- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

SoFi Technologies (NasdaqGS:SOFI) Partners With Benzinga To Enhance Investor Insights

Reviewed by Simply Wall St

SoFi Technologies (NasdaqGS:SOFI) has experienced a notable share price increase of 20% over the past month. This significant movement aligns with the announcement of a new partnership with Benzinga, which aims to enhance SoFi Invest members' access to premium market insights and research tools. While the broader market saw little change, with fluctuations in oil prices and geopolitical tensions influencing mixed trading outcomes, SoFi's strategic initiative likely added positive momentum to its stock. By integrating institutional-grade research resources, SoFi has positioned itself to better cater to everyday investors, potentially bolstering market confidence in the company's offerings.

We've identified 1 warning sign for SoFi Technologies that you should be aware of.

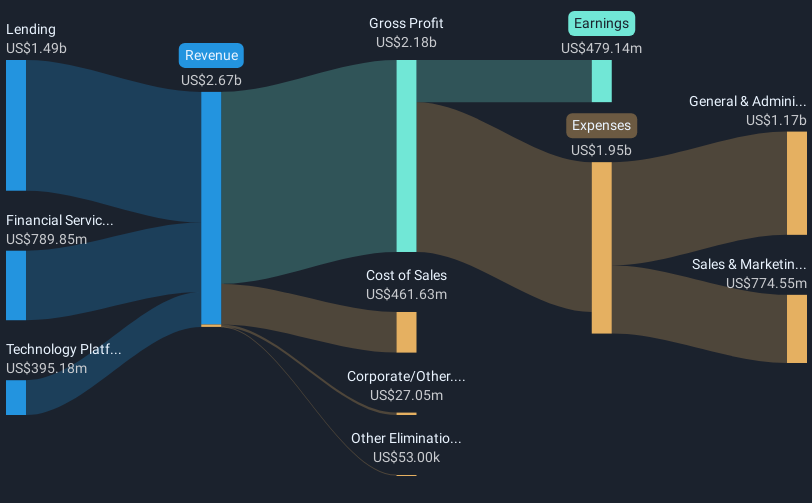

The recent partnership with Benzinga could bolster SoFi Technologies' capacity to enhance its financial service offerings, potentially driving future revenue and earnings growth. By integrating premium market insights, SoFi aims to attract more investors and boost its platform engagement, aligning with its expansion goals like those seen in SoFi Invest. The move supports analysts' forecasts of 14.6% annual revenue growth, although economic uncertainties remain a concern. The enhancement of trust through richer data and research tools may contribute to increased member activity and trust, which are crucial for sustaining high-margin fee-based revenue streams.

Over the longer term, SoFi's stock has increased a significant 150.57% over the past three years, demonstrating substantial appreciation relative to its more recent monthly gain. This long-term performance exceeds the past year's industry return of 30% and the broader US market return of 10.4%, underscoring the company's robust growth metrics despite potential risks. Such performance provides context for the recent analyst consensus price target of US$13.82, which is only slightly above the current share price of US$13.27. This indicates that the market largely believes SoFi is fairly valued, with its performance closely aligned with expectations amid ongoing financial industry shifts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives