- United States

- /

- Consumer Finance

- /

- NasdaqGS:SLM

Is SLM (SLM) Still Undervalued After Its Recent Share Price Gains?

Reviewed by Simply Wall St

SLM (SLM) has quietly outpaced the broader market over the past month, with the stock up about 11% and roughly 17% over the past year, prompting closer attention to its valuation.

See our latest analysis for SLM.

With the share price now around $30.10 and a 30 day share price return of just over 11%, SLM’s recent momentum contrasts with a softer 90 day patch. However, it still sits comfortably on top of a powerful five year total shareholder return trend.

If this kind of steady compounding appeals to you, it might be worth exploring what else is working in financials by checking out fast growing stocks with high insider ownership.

With shares trading near 30 dollars, analysts seeing upside to roughly 35 dollars, and fundamentals still growing, investors now face the key question: is SLM a buy at this level, or is future growth already priced in?

Most Popular Narrative: 13.3% Undervalued

With SLM last closing at $30.10 against a narrative fair value of about $34.73, the current setup suggests upside if the thesis plays out.

The recently enacted federal student loan reforms, which cap borrowing under Parent PLUS and eliminate Grad PLUS, are expected to shift $4.5 to $5 billion in annual loan volume from the federal to the private market, directly expanding SLM's addressable market; this is poised to drive higher revenue growth beginning in 2027 as the impact phases in.

Curious how a reshaped federal lending landscape, richer margins, and buybacks combine into that higher fair value? See which forward earnings assumptions power this narrative.

Result: Fair Value of $34.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and any sustained deterioration in credit quality could quickly erode SLM’s growth runway and challenge the current undervaluation case.

Find out about the key risks to this SLM narrative.

Another Lens on Value

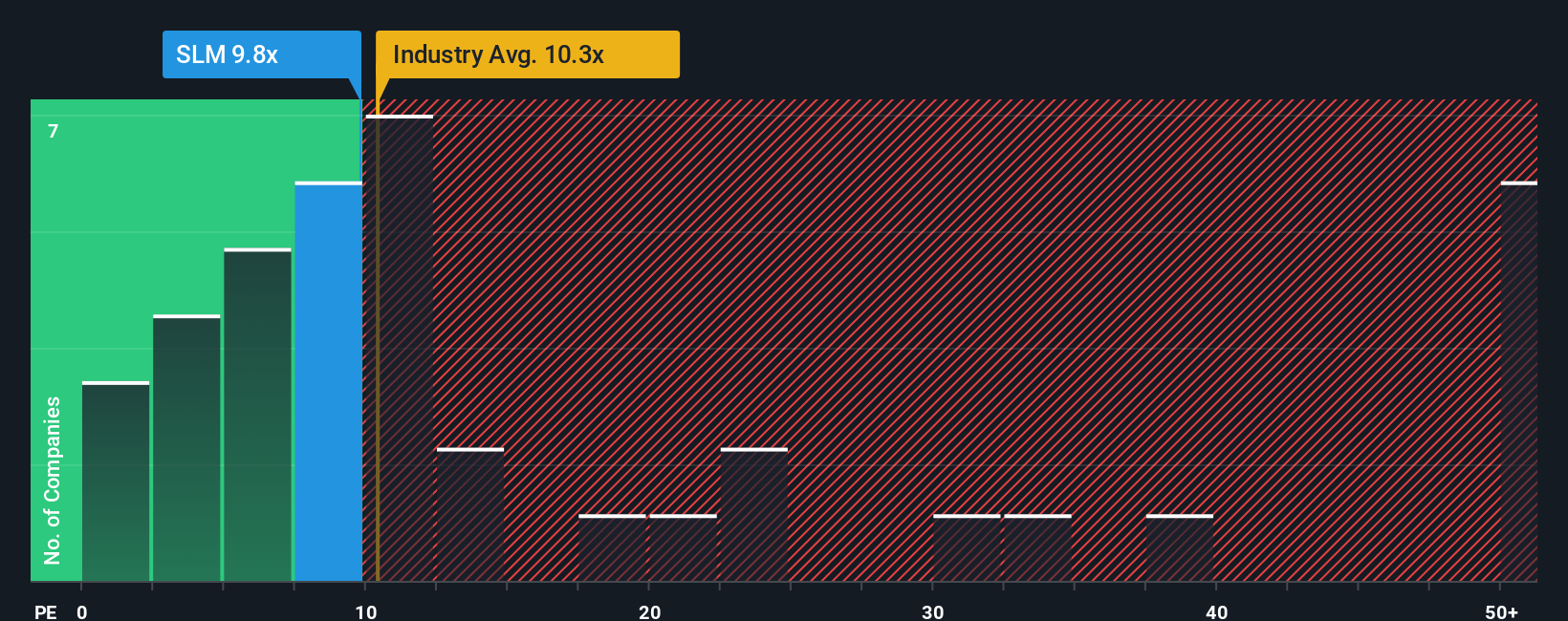

On simple earnings math, SLM does not look obviously cheap. It trades on about 10.1 times earnings, very similar to the 10 times average for the US consumer finance sector, yet below a fair ratio of 14.6 times suggested by our model. This raises the question of whether there is a hidden margin of safety or whether it is a value trap in disguise.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SLM Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes, Do it your way.

A great starting point for your SLM research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t stop with just one opportunity. Use the Simply Wall St Screener now to uncover fresh, data driven ideas that other investors could be overlooking.

- Capture potential mispricings by acting on these 918 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully appreciated yet.

- Ride powerful income trends by targeting these 14 dividend stocks with yields > 3% that can help strengthen your portfolio’s regular cash returns.

- Position yourself at the frontier of digital finance by backing these 81 cryptocurrency and blockchain stocks building real businesses around blockchain and decentralized technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SLM

SLM

Through its subsidiaries, originates and services private education loans to students and their families to finance the cost of their education in the United States.

Good value with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026