- United States

- /

- Consumer Finance

- /

- NasdaqGS:UPST

Upstart Holdings (UPST): A Fresh Look at Valuation Following Improved Delinquency Data and Analyst Reassurance

Reviewed by Kshitija Bhandaru

Upstart Holdings (UPST) shares caught a wave of renewed optimism after August’s delinquency rate was revised downward. Improvements in underwriting and a shift toward super-prime borrowers are also calming investor nerves following recent industry turbulence.

See our latest analysis for Upstart Holdings.

After some turbulence fueled by auto industry bankruptcies and concerns about rising delinquencies, Upstart’s share price has found its footing as recent data revisions and a greater focus on super-prime borrowers signal improved stability. While momentum has cooled, as evidenced by modest share price returns over recent months, investors with a longer view will note the company’s 1-year total shareholder return remains in positive territory. This hints at renewed optimism as risk perception shifts.

If Upstart’s evolving narrative has you rethinking what to watch next, consider this the perfect opportunity to discover fast growing stocks with high insider ownership

So is the recent pullback just a pause before another rally, offering investors a chance to scoop up Upstart at a discount, or is the company’s strong growth outlook already fully reflected in its share price?

Most Popular Narrative: 34.7% Undervalued

Compared to the last close of $51.96, the most widely followed narrative points to a fair value of $79.54, implying significant upside potential for Upstart Holdings. The gap is driven by bold projections for revenue and margin expansion, setting the tone for a debate on what truly justifies this premium.

The analysts have a consensus price target of $80.846 for Upstart Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $105.0, and the most bearish reporting a price target of just $20.0.

What drives this striking difference between the narrative's fair value and the current price? A daring set of assumptions around Upstart's earnings power and future profit margins. Want to see which future milestones analysts believe could send shares soaring? Unpack the numbers fueling this call by reading the full narrative.

Result: Fair Value of $79.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising loan delinquencies and the challenge of maintaining accurate risk models remain key threats that could quickly shift the narrative around Upstart’s outlook.

Find out about the key risks to this Upstart Holdings narrative.

Another View: Multiples Suggest a Different Story

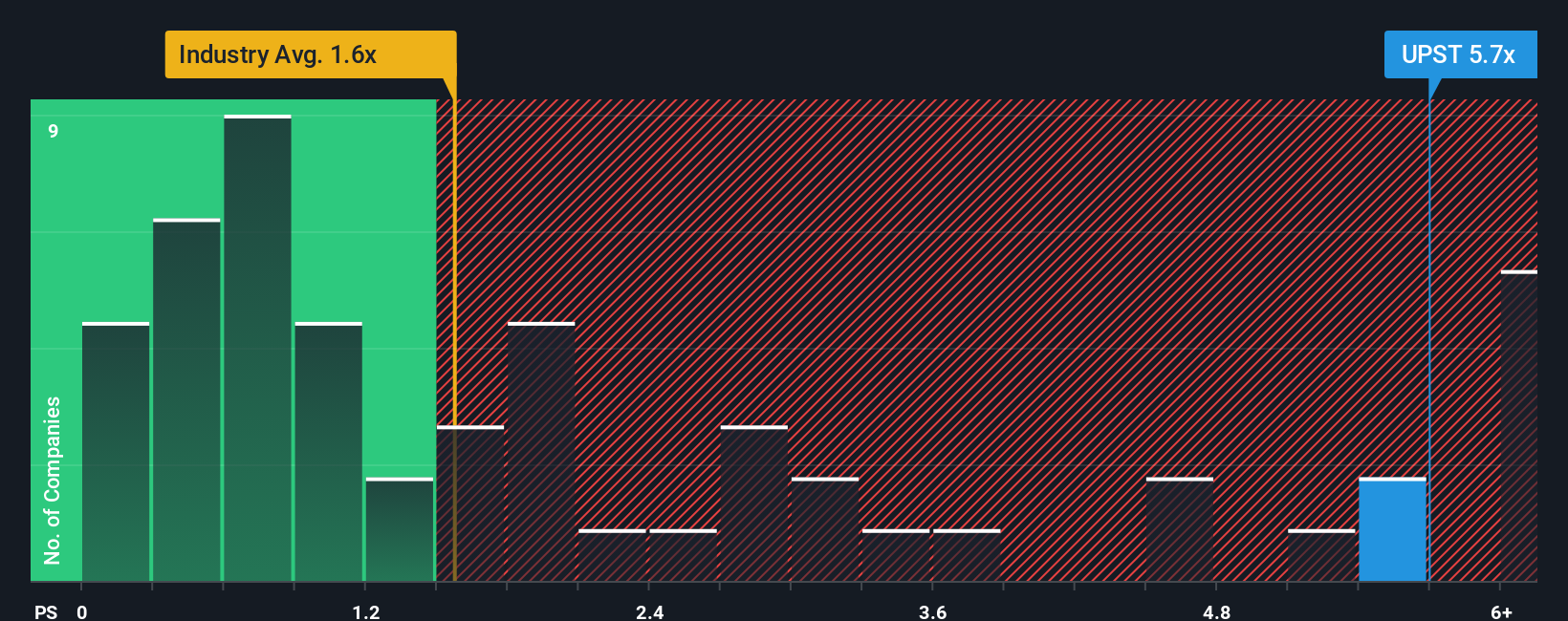

While many focus on those ambitious future growth projections, there is a more sobering perspective when we look at how Upstart Holdings is priced today. The company’s price-to-sales ratio sits at 5.7x, which is not only well above the US Consumer Finance industry average of 1.5x but also notably higher than the peer group’s average of 3.7x. A fair ratio for Upstart would be closer to 4.7x. This suggests the current premium leaves little margin for error if the narrative shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Upstart Holdings Narrative

If you see the story differently or want to shape your own view, you can dive in and build your personal Upstart narrative in just minutes. Do it your way

A great starting point for your Upstart Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Tap into the market's hidden potential now. Supercharge your watchlist with fresh stocks and unique themes built to inspire your next winning move.

- Pinpoint tomorrow's industry disruptors by reviewing these 24 AI penny stocks as they are positioned to capitalize on rapid advances in artificial intelligence.

- Boost your long-term gains with these 19 dividend stocks with yields > 3% that provide reliable income through attractive yields and strong payout histories.

- Challenge the ordinary and unlock growth opportunities in these 26 quantum computing stocks at the frontier of technology innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPST

Upstart Holdings

Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives