- United States

- /

- Capital Markets

- /

- NasdaqGS:NDAQ

Nasdaq (NDAQ): Revisiting Valuation After a Strong Year-to-Date Share Price Rally

Reviewed by Simply Wall St

Recent performance and context

Nasdaq (NDAQ) has been quietly grinding higher, with the stock up about 7% over the past month and 20% year to date, even as short term daily moves remain relatively modest.

See our latest analysis for Nasdaq.

That steady 20% year to date share price return, alongside a robust 5 year total shareholder return of around 130%, suggests momentum is building again as investors lean back into Nasdaq’s long term growth and data platform story.

If Nasdaq’s move has you rethinking the market’s plumbing, it could be a good moment to explore other exchanges and infrastructure plays via fast growing stocks with high insider ownership.

With shares near record highs, a modest premium to analyst targets and softer top line growth, the key question now is whether Nasdaq still trades below its true platform value or if the market is already baking in years of future expansion.

Most Popular Narrative: 9.9% Undervalued

With Nasdaq closing at $92.93 against a narrative fair value near $103, the story leans toward upside if the long term math holds.

The enhanced partnership with AWS is expected to modernize Nasdaq's market infrastructure across its financial services clientele, driving operational efficiencies, improving scalability, and potentially increasing market share, positively impacting net margins and future revenue growth.

Curious how this cloud push, rising margins and steady earnings climb all combine into that higher fair value view, and what growth runway those projections really assume? Click through to see the full set of assumptions driving this narrative and how far the earnings base is expected to stretch.

Result: Fair Value of $103.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower client decision cycles and tougher competition across exchanges and fintech could easily derail those margin gains and premium valuation assumptions.

Find out about the key risks to this Nasdaq narrative.

Another View: Rich on Earnings Multiples

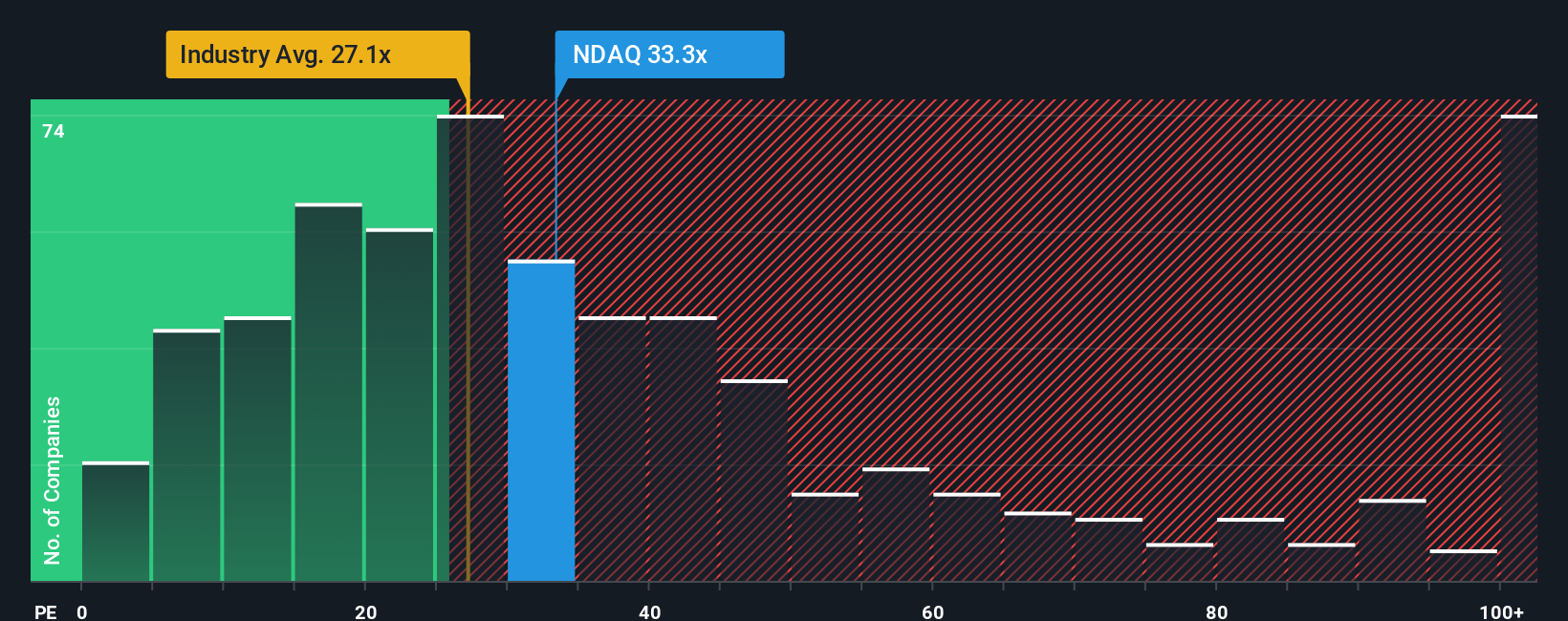

While the narrative fair value suggests upside, Nasdaq’s current price implies a price to earnings ratio of about 32.7x, above both the US Capital Markets average of 25x and a fair ratio of 16x that our model points to. If sentiment cools, how far could that multiple compress?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nasdaq Narrative

If this perspective does not quite fit your view, dive into the numbers yourself and shape a fresh storyline in just a few minutes, Do it your way.

A great starting point for your Nasdaq research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single stock. You may miss out on stronger setups if you ignore the wider universe of opportunities on the Simply Wall Street Screener.

- Capitalize on potential deep value by tracking these 912 undervalued stocks based on cash flows that may be trading at meaningful discounts to their long term cash flow potential.

- Explore opportunities in innovation by reviewing these 25 AI penny stocks involved in artificial intelligence adoption and revenue growth.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that combine solid yields with the potential for capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nasdaq might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NDAQ

Nasdaq

Operates as a technology company that serves capital markets and other industries worldwide.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)