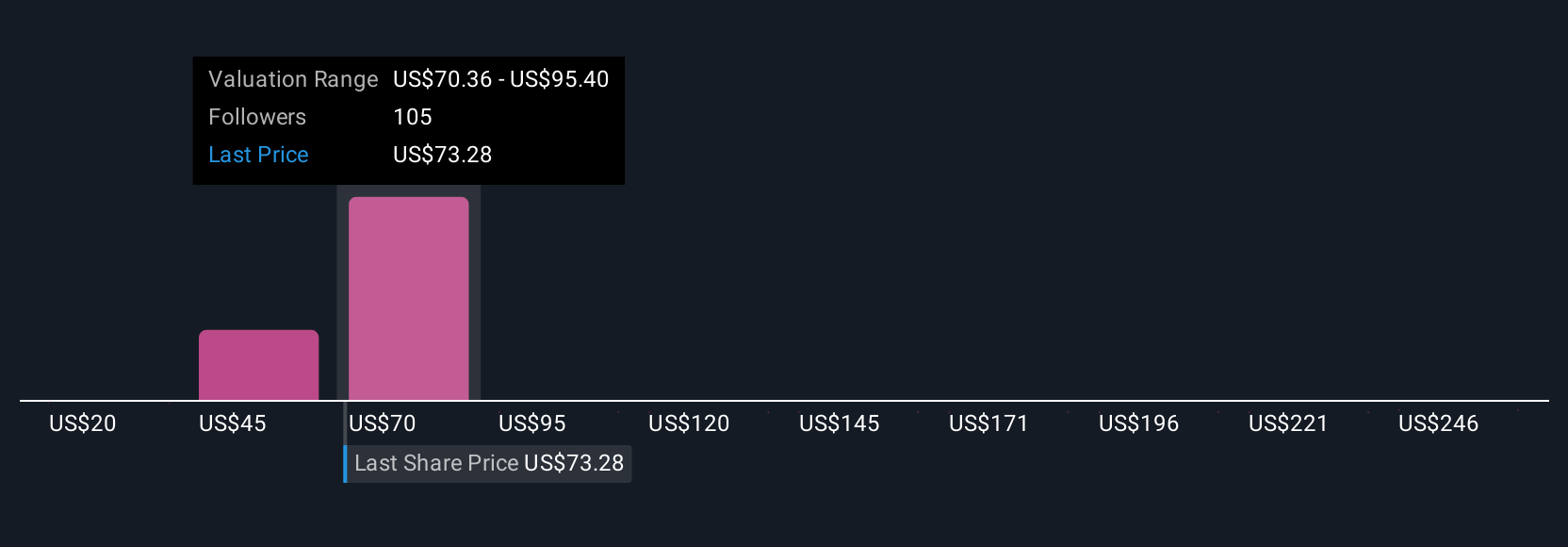

Sixteen retail investors in the Simply Wall St Community set fair values for Upstart from US$21.91 to US$85, showing significant range across estimates. While many see high growth potential, ongoing share price swings and questions about model consistency illustrate why perspectives can differ so widely, explore several viewpoints to understand all angles.

Explore 16 other fair value estimates on Upstart Holdings - why the stock might be worth less than half the current price!

Build Your Own Upstart Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Upstart Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Upstart Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Upstart Holdings' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPST

Upstart Holdings

Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives