- United States

- /

- Consumer Finance

- /

- NasdaqGS:NAVI

Student Loan Forgiveness Expansion Might Change The Case For Investing In Navient (NAVI)

Reviewed by Sasha Jovanovic

- Earlier this week, the Trump administration agreed to resume student loan forgiveness for more than 2.5 million borrowers, as part of a court settlement that reactivates key income-driven repayment programs through July 1, 2028, and waives tax bills on forgiven balances through 2025.

- This move could influence the operational outlook for student loan servicers like Navient, as well as shape discretionary consumer spending during the upcoming holiday season.

- We'll explore how the resumption of student loan forgiveness programs may alter Navient's investment narrative and future earnings outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Navient Investment Narrative Recap

To be a Navient shareholder today, you need to believe the company can adapt to shifting student loan policies while managing credit quality and regulatory changes. The recent student loan forgiveness news introduces added uncertainty for near-term revenue and earnings, as programs are set to reactivate and demand for federal relief rises, the biggest risk now is whether this increases volatility in servicing volumes and credit outcomes. If these impacts are muted, ongoing cost control and origination growth remain important short-term catalysts.

Among recent announcements, Navient's steady $0.16 quarterly dividend stands out. This commitment to returning capital directly to shareholders comes even as earnings remain pressured, and speaks to management's efforts to sustain investor confidence amid regulatory and macro headwinds tied to changing federal loan programs.

But with new forgiveness policies in play, investors should be aware that credit losses and delinquency trends could still surprise to the downside if...

Read the full narrative on Navient (it's free!)

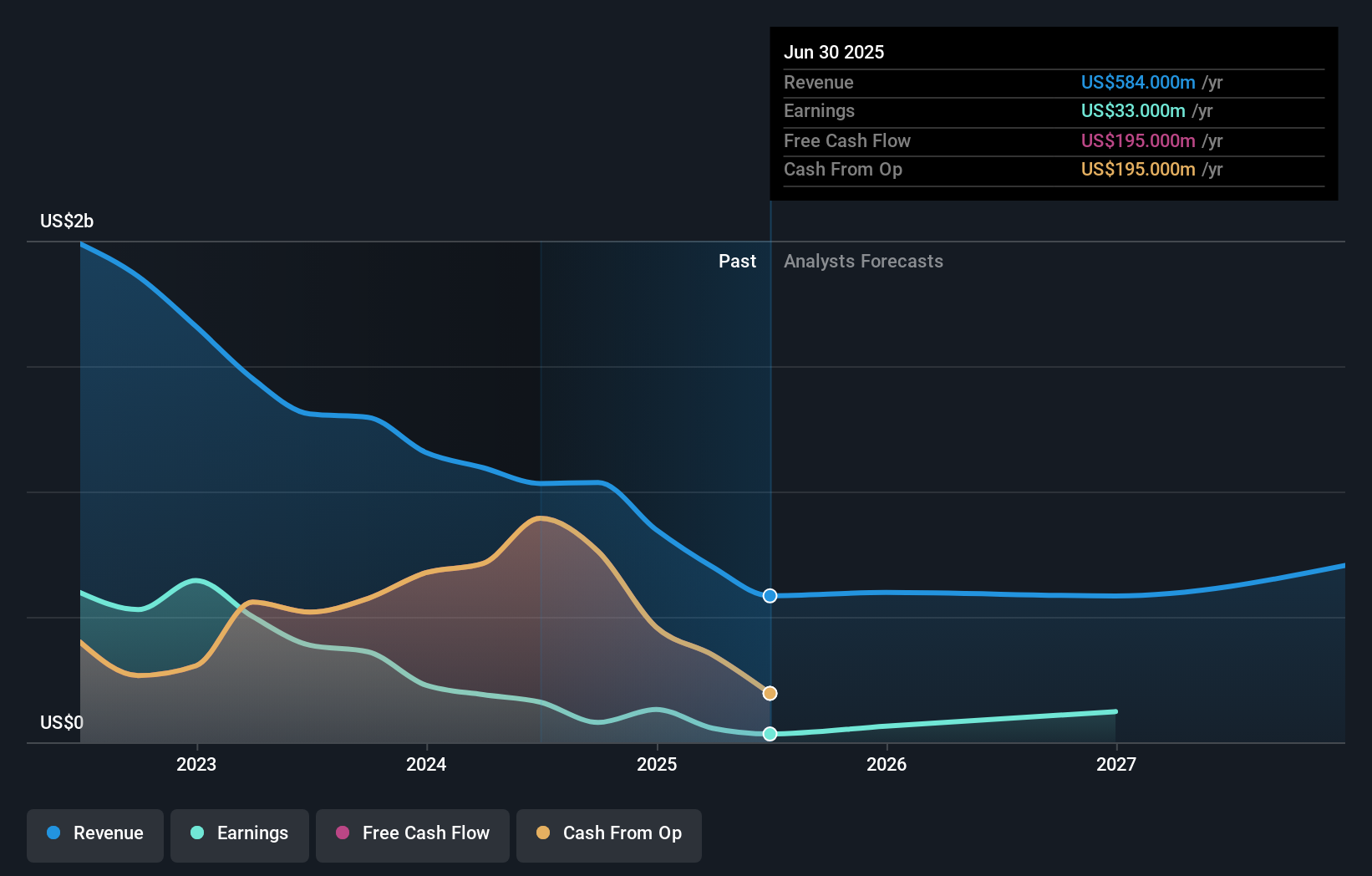

Navient's narrative projects $668.0 million revenue and $321.8 million earnings by 2028. This requires 4.6% yearly revenue growth and a $288.8 million earnings increase from $33.0 million today.

Uncover how Navient's forecasts yield a $14.10 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided a single US$14.10 fair value estimate for Navient, reflecting less diversity among private investor perspectives. This uniform view contrasts with ongoing risks around regulatory changes, a factor all investors should keep in mind when weighing the company’s future performance.

Explore another fair value estimate on Navient - why the stock might be worth as much as 12% more than the current price!

Build Your Own Navient Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Navient research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Navient research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Navient's overall financial health at a glance.

No Opportunity In Navient?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navient might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NAVI

Navient

Provides technology-enabled education finance and business processing solutions for education, health care, and government clients in the United States.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives