- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

Is It Too Late to Consider SoFi After a 231% Surge and Recent Dip?

Reviewed by Bailey Pemberton

If you have been eyeing SoFi Technologies lately and wondering whether now is the right time to buy, hold, or steer clear, you are certainly not alone. The stock has been on quite a run, with a staggering 231.7% gain over the last year and nearly quadrupling over three years. Even with some volatility, such as the recent 7.6% dip in the last week, momentum has generally remained strong. This has fueled conversations about growth potential and renewed risk appetite in fintech stocks. Big-picture market trends, from digital banking adoption to shifting consumer finance habits, have kept SoFi top of mind for investors assessing future winners.

But with every hot stock, valuation truly matters. That's where the numbers start to tell a more nuanced story. Despite SoFi’s eye-catching performance, it currently scores a 0 on our Value Score, a system that adds a point for each of six common valuation checks where the stock appears undervalued. SoFi does not come up as undervalued by a single one of these measures right now. That raises essential questions for anyone trying to make a rational decision rather than an emotional one.

Let’s break down how the most widely used valuation approaches assess SoFi, and then touch on a smarter, more holistic perspective to valuation at the end of the article. This kind of perspective just might surprise you.

SoFi Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: SoFi Technologies Excess Returns Analysis

The Excess Returns valuation model focuses on a company's ability to deliver returns that exceed its cost of equity. In other words, it measures whether SoFi Technologies is creating genuine value above the baseline expected by investors. This is a useful approach for assessing businesses, especially in finance, where sustained profitability and efficient equity use matter a great deal.

According to the latest data, SoFi’s current Book Value stands at $6.16 per share, with a Stable Book Value projected at $7.16 per share, based on estimates from seven analysts. SoFi's Stable EPS (earnings per share) is estimated at $0.58, while the Cost of Equity is also $0.58 per share. This translates to a very slim Excess Return of only $0.01 per share. The average Return on Equity for SoFi sits at 8.16%. On a book value basis, the company is barely generating any value over its capital cost. These figures indicate that SoFi's ability to add value for shareholders using its equity capital is currently minimal.

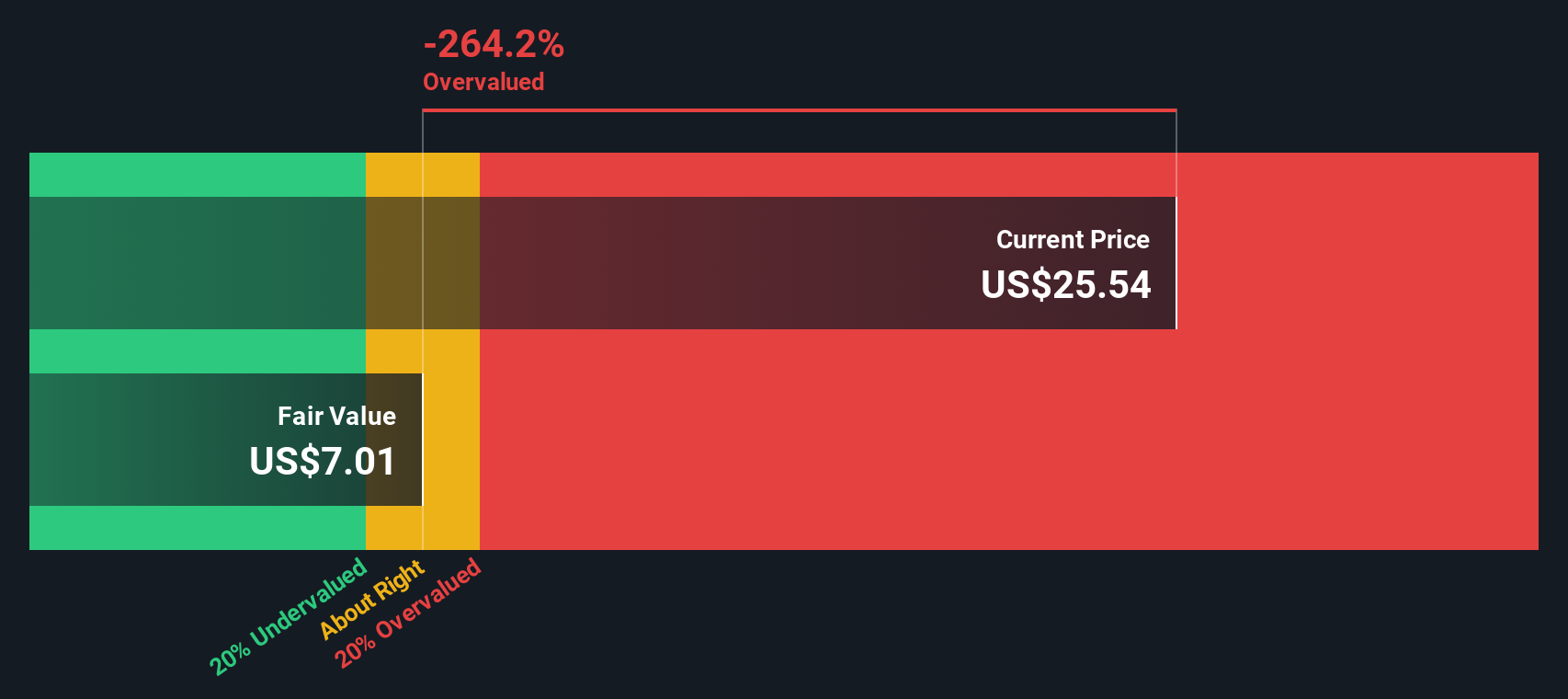

After running these inputs through the model, the estimated intrinsic value of SoFi Technologies comes out well below its current trading price. In fact, the Excess Returns model suggests the stock is a staggering 256.8% overvalued compared to its intrinsic worth. This implies that, at today’s price, the market is assuming a much brighter future performance than fundamentals justify.

Result: OVERVALUED

Our Excess Returns analysis suggests SoFi Technologies may be overvalued by 256.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: SoFi Technologies Price vs Earnings

For profitable companies like SoFi Technologies, the Price-to-Earnings (PE) ratio is often the go-to metric for valuation. The PE ratio tells investors how much they are paying for each dollar of earnings, making it a practical way to assess whether the stock price fairly reflects the company’s financial performance.

The “right” PE ratio depends on more than just profits. Fast-growing, lower-risk companies can command higher PE multiples, while slower-growing or riskier ones usually trade at lower ratios. Factors such as projected earnings growth, profitability, market size, and perceived risk all influence what’s considered a reasonable PE.

