- United States

- /

- Diversified Financial

- /

- NasdaqCM:SEZL

Will Sezzle’s (SEZL) New Retail Partnerships Reveal a Shifting Competitive Edge This Holiday Season?

Reviewed by Sasha Jovanovic

- Sezzle announced in early October 2025 that it has expanded its merchant partnerships across fashion, sporting goods, beauty, fitness, and digital content categories just ahead of the holiday shopping season, onboarding retailers such as Cato Fashions, SCHEELS, D&B Supply, Dermstore, and digital platform Whop.

- Early data showed Sezzle orders at Cato Fashions averaged nearly twice the retailer’s usual order value in the first month, offering a glimpse into the potential impact of flexible payments for both merchants and shoppers even as overall holiday retail spending is projected to decline.

- We'll explore how Sezzle's expanded retailer collaborations ahead of the holidays may influence its growth outlook and market positioning.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Sezzle Investment Narrative Recap

To be a Sezzle shareholder today, you need to believe in the company's ability to consistently grow through merchant partnerships and capitalize on younger generations’ shift to flexible, digital payments, while keeping credit risk and profitability in check. The October expansion of Sezzle’s merchant base is interesting for short-term holiday order volume, but its impact on the most important near-term driver, efficient customer acquisition translating to higher-margin product adoption, is likely limited, and it does not materially change the largest risk: credit losses tied to new user acquisition.

Among recent announcements, Sezzle’s Q2 results serve as the clearest snapshot of its current momentum. With 76% revenue growth year-on-year and continued profit generation, the company is outpacing much of the sector, yet still faces the challenge of balancing rapid user and revenue expansion with disciplined underwriting, a critical factor for sustaining robust net margins as it broadens its merchant and consumer reach.

But in contrast to the excitement around order value growth, it’s worth noting that elevated provision for credit losses remains a factor investors should be aware of as...

Read the full narrative on Sezzle (it's free!)

Sezzle's narrative projects $885.4 million revenue and $232.2 million earnings by 2028. This requires 33.5% yearly revenue growth and a $127.6 million earnings increase from $104.6 million today.

Uncover how Sezzle's forecasts yield a $119.25 fair value, a 54% upside to its current price.

Exploring Other Perspectives

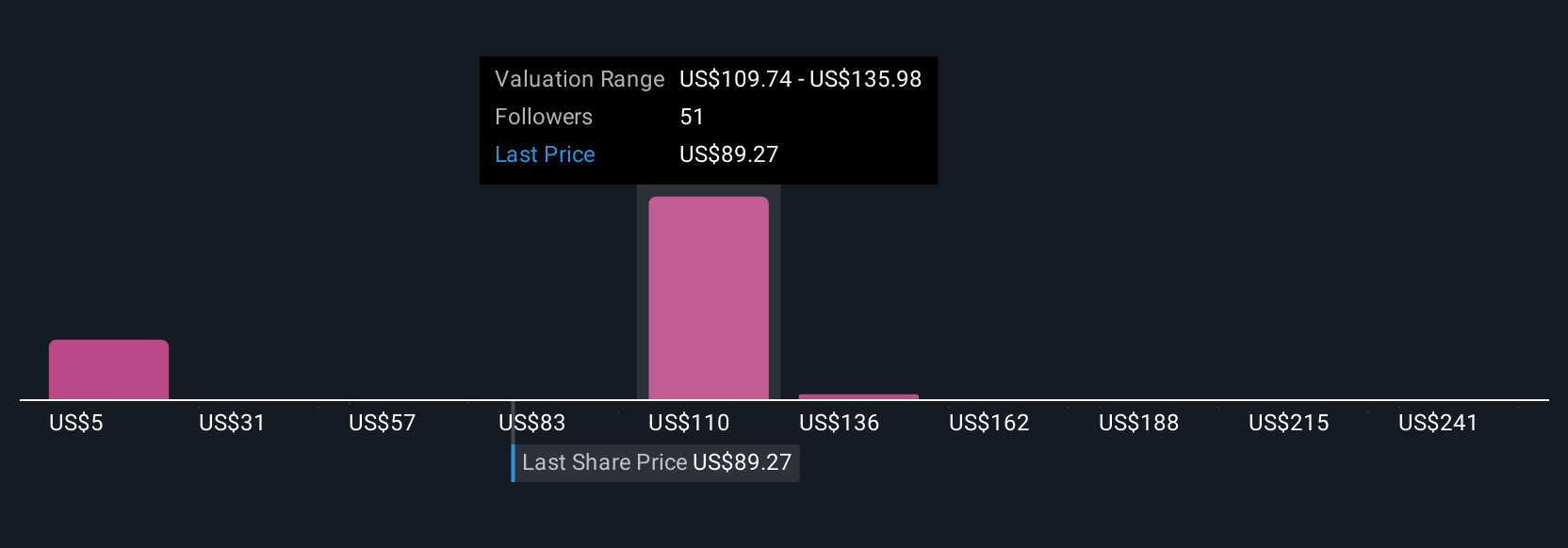

Fifteen community-sourced fair value estimates for Sezzle span from US$4.77 to US$346.57, highlighting sharply different outlooks among the Simply Wall St Community. While many expect impressive top-line growth, persistent credit loss pressures paint a more complex picture for long-term returns, review a range of opinions to see how your view may fit.

Explore 15 other fair value estimates on Sezzle - why the stock might be worth over 4x more than the current price!

Build Your Own Sezzle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sezzle research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sezzle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sezzle's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SEZL

Sezzle

Operates as a technology-enabled payments company primarily in the United States and Canada.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives