- United States

- /

- Capital Markets

- /

- NasdaqGS:TRIN

Candel Therapeutics Funding Could Be A Game Changer For Trinity Capital (TRIN)

Reviewed by Sasha Jovanovic

- Earlier this month, Candel Therapeutics announced it had secured a five-year, US$130 million term loan facility from Trinity Capital Inc., of which US$50 million was drawn at closing to support clinical trials and pre-commercial activities for its lead cancer immunotherapy programs.

- This substantial funding highlights Trinity Capital's active push into innovative healthcare lending, complemented by recent executive hires targeting life sciences expansion across the U.S.

- We'll explore how this high-profile commitment to the oncology sector marks a significant evolution in Trinity Capital's investment case.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Trinity Capital Investment Narrative Recap

To be a long-term shareholder in Trinity Capital, you need to believe in the durability of the venture lending model, the potential for scale-driven profitability, and the company's capacity to manage credit risk and portfolio diversity as it accelerates loan originations. The Candel Therapeutics funding increases Trinity's healthcare exposure, which may amplify near-term growth opportunities, but it does not materially alter the most important catalyst, sustained origination momentum, or the biggest risk, which remains a sudden deterioration in credit quality.

The recent appointment of Paul D'Agrosa as Managing Director of Life Sciences is particularly relevant, aligning Trinity’s enhanced focus on healthcare with deeper leadership in the sector. By bringing significant origination expertise and relationship management experience, this move reinforces the company’s commitment to expanding its life sciences vertical, directly supporting its short-term catalysts and highlighting the growing role of sector specialization in driving origination.

However, despite this progress, investors should be especially mindful that if innovation sector lending slows or portfolio performance weakens, there could be...

Read the full narrative on Trinity Capital (it's free!)

Trinity Capital's narrative projects $344.1 million in revenue and $159.5 million in earnings by 2028. This requires 10.5% yearly revenue growth and a $20.7 million earnings increase from the current earnings of $138.8 million.

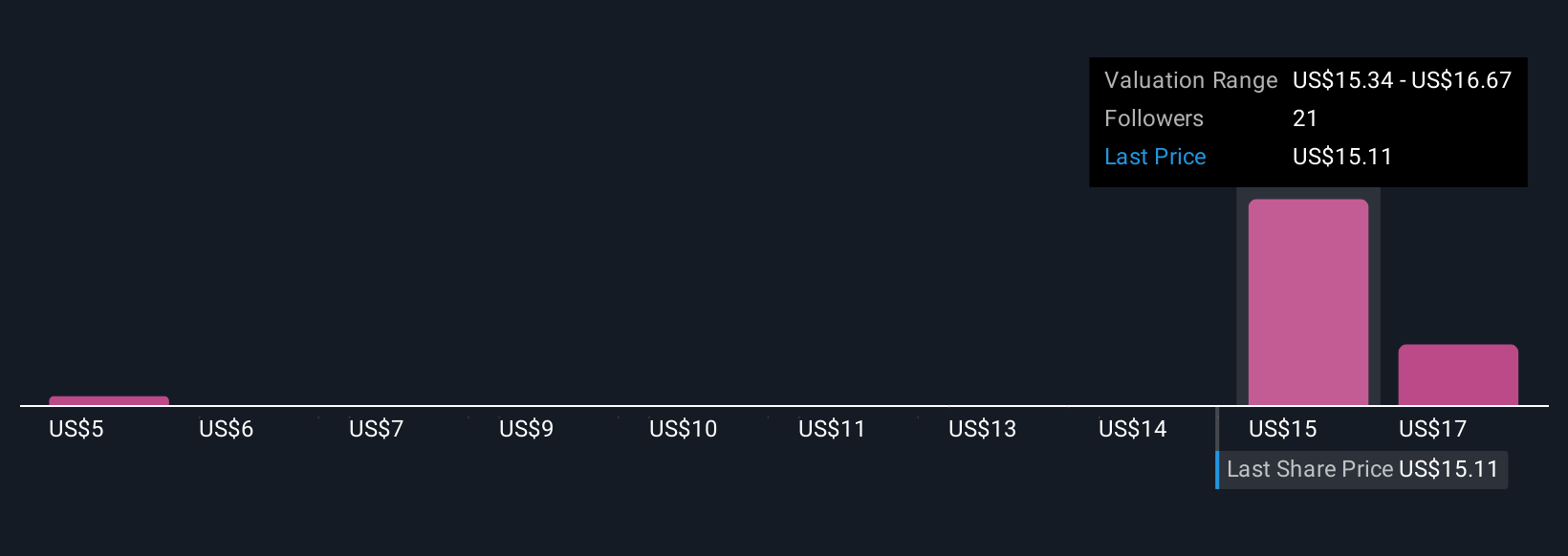

Uncover how Trinity Capital's forecasts yield a $16.44 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community have issued fair value estimates for Trinity Capital stock, ranging from US$4.71 to US$25.37 per share. While some see significant upside, others caution that the company’s rapid loan origination pace could heighten future credit quality risks, suggesting the need to weigh these broad perspectives when evaluating Trinity's performance outlook.

Explore 8 other fair value estimates on Trinity Capital - why the stock might be worth less than half the current price!

Build Your Own Trinity Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trinity Capital research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Trinity Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trinity Capital's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trinity Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRIN

Trinity Capital

A business development company specializing in term loans, equipment financing, and private equity-related investments.

Undervalued with proven track record.

Market Insights

Community Narratives