- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

SoFi (SOFI) Net Profit Margin Jumps to 18.9%, Reinforcing Bullish Narratives on Growth

Reviewed by Simply Wall St

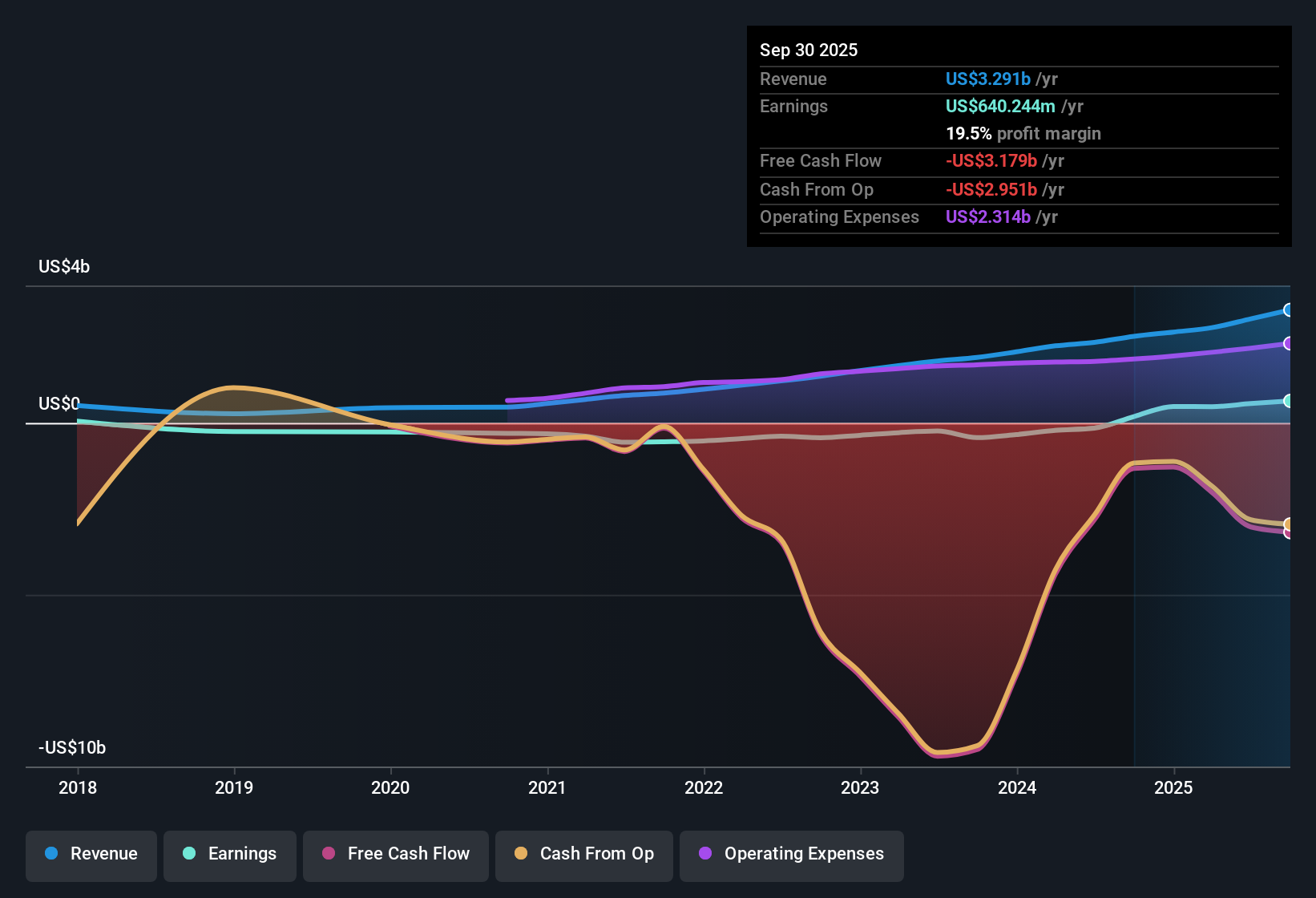

SoFi Technologies (SOFI) reported a net profit margin of 18.9%, up sharply from last year’s 7.3%, with earnings growth over the past year soaring 236.6% compared to its five-year average of 51.2%. Revenue is expected to grow at 16.2% per year, outpacing the US market’s 10.3% forecast, while earnings are projected to rise by 22% per year, well ahead of the market’s 15.7% rate. These improvements signal an accelerated period of growth and set the stage for investor optimism during earnings season.

See our full analysis for SoFi Technologies.The next section puts SoFi’s headline numbers side by side with the dominant narratives, showing where the story matches up and where it may surprise the market.

See what the community is saying about SoFi Technologies

Fee-Based Revenue Jumps 72%

- SoFi’s fee-based businesses, like its Loan Platform and Technology Platform, reported a 72% year-over-year increase in revenue and now exceed $1.5 billion annualized. This marks a critical move toward diversified, capital-light growth beyond lending.

- Bulls argue that these platforms will drive resilient margins and sustained profit growth, pointing to strong cross-sell rates and technology innovation as advantages.

- The 34% jump in members and launch of new products this quarter support cross-selling momentum.

- Annualized fee revenues above $1.5 billion reinforce the bullish case for durable, high-margin expansion.

PE Ratio at 60x vs Peer 52.7x

- SoFi trades at a price-to-earnings ratio of 60x, notably above the consumer finance industry’s 10.1x average and the peer average of 52.7x. This premium is fueled by expectations of rapid growth and margin expansion.

- According to analysts’ consensus view, this premium leaves little room for disappointment as high investor expectations are already priced in.

- If SoFi meets consensus earnings projections and achieves $954.1 million in net income by 2028, maintaining growth would still require a 40.3x PE, which remains far above the sector’s average of 10.6x.

- This valuation gap suggests that even with strong financial progress, the share price could be vulnerable if growth moderates.

- For a full breakdown of what drives analyst confidence and skepticism, dig into the latest consensus narrative for SoFi and see how the full story stacks up. 📊 Read the full SoFi Technologies Consensus Narrative.

DCF Fair Value Sits 72% Below Market

- The current share price of $30.90 is more than triple the DCF fair value estimate of $8.77, underscoring just how aggressively the market is valuing future growth and profitability potential.

- Analysts' consensus narrative notes that while business momentum and margin forecasts are positive, the large gap to fair value signals that today’s price bakes in extraordinary optimism.

- Analysts’ price target, based on future revenue and profit, is $25.03, which is still below the present market price. This highlights the delicate balance between growth hopes and valuation reality.

- Despite robust fundamentals, the ongoing premium raises the bar for continued outperformance and leaves little margin for error in future quarters.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for SoFi Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a fresh take on SoFi's results? Build your own narrative in just a few minutes and shape how you see the future. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding SoFi Technologies.

See What Else Is Out There

Despite breakout growth, SoFi’s high valuation means even strong results have left little room for underperformance. Shares are trading far above fair value estimates.

If chasing optimism feels risky, use our these 849 undervalued stocks based on cash flows to zero in on companies where current prices look far more attractive compared to their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion