- United States

- /

- Oil and Gas

- /

- NYSEAM:LEU

Exploring 3 Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

Over the last 7 days, the market has risen 1.8%, and in the past year, it has climbed 32%, with earnings forecasted to grow by 15% annually. In this thriving environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding; here are three lesser-known companies that stand out as promising opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| River Financial | 122.41% | 16.43% | 18.50% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Tiptree | 68.59% | 20.55% | 20.06% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

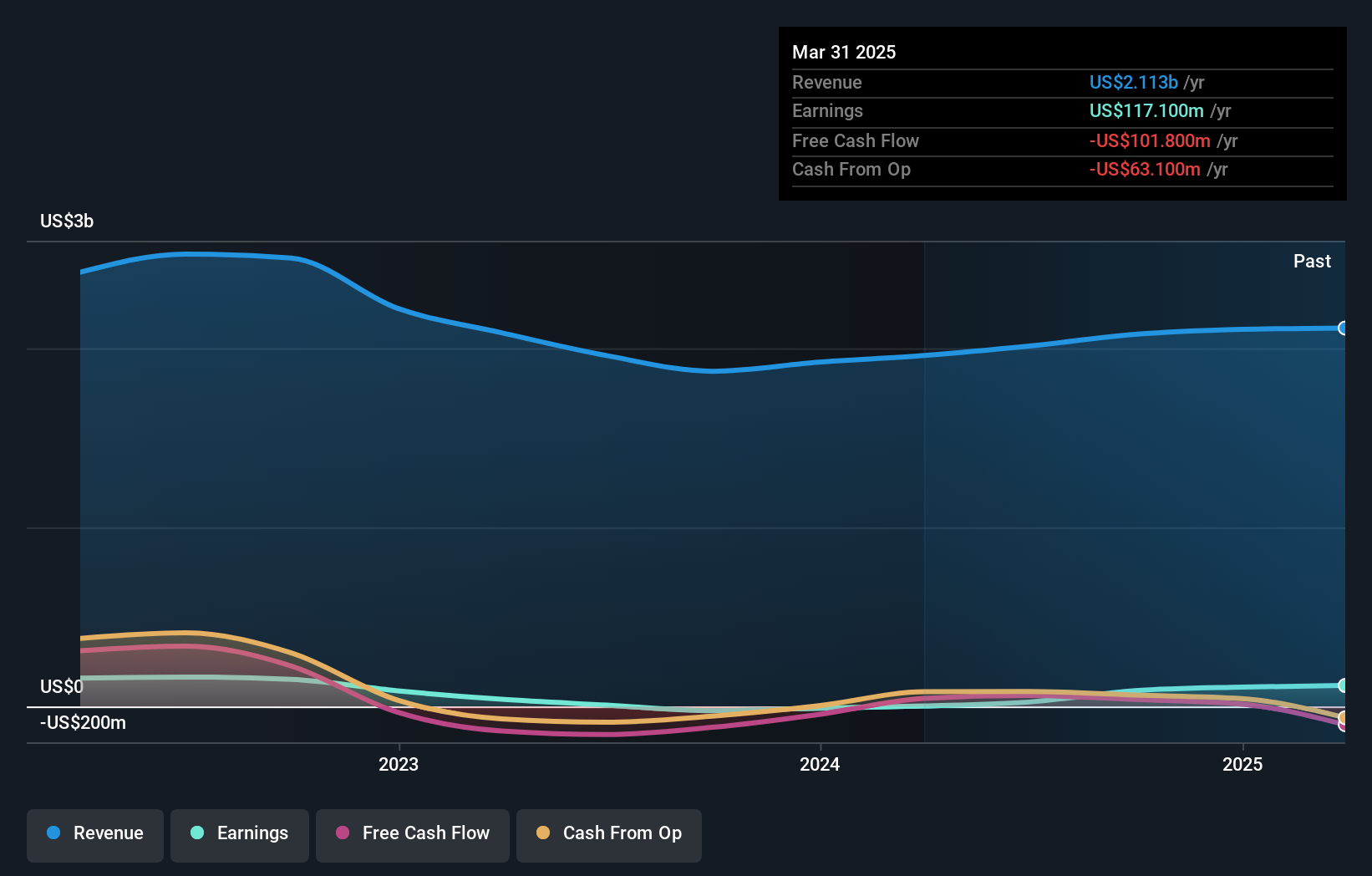

Sezzle (NasdaqCM:SEZL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sezzle Inc. operates as a technology-enabled payments company primarily in the United States and Canada, with a market cap of $990.99 million.

Operations: Sezzle generates revenue primarily through lending to end-customers, amounting to $192.69 million. The company's net profit margin is a critical metric for evaluating its financial health and efficiency.

Sezzle's debt to equity ratio has impressively reduced from 1676.6% to 137% over the past five years, reflecting strong financial management. The company's EBIT covers its interest payments 4.9 times, indicating solid earnings quality. Sezzle reported a net income of US$29.7 million for Q2 2024, up from US$1.14 million last year, showing robust growth in profitability despite significant insider selling recently and high share price volatility over the past three months.

- Take a closer look at Sezzle's potential here in our health report.

Understand Sezzle's track record by examining our Past report.

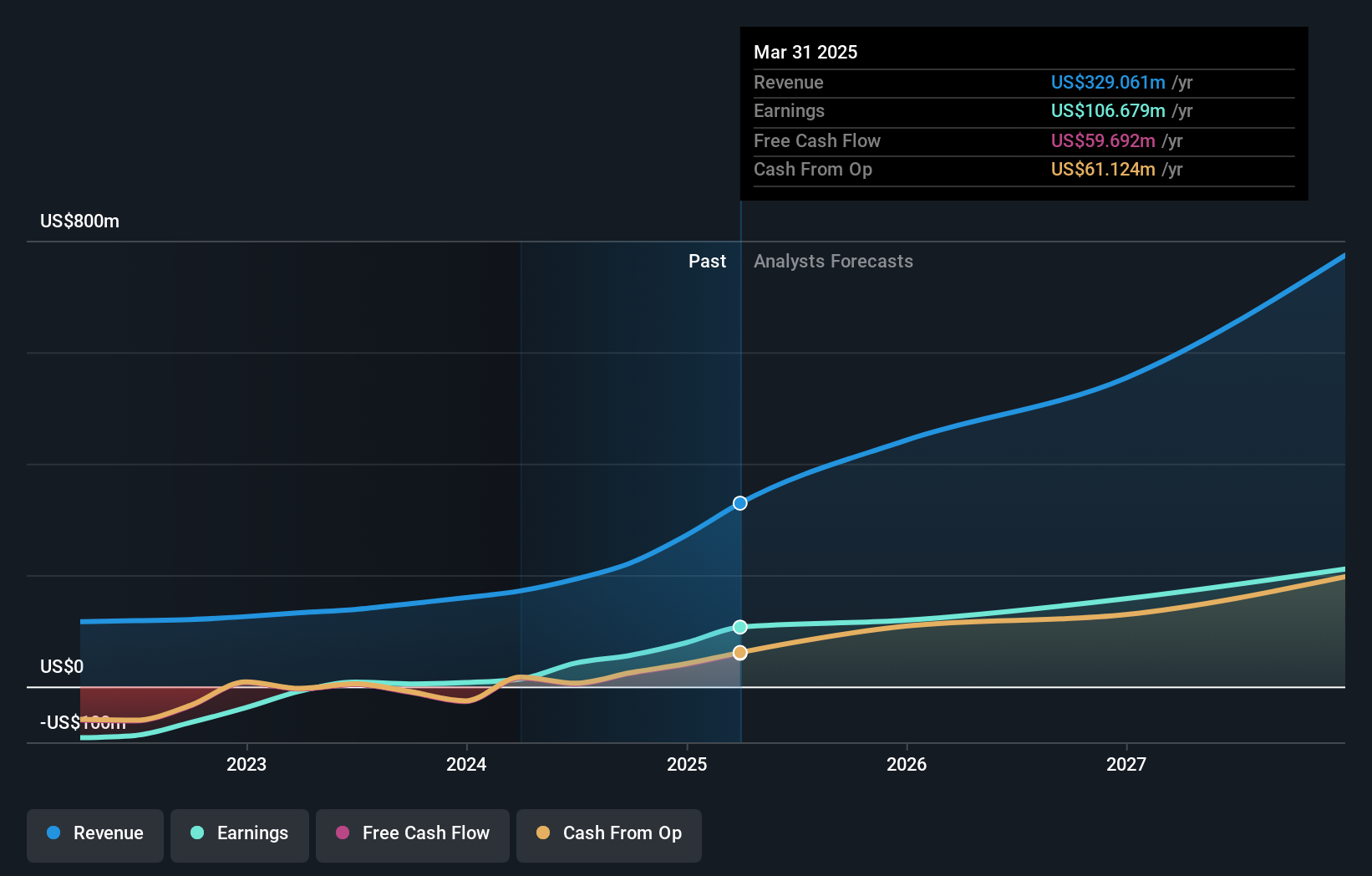

Centrus Energy (NYSEAM:LEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Centrus Energy Corp. supplies nuclear fuel components and services for the nuclear power industry in the United States, Belgium, Japan, and internationally, with a market cap of $863.49 million.

Operations: Centrus Energy generates revenue primarily from two segments: Technical Solutions ($71.80 million) and Low-Enriched Uranium (LEU) ($320.80 million). The company's market cap is $863.49 million.

Centrus Energy, a small-cap player in the energy sector, has shown remarkable growth with earnings surging by 164.9% over the past year, outpacing the broader oil and gas industry. The company reported Q2 revenue of US$189 million compared to US$98.4 million last year and net income of US$30.6 million versus US$12.7 million previously. Despite high volatility in its share price recently, Centrus is trading at 66% below its estimated fair value and maintains more cash than total debt, ensuring strong financial health.

- Click here and access our complete health analysis report to understand the dynamics of Centrus Energy.

Review our historical performance report to gain insights into Centrus Energy's's past performance.

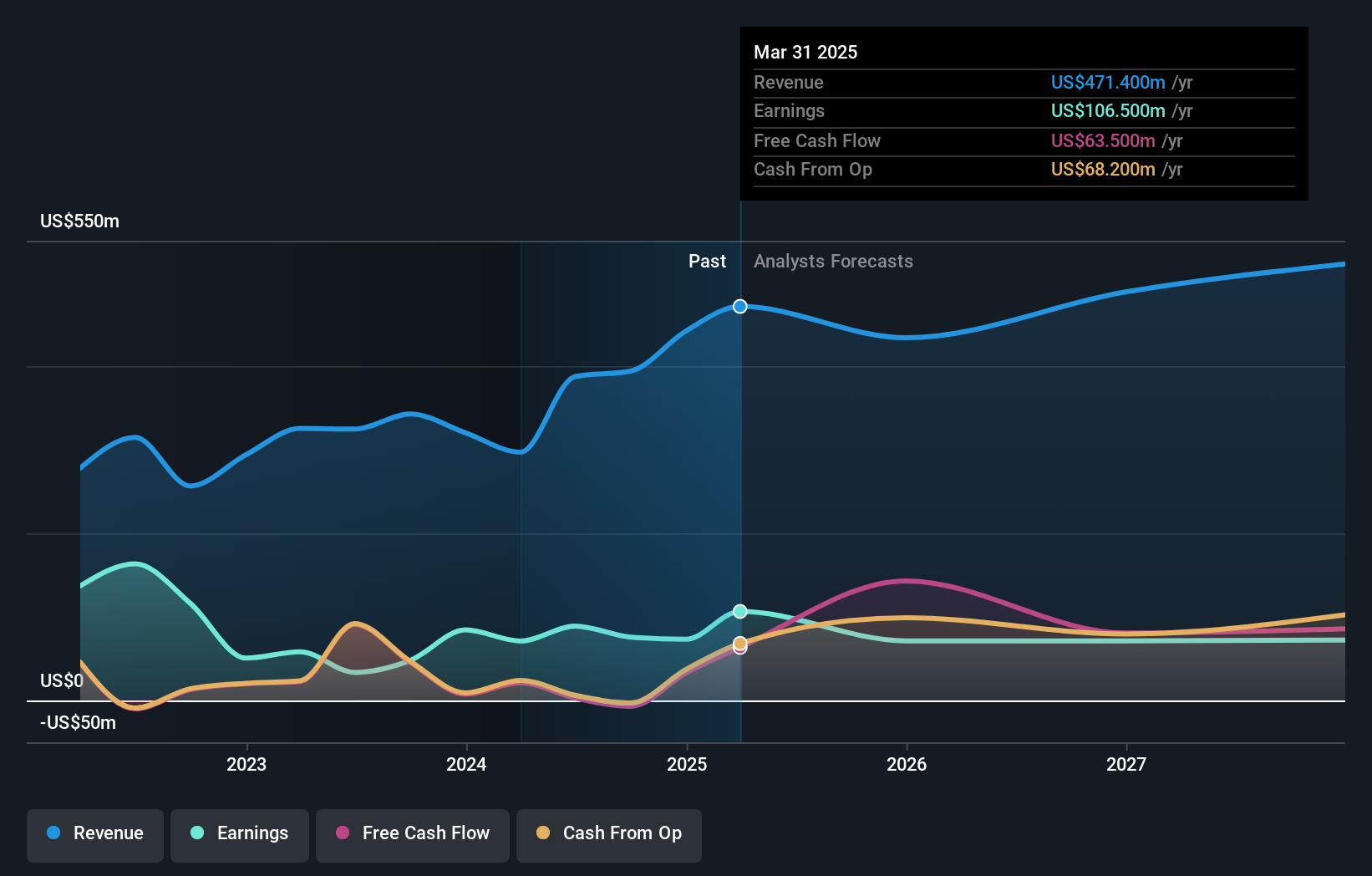

Valhi (NYSE:VHI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Valhi, Inc. operates in the chemicals, component products, and real estate management and development sectors across Europe, North America, the Asia Pacific, and internationally with a market cap of $834.98 million.

Operations: Valhi generates revenue from three primary segments: chemicals ($1.78 billion), component products ($157.40 million), and real estate management and development ($78.50 million).

Valhi has shown impressive earnings growth of 215.4% over the past year, outpacing the Chemicals industry's -4.8%. The company's net debt to equity ratio stands at a satisfactory 8.6%, and its interest payments are well covered by EBIT with a 4.7x coverage ratio. Despite a volatile share price in recent months, Valhi's high-quality earnings and reduced debt-to-equity ratio from 78% to 38.7% over five years highlight its financial resilience and potential for future stability.

- Delve into the full analysis health report here for a deeper understanding of Valhi.

Gain insights into Valhi's past trends and performance with our Past report.

Turning Ideas Into Actions

- Delve into our full catalog of 208 US Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:LEU

Centrus Energy

Supplies nuclear fuel components and services for the nuclear power industry in the United States, Belgium, Japan, and internationally.

Solid track record with excellent balance sheet.