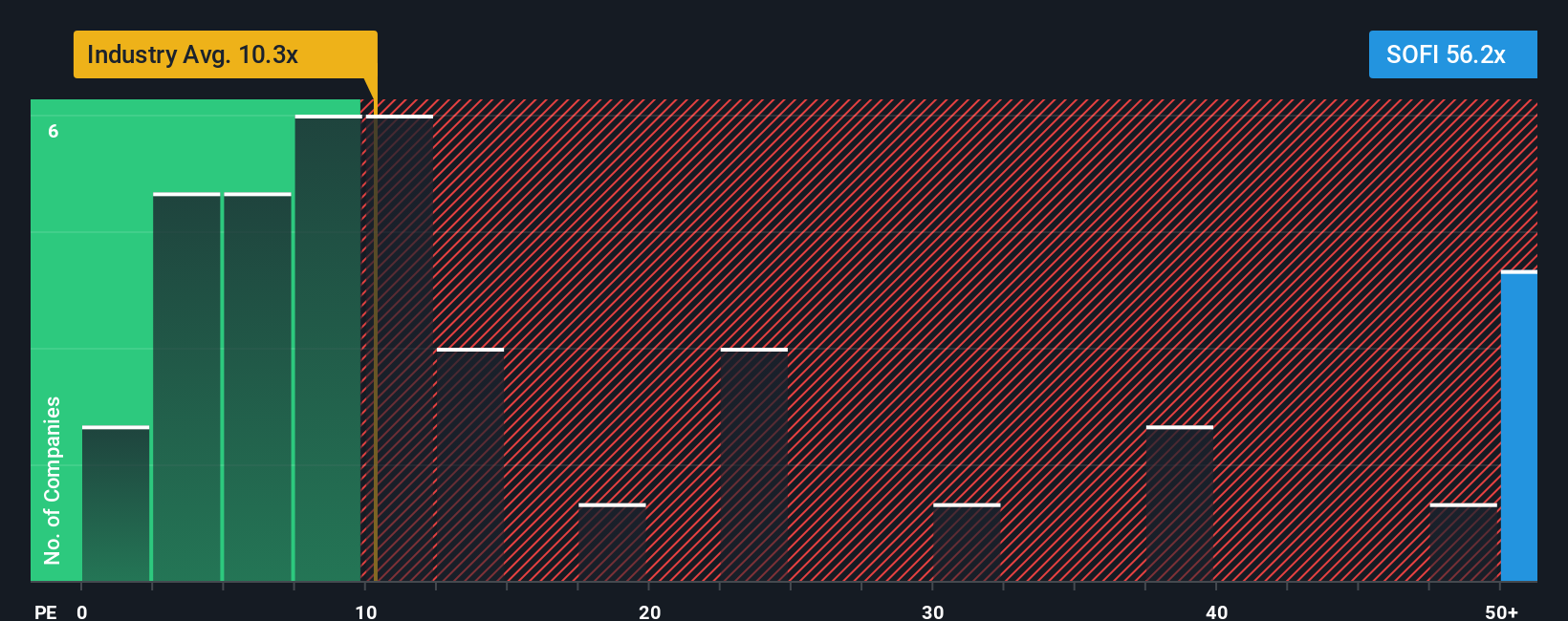

SoFi Technologies currently trades at a PE ratio of 55.37x. For perspective, the average for SoFi’s peers is 18.82x, and the broader Consumer Finance industry typically sees an average PE of 10.14x. At first glance, SoFi appears to be priced at a significant premium to both competitors and the sector overall.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio, which sits at 22.95x for SoFi, factors in growth potential, profit margins, industry dynamics, company size, and the risks specific to SoFi. This proprietary measure offers a more nuanced benchmark than a simple industry or peer average because it considers exactly why SoFi might deserve a higher or lower multiple.

Comparing the current PE of 55.37x to the Fair Ratio of 22.95x shows SoFi is trading well above what would be justified by its fundamentals and outlook. This suggests the stock is likely overvalued at current levels, even allowing for its unique growth prospects and strengths.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SoFi Technologies Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about SoFi Technologies: an actionable perspective that links why you think the company will win or lose, what you expect for its future (like revenue, earnings, and profit margin), and how all of this adds up to a fair value. Narratives turn numbers into a living picture of a company's journey, backing your forecasts and assumptions with context that numbers alone just can't provide.

On Simply Wall St, Narratives are accessible on the Community page and used by millions of investors. They are an easy tool for every investor, whether pro or new, to compare their story-driven fair value against SoFi’s latest share price, helping you decide whether to buy, hold, or sell. As the news, financial results, or big headlines roll in, Narratives update dynamically, reflecting the latest information and keeping your view fresh and relevant.

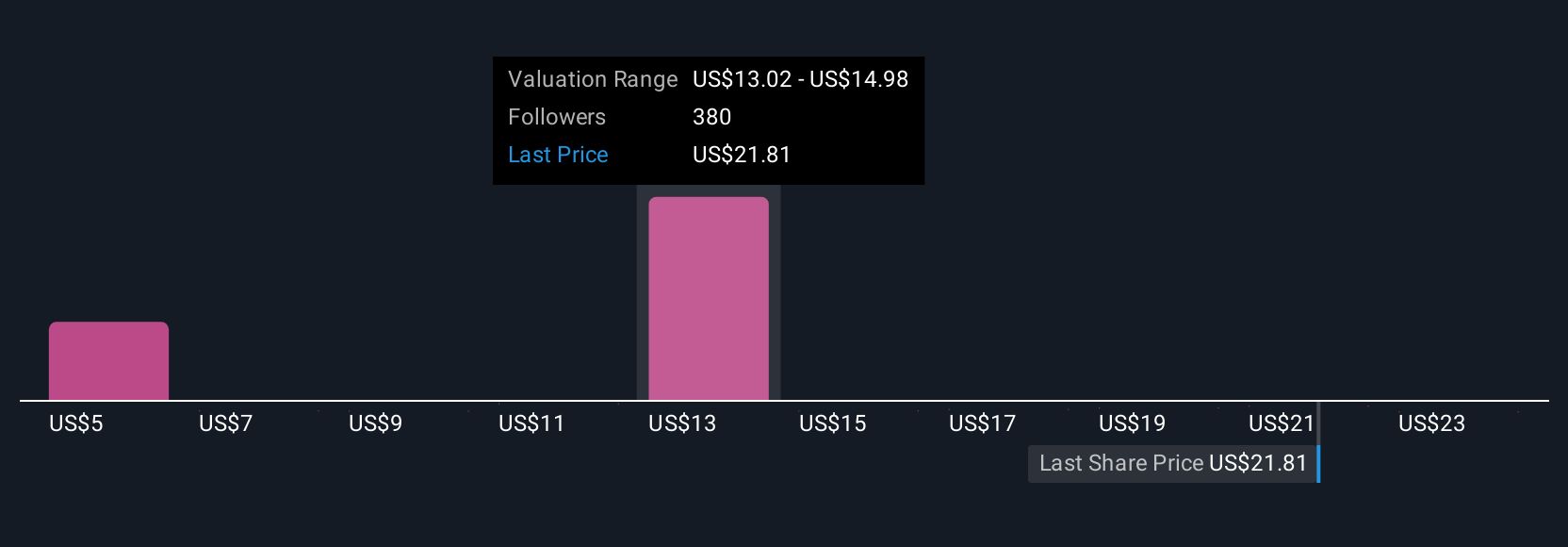

For example, some investors see SoFi’s future so bright they peg fair value as high as $30.00 per share, while others remain cautious, believing it could deserve as little as $6.00. This is a real illustration of how the story behind the numbers truly matters.

Do you think there's more to the story for SoFi Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives