- United States

- /

- Consumer Finance

- /

- NasdaqGS:QFIN

Qifu Technology's (NASDAQ:QFIN) three-year earnings growth trails the solid shareholder returns

While Qifu Technology, Inc. (NASDAQ:QFIN) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 20% in the last quarter. But that shouldn't obscure the pleasing returns achieved by shareholders over the last three years. After all, the share price is up a market-beating 92% in that time.

Since the stock has added US$90m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Qifu Technology

SWOT Analysis for Qifu Technology

- Debt is not viewed as a risk.

- Dividends are covered by earnings and cash flows.

- Earnings declined over the past year.

- Dividend is low compared to the top 25% of dividend payers in the Consumer Finance market.

- Shareholders have been diluted in the past year.

- Annual earnings are forecast to grow faster than the American market.

- Good value based on P/E ratio and estimated fair value.

- Revenue is forecast to grow slower than 20% per year.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

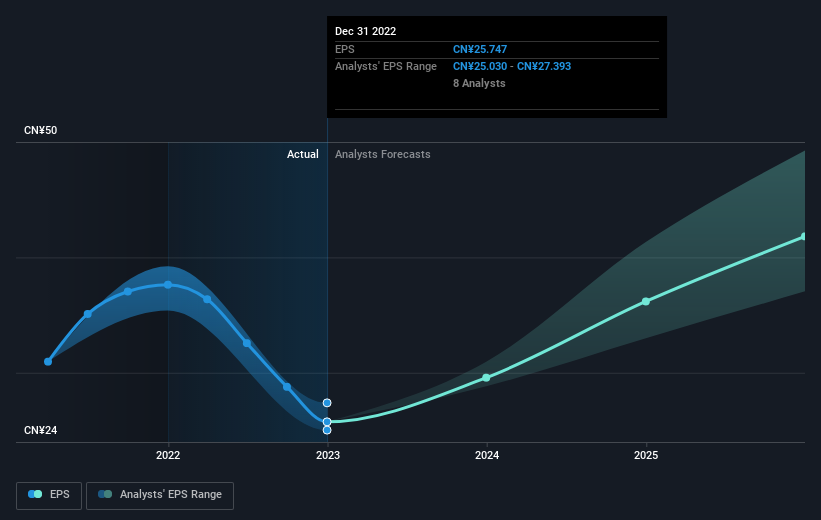

Qifu Technology was able to grow its EPS at 13% per year over three years, sending the share price higher. This EPS growth is lower than the 24% average annual increase in the share price. This suggests that, as the business progressed over the last few years, it gained the confidence of market participants. It's not unusual to see the market 're-rate' a stock, after a few years of growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Qifu Technology's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Qifu Technology, it has a TSR of 106% for the last 3 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Qifu Technology shareholders have gained 31% (in total) over the last year. And yes, that does include the dividend. That gain actually surpasses the 27% TSR it generated (per year) over three years. The improving returns to shareholders suggests the stock is becoming more popular with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Qifu Technology you should be aware of.

But note: Qifu Technology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade Qifu Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Qifu Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:QFIN

Qifu Technology

Qifu Technology, Inc., together with its subsidiaries, operate AI-empowered credit-tech platform under the Qifu Jietiao brand in the People’s Republic of China.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives