- United States

- /

- Banks

- /

- NYSE:LOB

Discovering Hidden Stock Opportunities In December 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 2.8%, contributing to a remarkable 24% increase over the past year, with earnings forecasted to grow by 15% annually. In this thriving environment, identifying hidden stock opportunities involves finding companies with strong fundamentals and growth potential that have not yet caught widespread investor attention.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

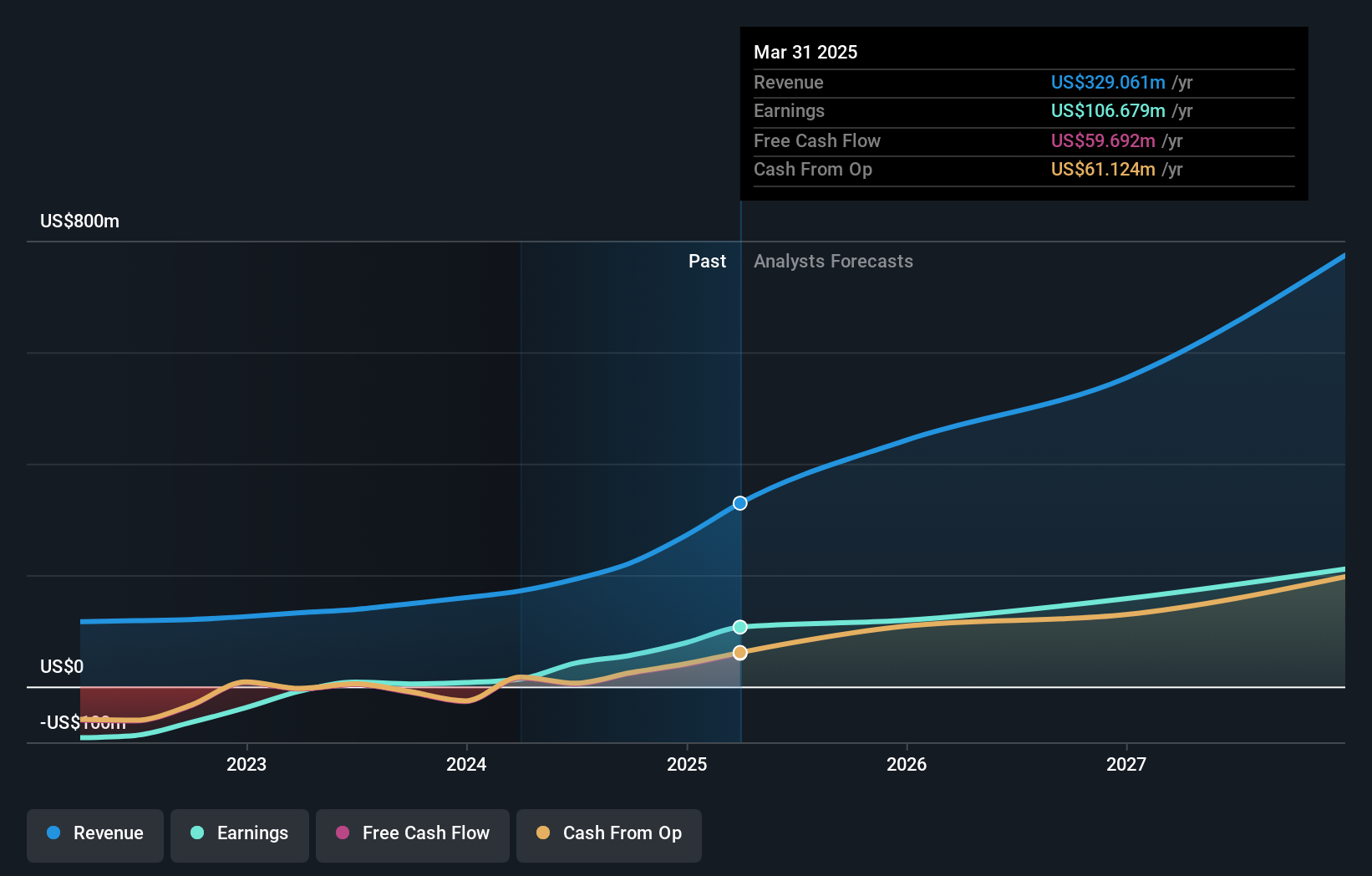

Sezzle (NasdaqCM:SEZL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sezzle Inc. is a technology-enabled payments company that operates mainly in the United States and Canada, with a market cap of $1.43 billion.

Operations: Sezzle generates revenue primarily through lending to end-customers, amounting to $221.81 million.

Sezzle, a nimble player in the payment solutions space, has shown remarkable earnings growth of 1070% over the past year, significantly outpacing the industry's 14.6%. The company's debt management appears prudent with interest payments well-covered by EBIT at 6.8 times and a satisfactory net debt to equity ratio of 22.7%. However, its overall debt to equity ratio has risen from 77.3% to 153.6% over five years, indicating increased leverage. Recent partnerships with Bealls Inc., Rural King, and Backcountry highlight Sezzle's strategic focus on expanding its reach through flexible financing options during peak shopping seasons.

