- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

As SoFi Technologies (NASDAQ:SOFI) Dips, Institutions are Getting a Fresh Buying Opportunity

Many growth stocks took a hit in the recent weeks, and SoFi Technologies, Inc. (NASDAQ: SOFI) has not been spared, as it dipped over 35%. As the stock reaches toward the yearly lows, we'll look into the current state of the ownership and reflect on the recent moves made by the insiders and institutions.

View our latest analysis for SoFi Technologies

Latest Developments

SoFi Technologies recently announced a secondary offering of 50m shares of its common stock. The offering consists entirely of shares sold by the existing stockholders and will not change or dilute the number of shares outstanding.

Among the shareholders who reduced their stake, Softbank Group stands as the most prominent seller, with 22.5m shares at an average price of US$21.60 – well above the current trading price of US$15.20.

Arguably, a more concerning move is the decision of a known venture capitalist, Chamath Palihapitiya, to reduce his stake by 15%. Mr.Palihapitiya stated it was due to financing other projects. His remaining stake is still one of the top SoFi holdings at 2.81%.

Yet, despite all the short-term stock price declines, the fundamentals have not significantly changed. SoFi actually raised the forecasts for FY 2021 revenues, guiding them between US$1,002b to US$1,012b. Furthermore, FY 2022 projections are currently at US$1.5b, giving the Y/Y revenue growth projection of almost 50%.

Who Owns SoFi Technologies?

SoFi Technologies is a pretty big company. It has a market capitalization of US$12b. Normally institutions would own a significant portion of a company this size. Looking at our data on the ownership groups (below), it seems that institutions are noticeable on the share registry. Let's delve deeper into each type of owner to discover more about SoFi Technologies.

What Does The Institutional Ownership Tell Us About SoFi Technologies?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

SoFi Technologies already has institutions on the share registry. Indeed, they own a respectable stake in the company. This implies the analysts working for those institutions have looked at the stock, and they like it. Looking at our archives, we can see that institutional ownership increased by 2% over the last few months - a positive trend.

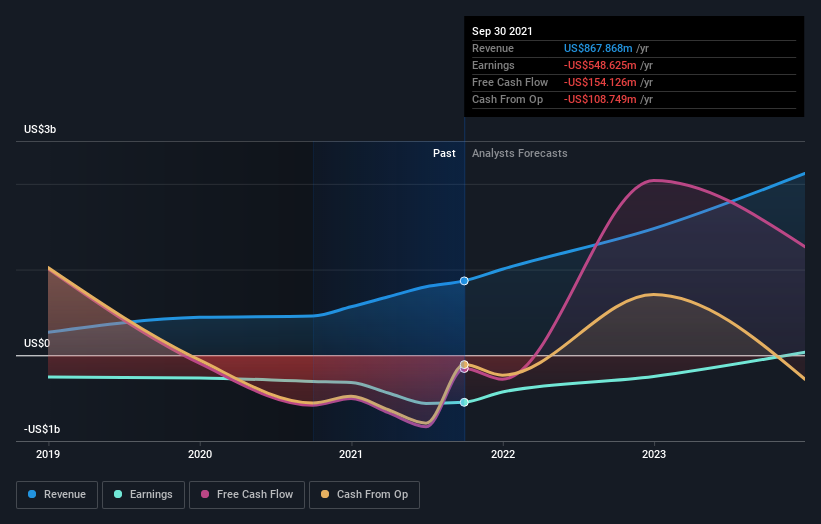

You can see SoFi Technologies' historical earnings and revenue below, but keep in mind there's always more to the story.

We note that hedge funds don't have a meaningful investment in SoFi Technologies. Looking at our data, we can see that the largest shareholder is SoftBank Group Corp., with 12% of shares outstanding. The Vanguard Group, Inc. is the second-largest shareholder owning 5.9% of common stock, and Clay Wilkes holds about 5.3% of the company stock. Clay Wilkes, the third-largest shareholder, also happens to hold the title of Member of the Board of Directors.

On studying our ownership data, we found that 25 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of SoFi Technologies

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management runs the business, but the CEO will answer to the board, even if they are a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, too much power is concentrated within this group on some occasions.

Our most recent data indicates that insiders own some shares in SoFi Technologies, Inc. Insiders own US$1.2b worth of shares (at current prices). Most would say this shows a good alignment of interests between shareholders and the board. Still, it might be worth checking if those insiders have been selling.

General Public Ownership

The general public-- including retail investors -- owns a 45% stake in the company and can't easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Public Company Ownership

Public companies currently own 12% of SoFi Technologies stock. It's hard to say for sure, but this suggests they have entwined business interests. This might be a strategic stake, so it's worth watching this space for changes in ownership.

Next Steps:

SoFi has significantly retraced in the last few weeks, dropping almost to the yearly low. Yet, the fundamentals have not changed much - if anything, the company has boosted the revenue expectations.

Although there has been a stock offering, there isn't any dilution, and the institutional interest has not declined - it has actually increased by 2% over the last 2 months.

To truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for SoFi Technologies that you should be aware of.

But ultimately, it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion