- United States

- /

- Capital Markets

- /

- NasdaqGS:NDAQ

Does Nasdaq’s Fintech Pivot Justify Its Strong 2025 Rally and Premium Valuation?

Reviewed by Bailey Pemberton

- Wondering if Nasdaq at around $93.57 is still a smart buy, or if most of the upside has already been priced in? This breakdown will help you decide whether the current tag makes sense or not.

- The stock has climbed about 3.7% over the last week, 5.4% over the past month, and is now up roughly 20.8% year to date, building on multi year gains of 18.2% over 1 year, 61.1% over 3 years, and 133.6% over 5 years.

- Recent news coverage has focused on Nasdaq’s evolution beyond a traditional exchange operator into a broader financial technology and data business, including continued investment in market infrastructure and analytics platforms. This strategic tilt toward recurring, higher margin services helps explain why investors have been reassessing its long term growth and risk profile.

- Despite those gains, Nasdaq currently scores just 0 out of 6 on our undervaluation checks. Next we will unpack what that means across different valuation methods and hint at a more nuanced way to judge value that we will return to at the end of the article.

Nasdaq scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Nasdaq Excess Returns Analysis

The Excess Returns model looks at how much profit Nasdaq can generate above the return that investors demand on its equity, then capitalizes those surplus earnings into an intrinsic value per share.

For Nasdaq, the model starts with a Book Value of $20.99 per share and a Stable EPS of $4.10 per share, based on weighted future Return on Equity estimates from 4 analysts. With an Average Return on Equity of 17.70% and a Cost of Equity of $1.98 per share, the company is expected to generate Excess Return of $2.11 per share from its investments. Analysts also see Stable Book Value rising to $23.15 per share over time, based on projections from 3 analysts.

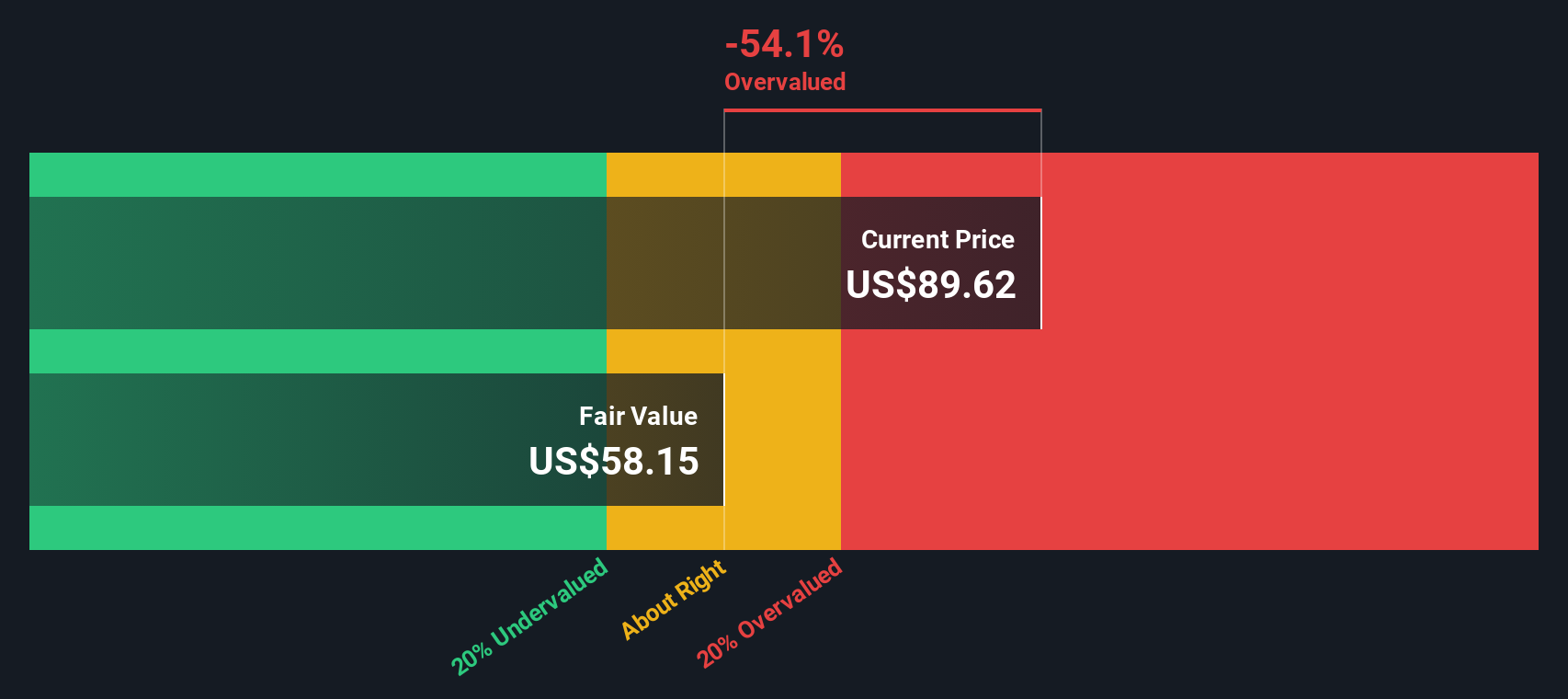

Putting these inputs together, the Excess Returns framework produces an intrinsic value of about $63 per share for Nasdaq. Compared with the current price around $93.57, this implies the stock is roughly 48.6% overvalued, indicating that the market is already paying a steep premium for its future profitability.

Result: OVERVALUED

Our Excess Returns analysis suggests Nasdaq may be overvalued by 48.6%. Discover 903 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Nasdaq Price vs Earnings

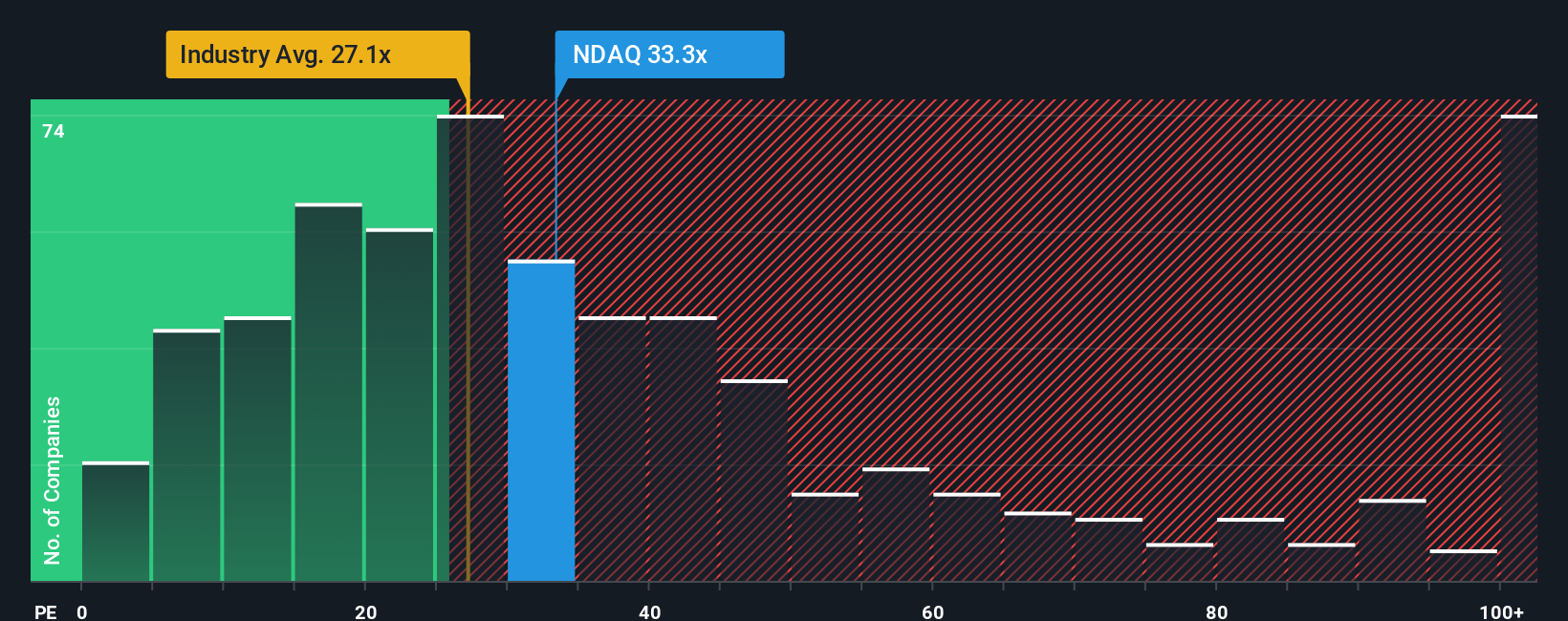

For a profitable, established business like Nasdaq, the price to earnings ratio is a useful way to judge whether investors are paying a reasonable price for each dollar of current profits. In general, companies with faster and more reliable earnings growth, and lower perceived risk, can justify a higher normal or fair PE ratio. Slower growth or higher risk should pull that multiple down.

Nasdaq currently trades on about 32.9x earnings, slightly above both its Capital Markets industry average of roughly 25.4x and a peer group average of about 32.1x. Simply Wall St goes a step further by estimating a Fair Ratio of 16.1x, a proprietary view of what Nasdaq’s PE should be once factors like earnings growth, profitability, industry positioning, market cap and company specific risks are blended together.

This Fair Ratio framework is more tailored than a simple peer or industry comparison because it adjusts for Nasdaq’s own fundamentals rather than assuming that all Capital Markets companies deserve similar valuations. Comparing the current 32.9x PE with the Fair Ratio of 16.1x suggests the shares are trading at a substantial premium to what those fundamentals would justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nasdaq Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page that lets you describe your story for a company in plain language. You can link that story to your own forecast for revenue, earnings and margins, and convert it into a Fair Value you can compare with today’s share price to inform whether you prefer to buy, hold or sell. The whole view stays live and automatically updates as fresh news or earnings arrive. For example, one investor might build a bullish Nasdaq narrative that assumes solutions revenue keeps compounding, margins expand toward the mid 30s and a Fair Value above the current analyst high of about $115 is justified. Another more cautious investor could build a bearish narrative that assumes tougher competition, slower adoption of new platforms and a Fair Value closer to the lowest analyst target of roughly $74, all within the same simple framework.

Do you think there's more to the story for Nasdaq? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nasdaq might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NDAQ

Nasdaq

Operates as a technology company that serves capital markets and other industries worldwide.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)