- United States

- /

- Diversified Financial

- /

- NasdaqGS:RELY

Remitly (RELY) Valuation Check After Q3 Beat, Slower Growth Guidance and Rising Credit Risk Concerns

Reviewed by Simply Wall St

Remitly Global (RELY) cleared the bar on third quarter revenue and customer growth, yet the stock slipped as guidance pointed to slower revenue momentum, a thinner take rate, and rising credit concerns.

See our latest analysis for Remitly Global.

That reaction comes on top of a tough run. The latest $12.93 share price reflects a steep year to date share price decline, while the three year total shareholder return is still comfortably positive, suggesting long term believers are not capitulating yet.

If this reset in expectations has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership for other growth stories backed by committed insiders.

With revenue still growing and the share price now sitting well below analyst targets, the reset raises a key question for investors: is Remitly now undervalued, or is the market correctly pricing in slower growth ahead?

Most Popular Narrative Narrative: 39.9% Undervalued

With the narrative fair value at $21.50 versus a $12.93 last close, the market is pricing in far less upside than this roadmap implies.

The strategic launch of stablecoin functionality and multicurrency wallets positions Remitly to capitalize on the accelerating adoption of digital financial services and rising global smartphone penetration, which should drive higher customer acquisition, improve retention, and diversify revenue streams. Agentic AI capabilities embedded in customer acquisition channels (e.g., WhatsApp) and support functions facilitate migration from offline to online remittances, unlock operational efficiencies, reduce cost to serve, and should widen net margins as digital adoption in emerging markets accelerates.

Curious how this combination of faster revenue growth, richer margins, and a premium earnings multiple all fit together into one price target playbook? Read on.

Result: Fair Value of $21.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and tighter stablecoin regulation could pressure Remitly's fees, slow customer growth, and challenge the optimistic re-rating embedded in this narrative.

Find out about the key risks to this Remitly Global narrative.

Another View: Rich On Earnings Multiples

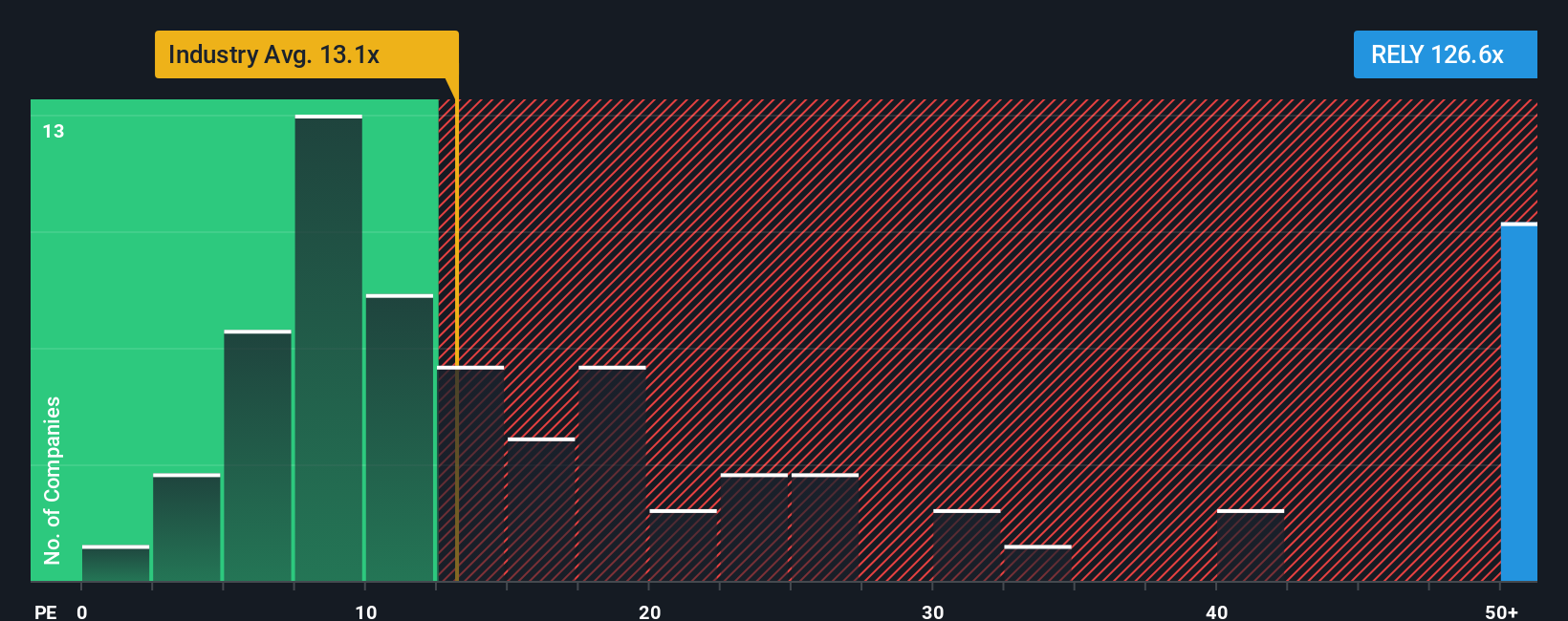

There is a catch. On earnings, Remitly trades at about 128.8 times profits, far above the US diversified financials average of 13.7 times and a fair ratio of 29 times. If sentiment cools or growth underdelivers, that gap could close fast. Which way do you think it snaps?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Remitly Global Narrative

If you see the numbers differently or would rather dig into the data yourself, you can build a personalized thesis in minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Remitly Global.

Looking for more investment ideas?

Ready for your next move? Use the Simply Wall St Screener now to uncover focused, data backed opportunities other investors may be overlooking today.

- Target potential bargains by reviewing these 930 undervalued stocks based on cash flows that our models flag as priced below their estimated cash flow value.

- Capture innovation trends early by scanning these 24 AI penny stocks positioned to benefit from accelerating demand for intelligent automation.

- Strengthen your income strategy by reviewing these 14 dividend stocks with yields > 3% that can potentially boost portfolio yield without sacrificing fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RELY

Remitly Global

Engages in the provision of digital financial services in the United States, Canada, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026