- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

Is SoFi Stock's Rally Justified After Jumping 84% in 2024?

Reviewed by Bailey Pemberton

If you have ever wondered whether to buy, hold, or sell SoFi Technologies stock, you are definitely not alone. Over the last year, SoFi has been one of the most talked-about names in fintech, and it is easy to see why. After all, the stock price has soared 231.7% over the past year and has skyrocketed 390.9% in the last three years. This has created a wild ride for any investor willing to stomach the ups and downs. Even in 2024 alone, shares are up 83.8% year-to-date, which certainly puts SoFi near the top of the leaderboard for high-growth tech companies.

But it is not all smooth sailing, and recent moves show how fast sentiment can shift. Over the past week, SoFi pulled back by 7.6%, cooling down a bit from its momentum. This comes as markets digest ongoing regulatory changes in the fintech space, as well as renewed debate about competition and risk in consumer lending, which is the core of SoFi's business model. There is also growing optimism about digital banking's future, which seems to be encouraging some investors to look past short-term volatility and focus on long-term potential.

Given all these big swings, the question at the top of most investors' minds is whether SoFi stock is actually undervalued or if its rapid rise is running ahead of fundamentals. That is where valuation metrics come in. By one widely used scoring method, SoFi earns a valuation score of 0 out of 6, meaning it is not classified as undervalued on any of six major checks. Of course, relying on a checklist is just the beginning. There is a better, more insightful way to dig into valuation, which I will get to later in this article. First, though, let us break down what the traditional valuation checks actually reveal about SoFi right now.

SoFi Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: SoFi Technologies Excess Returns Analysis

The Excess Returns model provides a valuation by analyzing how much profit the company makes above its cost of capital. This approach is especially relevant for financial firms like SoFi because it emphasizes whether management is generating returns higher than shareholders could expect elsewhere, adjusted for risk.

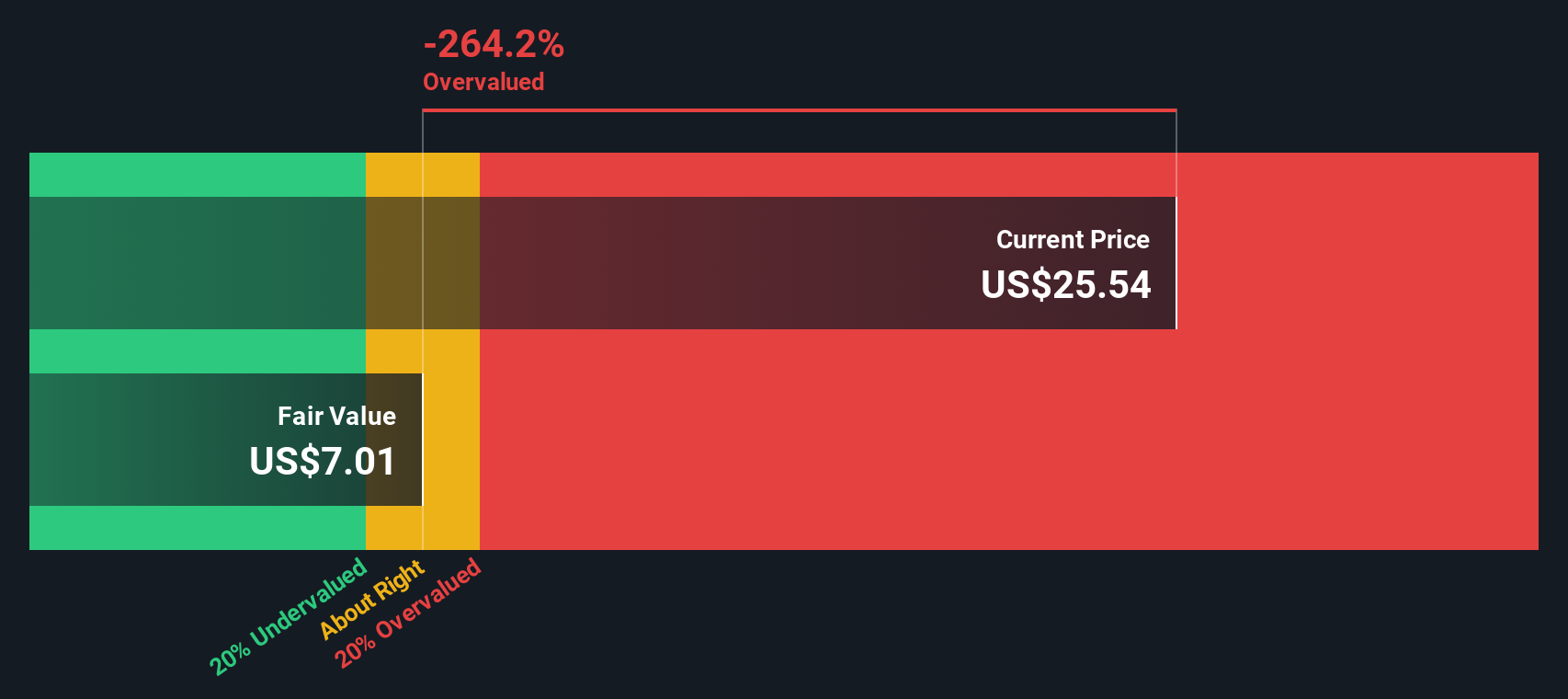

According to the model, SoFi Technologies has a Book Value of $6.16 per share and a Stable EPS estimate of $0.58 per share, based on projections from a consensus of five analysts. The Cost of Equity is nearly identical at $0.58 per share, which means the company’s Excess Return is just $0.01 per share. A key metric here is the Average Return on Equity, which sits at 8.16%. The projected Stable Book Value is $7.16 per share based on seven analyst estimates.

Given these figures, the Excess Returns model estimates an intrinsic value that is substantially below the current share price. Specifically, the model indicates the stock is 256.8% overvalued. This suggests that investors are currently pricing in far more growth and profitability than what is supported by underlying returns on equity.

Result: OVERVALUED

Our Excess Returns analysis suggests SoFi Technologies may be overvalued by 256.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: SoFi Technologies Price vs Earnings

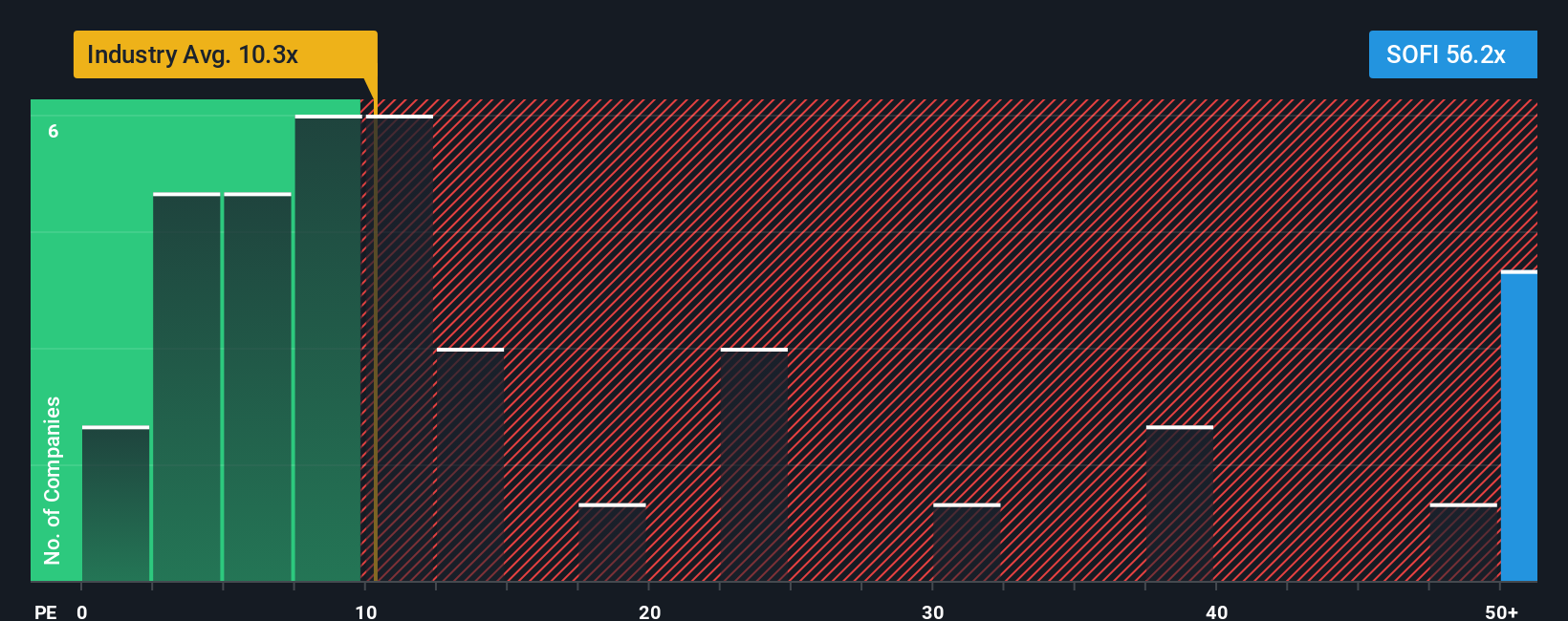

The price-to-earnings (PE) ratio is a widely used valuation metric for profitable companies because it directly links the company’s current price to its earnings power. For companies like SoFi Technologies that have reached profitability or are close to it, the PE ratio helps investors gauge how much they are paying for each dollar of earnings. Typically, faster-growing companies or those with lower risks will command higher PE ratios. In contrast, slower-growing firms or those with more risk are priced at lower multiples.

Currently, SoFi Technologies trades at a PE ratio of 55.37x. To give this some perspective, the Consumer Finance industry average PE is just 10.14x, and the average of SoFi’s peers comes in at 18.82x. Both of these benchmarks are well below where SoFi is trading right now, reflecting substantial growth expectations built into its share price.

This is where Simply Wall St's “Fair Ratio” comes in. The Fair Ratio for SoFi is calculated as 22.95x, taking into account not only the company’s expected earnings growth but also its risk profile, profit margin, size, and the context of its industry. Unlike simple peer or industry comparisons, the Fair Ratio provides a more tailored benchmark based on the company’s unique outlook and characteristics. Comparing SoFi’s actual PE of 55.37x to its Fair Ratio of 22.95x reveals that the stock is trading significantly above what would be considered fair, even when adjusting for its potential and risks.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SoFi Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story for SoFi Technologies expressed through the assumptions you make about its future, such as how quickly you expect revenue or earnings to grow, what you think profit margins could be, or your own sense of the company’s fair value. Narratives allow any investor to link their view of SoFi's journey directly to a dynamic financial forecast, which then produces a fair value that you can instantly compare to the stock’s current price.

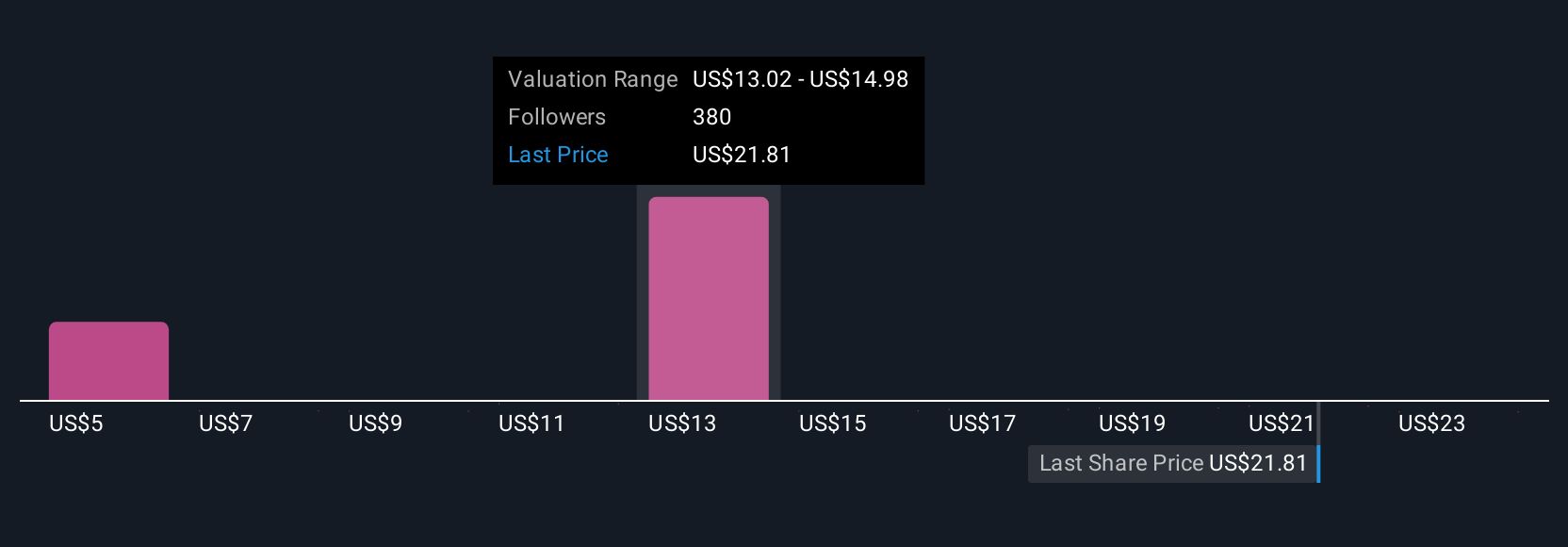

Narratives are easy to use and are available to everyone on Simply Wall St's Community page, a resource trusted by millions of investors. What makes Narratives powerful is that they update automatically when news or company results are released, helping you track how new developments might affect your outlook. With Narratives, you gain a clear framework for deciding whether to buy, hold, or sell: if your fair value is above the current price, you might see opportunity, but if it is below, you may want to wait or reassess.

For SoFi Technologies, for example, some investors have set bullish Narratives with fair values as high as $30, while others, using more cautious assumptions, see fair value closer to $6. This reflects just how much perspectives can differ even with the same data.

Do you think there's more to the story for SoFi Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives