- United States

- /

- Consumer Finance

- /

- NasdaqGS:QFIN

The Bull Case For Qifu Technology (QFIN) Could Change Following Analyst Upgrades and Consensus Earnings Boost - Learn Why

Reviewed by Simply Wall St

- Earlier this week, Qifu Technology was highlighted by multiple analyst reports for its consistent dividend growth, strong fundamentals, and improving earnings outlook, placing it among leading choices for resilient, income-driven portfolios.

- Market optimism appears to be reinforced by upward revisions in consensus earnings estimates, which signal increased confidence in the company's future profitability and resilience.

- With these positive analyst endorsements spotlighting Qifu Technology's earnings growth, we'll assess how this renewed confidence shapes the company's investment narrative.

Qifu Technology Investment Narrative Recap

For those considering Qifu Technology, the story centers on believing in its ability to maintain growth in earnings and dividends while navigating regulatory and competitive pressures in China's fintech sector. The recent recognition by analysts for dividend consistency and earnings outlook highlights confidence but does not fundamentally change the main short-term catalyst: continued revenue and earnings growth, which remains most at risk from regulatory changes rather than news-driven optimism.

The March 2025 dividend increase, with a payout of US$0.35 per Class A ordinary share, is particularly relevant given the recent coverage on dividend growth. This move underscores the company’s commitment to shareholder returns, directly supporting its position among income-oriented portfolios and reinforcing the short-term catalyst of enhanced earnings and capital distributions.

However, investors should not overlook that, in contrast, regulatory uncertainty is a factor you must be aware of if you own shares...

Read the full narrative on Qifu Technology (it's free!)

Qifu Technology's narrative projects CN¥20.9 billion in revenue and CN¥8.0 billion in earnings by 2028. This requires 6.8% yearly revenue growth and a CN¥1.7 billion earnings increase from CN¥6.3 billion today.

Exploring Other Perspectives

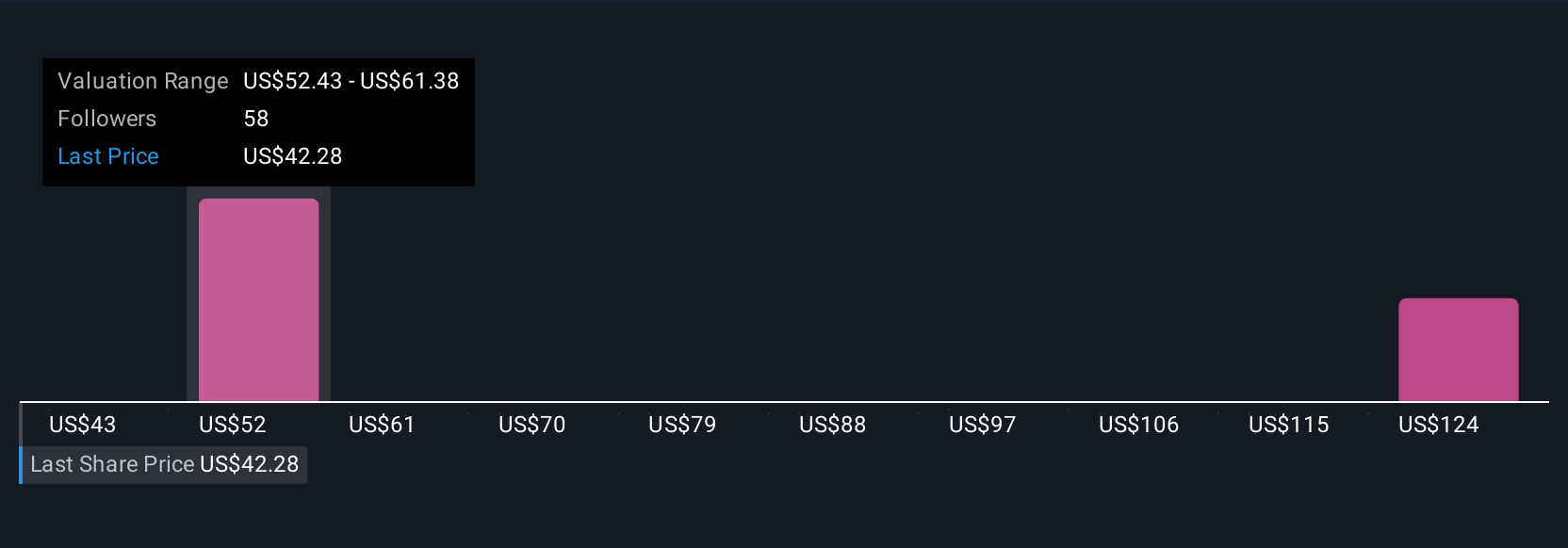

Seven private investors in the Simply Wall St Community see Qifu Technology's fair value estimates range widely from US$43.48 to US$131.76. Despite this spread, regulatory change remains a major factor that could shape the company’s future growth, so consider the variety of opinions before making decisions.

Build Your Own Qifu Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Qifu Technology research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Qifu Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Qifu Technology's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qifu Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QFIN

Qifu Technology

Qifu Technology, Inc., together with its subsidiaries, operate AI-empowered credit-tech platform under the Qifu Jietiao brand in the People’s Republic of China.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives