- United States

- /

- Consumer Finance

- /

- NasdaqGS:UPST

How Investors May Respond To Upstart Holdings (UPST) Expanding Lending Network Through CAFCU Partnership

Reviewed by Sasha Jovanovic

- Corporate America Family Credit Union announced it has partnered with Upstart to offer personal loans, home equity lines of credit, and auto refinance loans to a wider range of consumers, launching on the Upstart Referral Network in September 2025 and planning further product expansion this year.

- This collaboration not only adds distribution channels for Upstart but also includes CAFCU purchasing HELOC portfolios from Upstart's affiliate, indicating deeper integration between the two organizations in consumer lending.

- We will examine how expanding lending products and CAFCU's portfolio purchases may influence Upstart's medium-term business outlook and future growth.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Upstart Holdings Investment Narrative Recap

To be a shareholder in Upstart Holdings, you need to believe in the potential for its AI-powered lending platform to reshape how personal and secured lending works in the US, including expanding into new products such as HELOCs and auto loan refinancing. The recent partnership with CAFCU broadens Upstart’s distribution but does not fundamentally alter the most important short-term catalyst, maintaining underwriting accuracy in a volatile macro environment. The biggest immediate risk remains exposure to rising default rates if economic conditions worsen.

Among recent developments, the CAFCU partnership marks an important step for Upstart’s strategy to diversify its lending products and deepen links with credit unions. This aligns with ongoing catalysts such as Model 19’s improved underwriting, but it does not eliminate the substantial risk of mismatches between predicted and actual default rates, which could materially impact revenue and margins in challenging credit cycles.

Yet, with this expanded access comes heightened sensitivity to shifts in credit quality, a fact investors should...

Read the full narrative on Upstart Holdings (it's free!)

Upstart Holdings' outlook projects $1.8 billion in revenue and $337.2 million in earnings by 2028. This is based on analysts' forecasts of 27.2% annual revenue growth and an earnings increase of $343.6 million, from current earnings of -$6.4 million to $337.2 million.

Uncover how Upstart Holdings' forecasts yield a $75.46 fair value, a 62% upside to its current price.

Exploring Other Perspectives

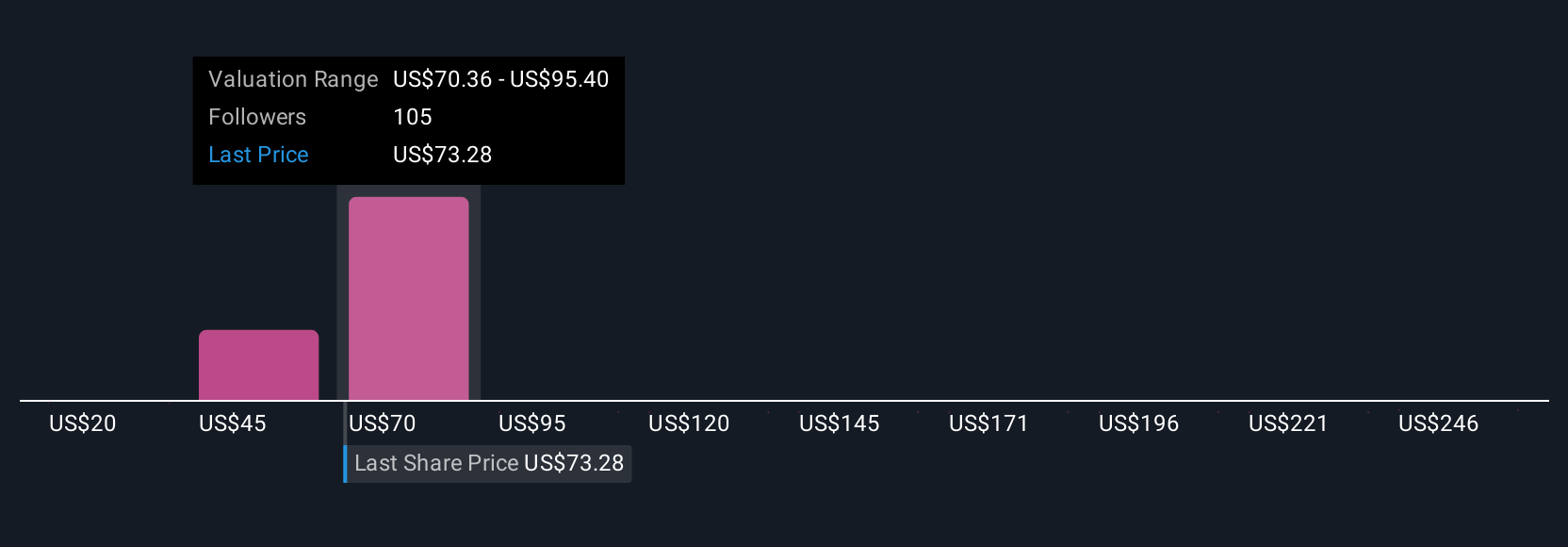

Seventeen members of the Simply Wall St Community estimate Upstart’s fair value anywhere from US$21.91 to US$85 per share. Given the company’s reliance on accurate risk modeling, the wide spread reflects how differently participants weigh the fundamental risk of underwriting in uncertain conditions.

Explore 17 other fair value estimates on Upstart Holdings - why the stock might be worth less than half the current price!

Build Your Own Upstart Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Upstart Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Upstart Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Upstart Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPST

Upstart Holdings

Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives