- United States

- /

- Diversified Financial

- /

- NasdaqCM:SEZL

Sezzle (SEZL): Evaluating Valuation Following New Merchant Partnerships Targeting Gen Z and Holiday Growth

Reviewed by Kshitija Bhandaru

Sezzle (NasdaqCM:SEZL) is making headlines after announcing a wider lineup of merchant partners ahead of the 2025 holiday season. This move could support growth even as shoppers rein in spending.

See our latest analysis for Sezzle.

Sezzle’s latest push to broaden its merchant base comes as the share price has pulled back sharply in recent weeks, with a 1-month share price return of -13.4% and a steep 43% drop over the past quarter. Despite this short-term pressure, momentum over the past year remains robust. Total shareholder return stands at an impressive 158%, hinting that many investors are still confident in Sezzle’s long-term growth story as it carves out space in the evolving buy now, pay later landscape.

If Sezzle’s recent moves have you interested in what else could deliver breakout returns, now’s a great time to look beyond the headlines and discover fast growing stocks with high insider ownership

With the share price under pressure but analyst targets suggesting substantial upside, the critical question now is whether Sezzle’s rapid growth trajectory remains underappreciated by the market or if expectations have already been factored in. Could this be the opening for new buyers, or is future growth already priced in?

Most Popular Narrative: 35.1% Undervalued

According to the latest and most watched narrative, Sezzle’s fair value sits notably above its current trading level. This suggests the stock may be flying under the radar. This creates an environment for some bold claims about future growth and a big catalyst to watch.

Ongoing investment in efficient, data-driven customer acquisition (marketing spend increase to $8.8 million with a targeted six-month payback and rapid ramp in high-LTV "mod" users) positions Sezzle to capitalize on the global shift toward digital payments, supporting expanding total addressable market (revenue growth) and potential for operating leverage (margin improvement) as investments mature.

Want to know the engine behind this double-digit upside? The narrative leans on rising revenue, aggressive customer growth strategies, and shifting profit margins. Wondering which future assumptions push that massive fair value? Check the full story and uncover the bold projections behind Sezzle's valuation.

Result: Fair Value of $119.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Sezzle’s heavy marketing spend and reliance on lower-margin products could weigh on profitability if user growth or product mix shifts do not meet expectations.

Find out about the key risks to this Sezzle narrative.

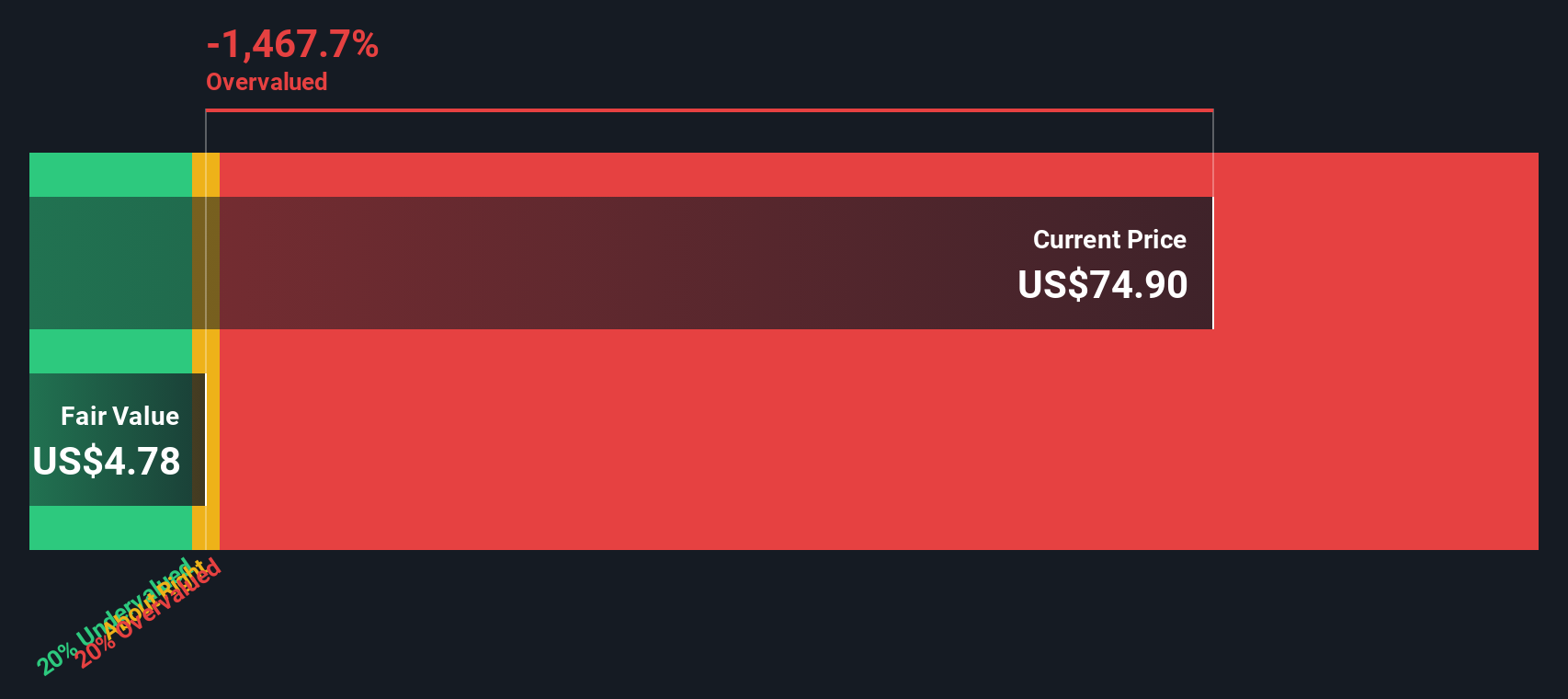

Another View: DCF Puts It in a Different Light

While analyst price targets suggest Sezzle is significantly undervalued, the SWS DCF model tells a different story. According to our cash flow analysis, the shares actually trade above the fair value estimate. This raises an intriguing question about how sustainable analyst growth expectations really are.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sezzle for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sezzle Narrative

If you see the numbers differently or want to test your own assumptions, it's quick and easy to build your own view right now, so why not Do it your way

A great starting point for your Sezzle research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take your portfolio further and see the kind of returns other investors are chasing by trying these powerful stock search shortcuts on Simply Wall St now.

- Uncover future tech leaders by starting with these 24 AI penny stocks focused on advancements in artificial intelligence and automation.

- Capture standout income opportunities and get ahead of inflation with these 19 dividend stocks with yields > 3% recognized for stable, high-yield payments.

- Spot companies trading at a bargain and aim for value-driven gains through these 893 undervalued stocks based on cash flows that meet strict cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SEZL

Sezzle

Operates as a technology-enabled payments company primarily in the United States and Canada.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives