- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

SoFiUSD Stablecoin Launch Could Be A Game Changer For SoFi Technologies (SOFI)

Reviewed by Sasha Jovanovic

- Earlier this month, SoFi Technologies launched SoFiUSD, a fully reserved U.S. dollar stablecoin issued by SoFi Bank, N.A., aiming to provide bank-grade, on-chain money movement infrastructure for banks, fintechs, enterprises, and consumers in markets with volatile local currencies.

- The move makes SoFi the first national bank to offer open access to its own stablecoin and infrastructure, extending its push to bridge traditional banking with crypto trading and on-chain settlement inside a single, regulated ecosystem.

- We’ll now examine how SoFiUSD’s bank-issued, fully reserved stablecoin model could reshape SoFi’s investment narrative and future growth drivers.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

SoFi Technologies Investment Narrative Recap

To own SoFi, you have to believe it can keep turning rapid member and product growth into profitable, higher margin fee income while justifying a rich valuation. The SoFiUSD launch strengthens its blockchain and infrastructure story, but the most important near term catalyst remains execution on earnings and guidance, while the biggest risk is that high growth expectations prove too optimistic if adoption of newer products slows.

The recent SoFi Smart Card launch is especially relevant here because it shows how SoFi is trying to deepen engagement inside its ecosystem at the same time as it builds on-chain capabilities like SoFiUSD. Together, these products could influence how much SoFi can grow cross sell and fee-based revenue, which is central to the current investment case.

However, investors should also be aware that SoFi’s high price to earnings multiple could become a headwind if...

Read the full narrative on SoFi Technologies (it's free!)

SoFi Technologies' narrative projects $5.1 billion revenue and $954.1 million earnings by 2028. This implies an earnings increase from current levels to reach the 2028 consensus.

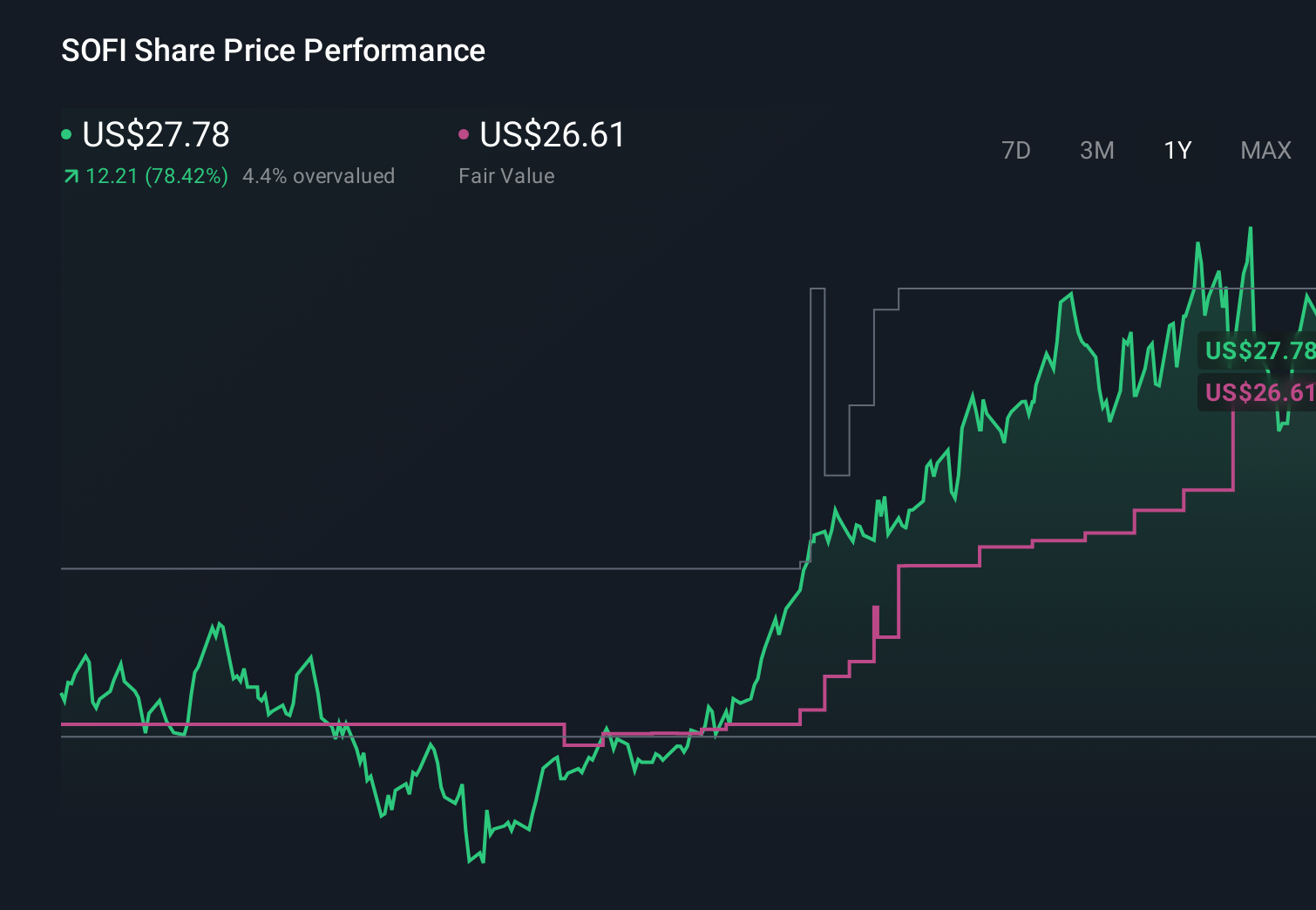

Uncover how SoFi Technologies' forecasts yield a $27.15 fair value, in line with its current price.

Exploring Other Perspectives

Sixty five members of the Simply Wall St Community currently place SoFi’s fair value between US$9.31 and US$38, with many estimates above the recent price. Against that backdrop, SoFi’s rich earnings multiple and reliance on continued rapid digital adoption are key issues for you to weigh as you compare different views on its future performance.

Explore 65 other fair value estimates on SoFi Technologies - why the stock might be worth as much as 40% more than the current price!

Build Your Own SoFi Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SoFi Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SoFi Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SoFi Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 34 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion