- United States

- /

- Diversified Financial

- /

- NasdaqCM:RVYL

Take Care Before Jumping Onto Ryvyl Inc. (NASDAQ:RVYL) Even Though It's 29% Cheaper

Unfortunately for some shareholders, the Ryvyl Inc. (NASDAQ:RVYL) share price has dived 29% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 81% share price decline.

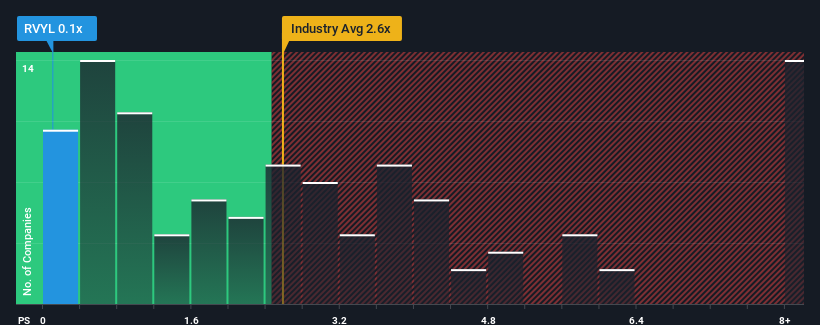

Following the heavy fall in price, Ryvyl may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Diversified Financial industry in the United States have P/S ratios greater than 2.6x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Ryvyl

What Does Ryvyl's Recent Performance Look Like?

Ryvyl certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ryvyl.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Ryvyl's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. Pleasingly, revenue has also lifted 187% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 4.9% over the next year. With the industry predicted to deliver 4.4% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Ryvyl's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Ryvyl's P/S Mean For Investors?

Ryvyl's P/S looks about as weak as its stock price lately. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that Ryvyl currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Having said that, be aware Ryvyl is showing 4 warning signs in our investment analysis, and 2 of those shouldn't be ignored.

If these risks are making you reconsider your opinion on Ryvyl, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RVYL

Ryvyl

A technology company, engages in the development, marketing, and sale of blockchain-based payment solutions in North America, Europe, and Asia.

Adequate balance sheet slight.