- United States

- /

- Diversified Financial

- /

- NasdaqGM:PAYO

Payoneer (PAYO) valuation check as it adopts Oscilar’s AI platform to modernize fraud and risk intelligence

Reviewed by Simply Wall St

Payoneer Global (PAYO) just tapped Oscilar to overhaul fraud and risk intelligence across its core payment rails, leaning into AI driven analytics to tighten controls and potentially sharpen margins over time.

See our latest analysis for Payoneer Global.

The Oscilar partnership lands as Payoneer’s share price sits at $5.96 and a recent 7 day share price return of 4.93 percent contrasts with a much weaker year to date share price return of minus 41.28 percent. This suggests long term holders are still underwater even as shorter term momentum tentatively improves.

If this fraud tech upgrade has you rethinking where digital finance is heading, it could be a good moment to explore high growth tech and AI stocks for other potential beneficiaries of the same structural trend.

With shares trading at a steep discount to analyst targets despite solid top line and accelerating profit growth, the key question is whether Payoneer is quietly undervalued or whether the market already anticipates its next leg of expansion.

Most Popular Narrative: 29.9% Undervalued

With Payoneer Global’s fair value pegged at $8.50 against a $5.96 last close, the prevailing narrative points to meaningful upside if its growth path holds.

Adoption and expansion of higher margin B2B payments and value added services such as automated accounts payable or receivable and virtual cards are driving take rate expansion, supporting higher revenue and net margin growth as Payoneer continues to move upmarket to serve more complex, multi entity customers globally.

Curious how modest revenue growth assumptions can still justify a premium earnings multiple for a diversified fintech? The narrative leans heavily on compounding margins and a richer customer mix. Want to see which long range profit and valuation targets need to click into place for that upside to materialise? The full story breaks down every moving part.

Result: Fair Value of $8.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying fintech competition and rapid blockchain adoption could erode Payoneer’s pricing power, undermining take rate gains and long term margin expansion.

Find out about the key risks to this Payoneer Global narrative.

Another View: Market Ratios Flash Caution

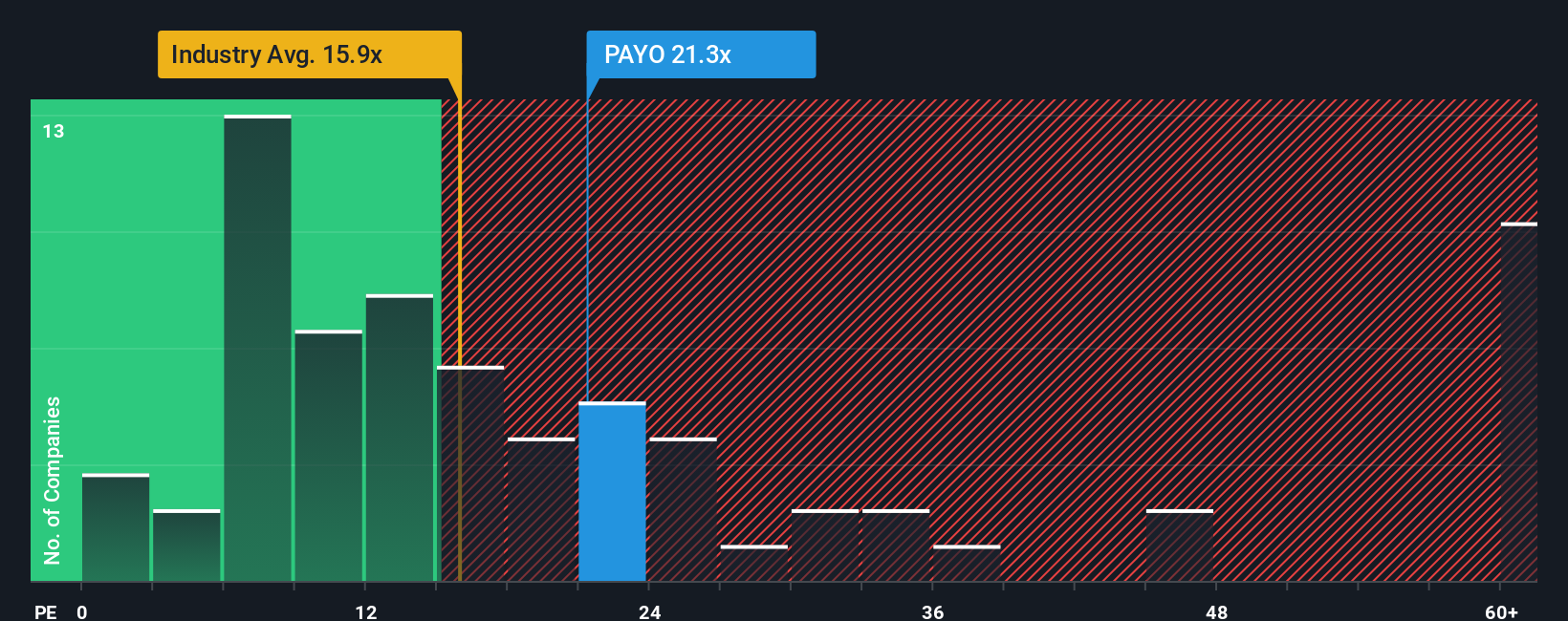

While narrative fair value suggests upside, today’s 29.4x earnings multiple looks demanding next to the US Diversified Financial industry at 13.6x, peers at 13.3x, and a fair ratio of 18.7x. That premium tilts risk higher, so what exactly is the market already pricing in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Payoneer Global Narrative

If you are not sold on this angle or would rather dig into the numbers yourself, you can build a fresh narrative in minutes, Do it your way.

A great starting point for your Payoneer Global research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Do not stop at one opportunity. Use the Simply Wall St Screener to quickly surface focused stock ideas that match your strategy before the market moves first.

- Capitalize on potential mispricing by scanning these 903 undervalued stocks based on cash flows that show strong cash flow support yet trade below what fundamentals may justify.

- Ride powerful innovation tailwinds by targeting these 26 AI penny stocks positioned at the heart of accelerating artificial intelligence adoption across industries.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that offer attractive yields supported by established businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PAYO

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)