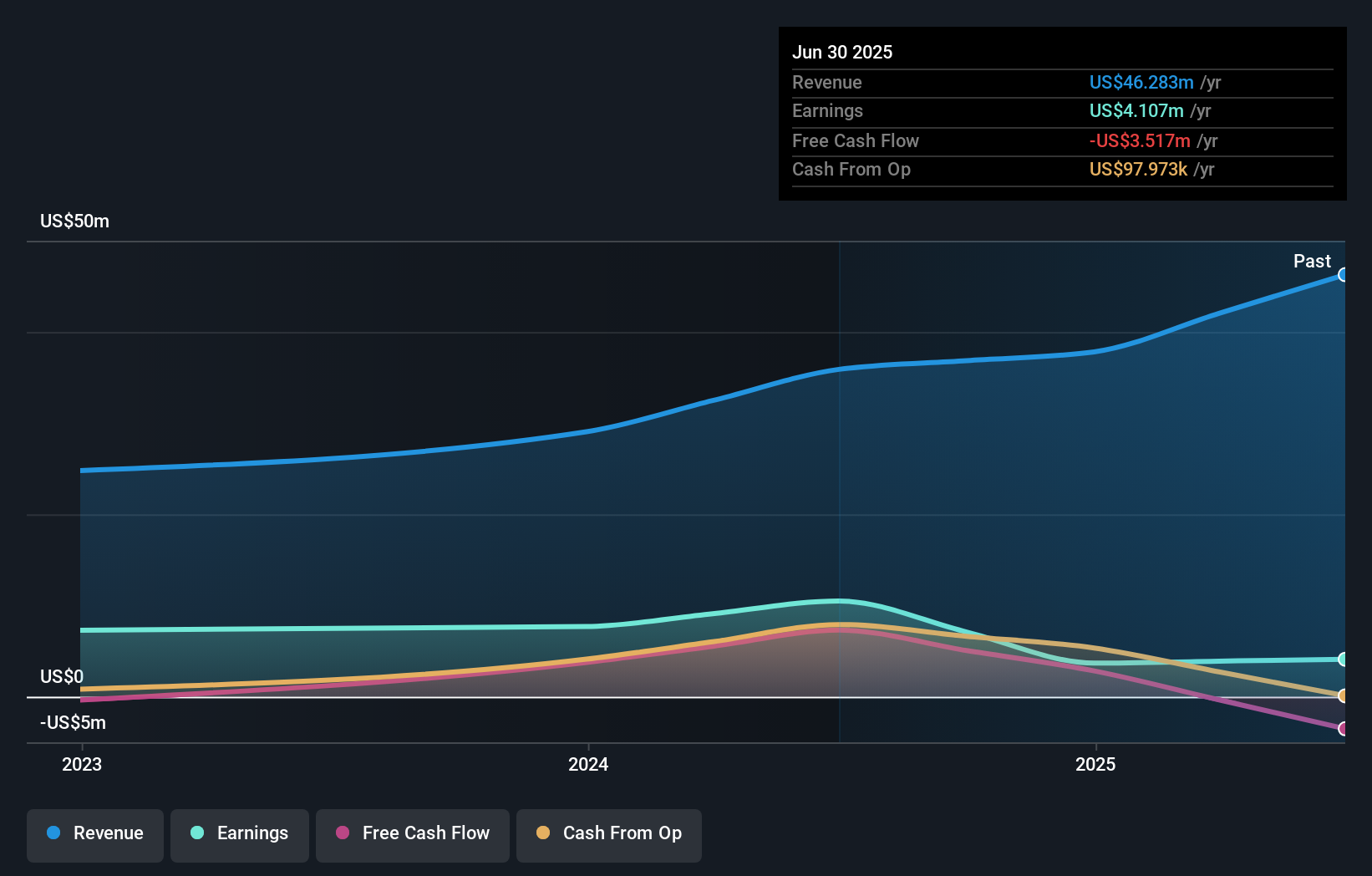

ZJK Industrial (NasdaqCM:ZJK)

Simply Wall St Value Rating: ★★★★★☆

Overview: ZJK Industrial Co., Ltd. operates through its subsidiaries to manufacture and sell precision fasteners, structural parts, and other precision metal products in various international markets, with a market cap of approximately $503.94 million.

Operations: ZJK Industrial generates revenue primarily from the sale of metal products, including fasteners, contributing $35.89 million to its revenue stream.

ZJK Industrial, a relatively small player in the machinery sector, has shown impressive growth with earnings surging by 40% over the past year, outpacing industry averages. The firm's debt situation is favorable as it holds more cash than total debt, and its interest payments are well-covered at 5324 times by EBIT. Recent financial results highlight a robust performance with sales reaching US$16.23 million for the half-year ending June 2024, up from US$9.39 million previously. Additionally, ZJK's inclusion in the NASDAQ Composite Index and recent IPO raise of US$6.25 million underscore its growing market presence.

- Take a closer look at ZJK Industrial's potential here in our health report.

Understand ZJK Industrial's track record by examining our Past report.

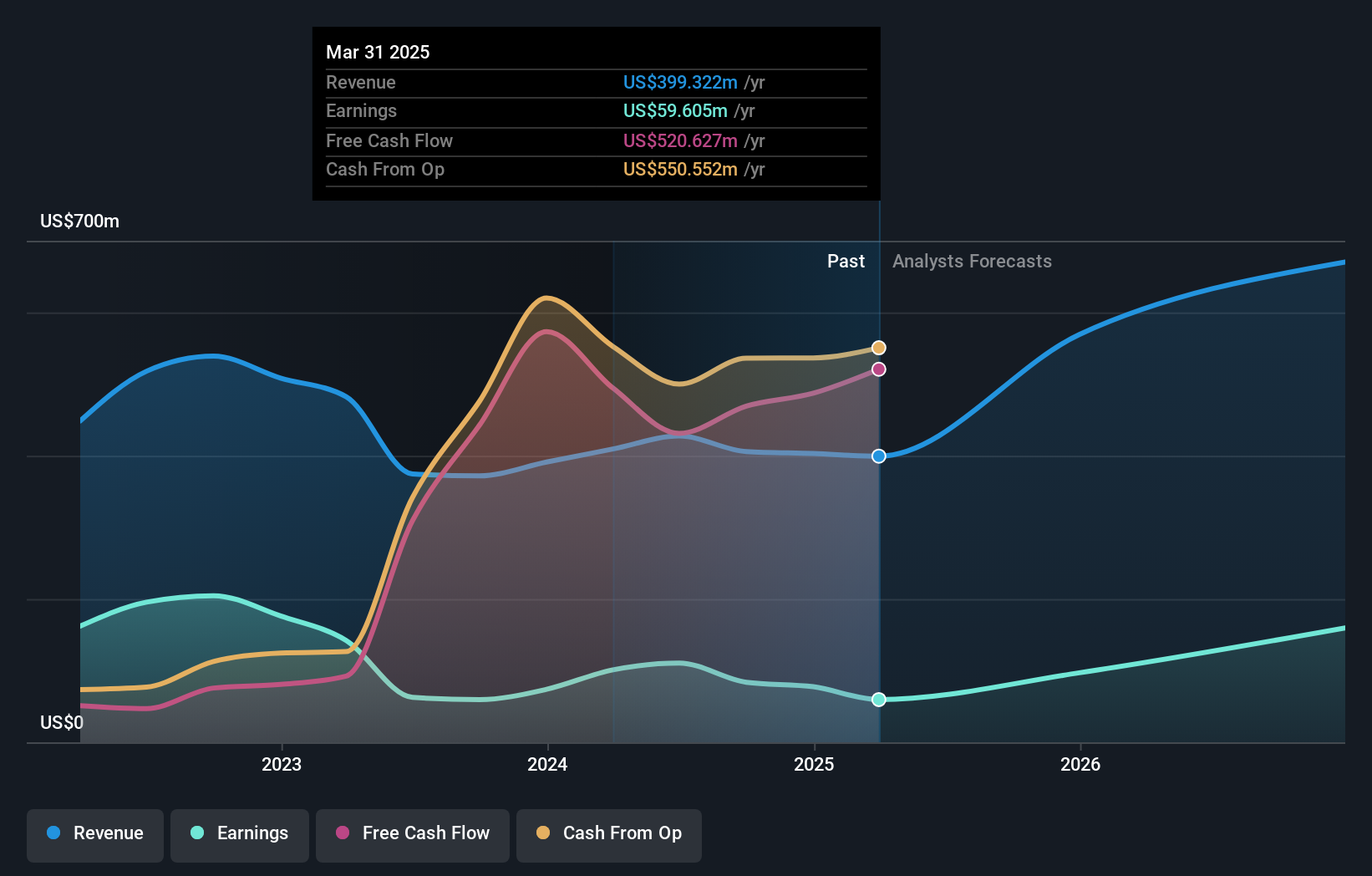

Live Oak Bancshares (NYSE:LOB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Live Oak Bancshares, Inc. is a bank holding company for Live Oak Banking Company, offering a range of banking products and services in the United States with a market cap of approximately $1.79 billion.

Operations: Live Oak Bancshares generates its revenue primarily from its banking segment, contributing $415.44 million, with an additional $4.23 million from fintech activities.

Live Oak Bancshares, a financial entity with total assets of US$12.6 billion and equity of US$1 billion, presents an intriguing opportunity. Their total deposits stand at US$11.4 billion against loans of US$9.7 billion, though they face challenges like a high bad loan ratio at 2.8%. Despite this, their earnings growth outpaced the industry by 40.7% over the past year and trades at 52.8% below its estimated fair value, suggesting potential undervaluation benefits for investors exploring small-cap opportunities in banking sectors with robust growth prospects and manageable risk factors.

Seize The Opportunity

- Investigate our full lineup of 243 US Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOB

Live Oak Bancshares

Operates as the bank holding company for Live Oak Banking Company that provides various banking products and services in the United States.

High growth potential with solid track record.