- United States

- /

- Diversified Financial

- /

- NasdaqCM:RVYL

Most Shareholders Will Probably Agree With Ryvyl Inc.'s (NASDAQ:RVYL) CEO Compensation

Key Insights

- Ryvyl to hold its Annual General Meeting on 2nd of November

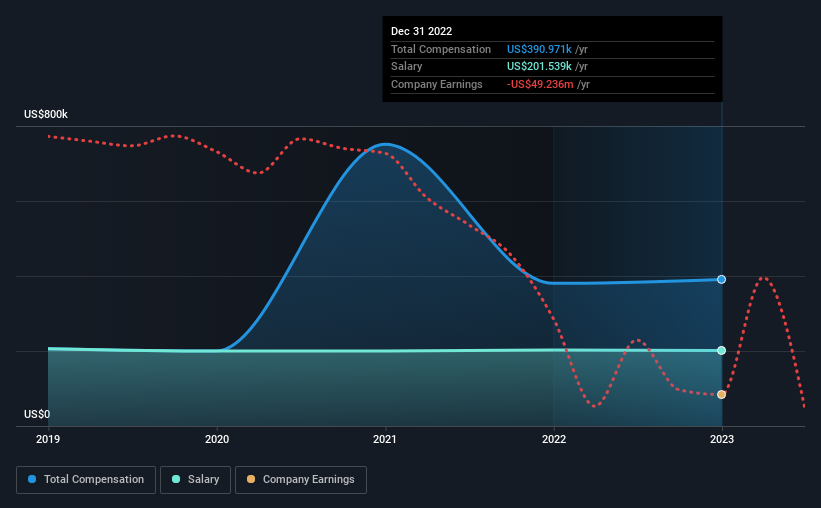

- Total pay for CEO Fredi Nisan includes US$201.5k salary

- The overall pay is 41% below the industry average

- Ryvyl's EPS declined by 47% over the past three years while total shareholder loss over the past three years was 91%

Shareholders may be wondering what CEO Fredi Nisan plans to do to improve the less than great performance at Ryvyl Inc. (NASDAQ:RVYL) recently. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 2nd of November. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

See our latest analysis for Ryvyl

How Does Total Compensation For Fredi Nisan Compare With Other Companies In The Industry?

According to our data, Ryvyl Inc. has a market capitalization of US$9.2m, and paid its CEO total annual compensation worth US$391k over the year to December 2022. That is, the compensation was roughly the same as last year. We note that the salary of US$201.5k makes up a sizeable portion of the total compensation received by the CEO.

For comparison, other companies in the American Diversified Financial industry with market capitalizations below US$200m, reported a median total CEO compensation of US$663k. That is to say, Fredi Nisan is paid under the industry median.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | US$202k | US$203k | 52% |

| Other | US$189k | US$177k | 48% |

| Total Compensation | US$391k | US$380k | 100% |

On an industry level, around 15% of total compensation represents salary and 85% is other remuneration. According to our research, Ryvyl has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Ryvyl Inc.'s Growth

Over the last three years, Ryvyl Inc. has shrunk its earnings per share by 47% per year. Its revenue is up 82% over the last year.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Ryvyl Inc. Been A Good Investment?

Few Ryvyl Inc. shareholders would feel satisfied with the return of -91% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

The fact that shareholders are sitting on a loss is certainly disheartening. The downward trend in share price performance may be attributable to the the fact that earnings growth has gone backwards. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 5 warning signs for Ryvyl (of which 3 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Ryvyl, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RVYL

Ryvyl

A financial technology company, develops software platforms and tools that focuses on providing payment acceptance and disbursement capabilities in North America, Europe, and Asia.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026