- United States

- /

- Diversified Financial

- /

- NasdaqGS:STNE

StoneCo (NasdaqGS:STNE) Rises 17% As Anticipation Builds For Q4 2024 Earnings Call

Reviewed by Simply Wall St

StoneCo (NasdaqGS:STNE) has recently announced its Q4 2024 Earnings Call and financial results release schedule, adding interest in its stock as investors anticipate insights into its performance and strategic direction. Over the last quarter, the company's share price rose by 17%, a notable gain amidst a generally turbulent market landscape characterized by fluctuation and uncertainty. While broader indices such as the S&P 500 and Nasdaq experienced declines, StoneCo's price movement also reflects its resilience in an otherwise volatile environment for tech stocks. In the context of a challenging economic backdrop, with ongoing concerns about tariffs and potential recession risks affecting global markets, StoneCo's preparation for its earnings announcement seems to have positively impacted its market presence and attractiveness to investors, aligning with the recent market trend of a modest 1.7% climb over the past week.

Our valuation report unveils the possibility StoneCo's shares may be trading at a discount.

Find companies with promising cash flow potential yet trading below their fair value.

Over the last three years, StoneCo's total shareholder return including share price and dividends was a decline of 23.56%. This performance, while challenging, can be understood in the context of several key events. Notably, StoneCo has been actively navigating its corporate strategy, highlighted by a share repurchase program announced in November 2024 worth up to BRL 2 billion. Despite this, the company experienced significant underperformance compared to the US Diversified Financial industry, which returned 18.2% over the past year.

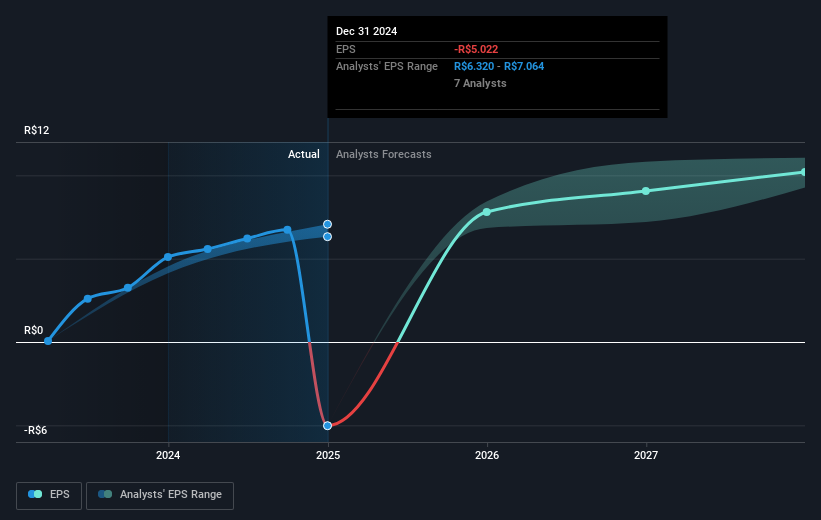

In addition, StoneCo's financial results show promising trends with its Q3 2024 earnings revealing a revenue increase to BRL 3,357.23 million and a higher net income, though these gains have yet to translate into positive long-term share price movement. The ongoing discussions regarding potential divestment of its software unit, Linx, further contribute to market sentiment as investors await decisive moves in the company's strategic direction.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade StoneCo, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STNE

StoneCo

Provides financial technology and software solutions to merchants and integrated partners to conduct electronic commerce across in-store, online, and mobile channels in Brazil.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives