- United States

- /

- Capital Markets

- /

- NasdaqGS:TIGR

UP Fintech Holding Limited's (NASDAQ:TIGR) 34% Jump Shows Its Popularity With Investors

UP Fintech Holding Limited (NASDAQ:TIGR) shares have had a really impressive month, gaining 34% after a shaky period beforehand. The last month tops off a massive increase of 102% in the last year.

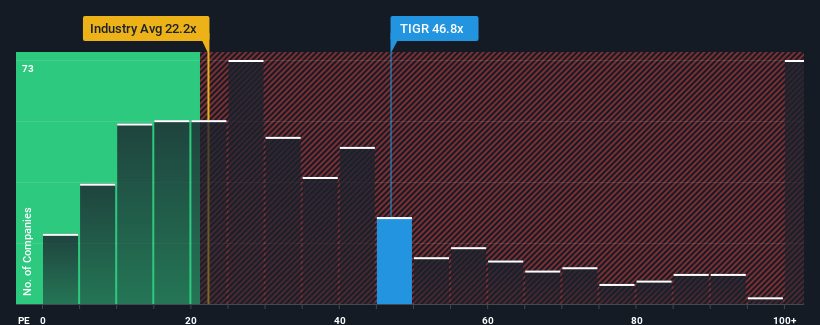

Following the firm bounce in price, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 18x, you may consider UP Fintech Holding as a stock to avoid entirely with its 46.8x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

UP Fintech Holding could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for UP Fintech Holding

How Is UP Fintech Holding's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like UP Fintech Holding's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 16% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 26% each year during the coming three years according to the five analysts following the company. With the market only predicted to deliver 10% each year, the company is positioned for a stronger earnings result.

With this information, we can see why UP Fintech Holding is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Shares in UP Fintech Holding have built up some good momentum lately, which has really inflated its P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of UP Fintech Holding's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for UP Fintech Holding that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TIGR

UP Fintech Holding

Provides online brokerage services focusing on Chinese investors in New Zealand, the Cayman Island, Singapore, the United States, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives