- United States

- /

- Electrical

- /

- NYSEAM:HYLN

Alpha Teknova Among 3 Penny Stocks Worth Noting

Reviewed by Simply Wall St

As the U.S. stock market experiences a mixed performance with major indices like the Dow Jones and S&P 500 showing gains, while tech-heavy sectors face challenges, investors are exploring diverse opportunities. Penny stocks, though an older term in investing, continue to represent a segment of smaller or less-established companies that can offer significant value. By focusing on those with strong financial health and potential for growth, investors can discover promising opportunities among these lesser-known stocks.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.75 | $379.32M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.815 | $658.23M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $3.745 | $588.08M | ✅ 4 ⚠️ 2 View Analysis > |

| FinVolution Group (FINV) | $4.95 | $1.2B | ✅ 3 ⚠️ 1 View Analysis > |

| Puma Biotechnology (PBYI) | $4.97 | $246.41M | ✅ 3 ⚠️ 3 View Analysis > |

| Performance Shipping (PSHG) | $2.2293 | $27.72M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.47 | $568.6M | ✅ 5 ⚠️ 0 View Analysis > |

| Nephros (NEPH) | $4.93 | $51.75M | ✅ 3 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.80 | $6.53M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.775 | $85.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 357 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Alpha Teknova (TKNO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alpha Teknova, Inc. produces essential reagents for the discovery, development, and commercialization of novel therapies, vaccines, and molecular diagnostics globally with a market cap of $230.18 million.

Operations: The company's revenue is derived from its Specialty Chemicals segment, which generated $39.80 million.

Market Cap: $230.18M

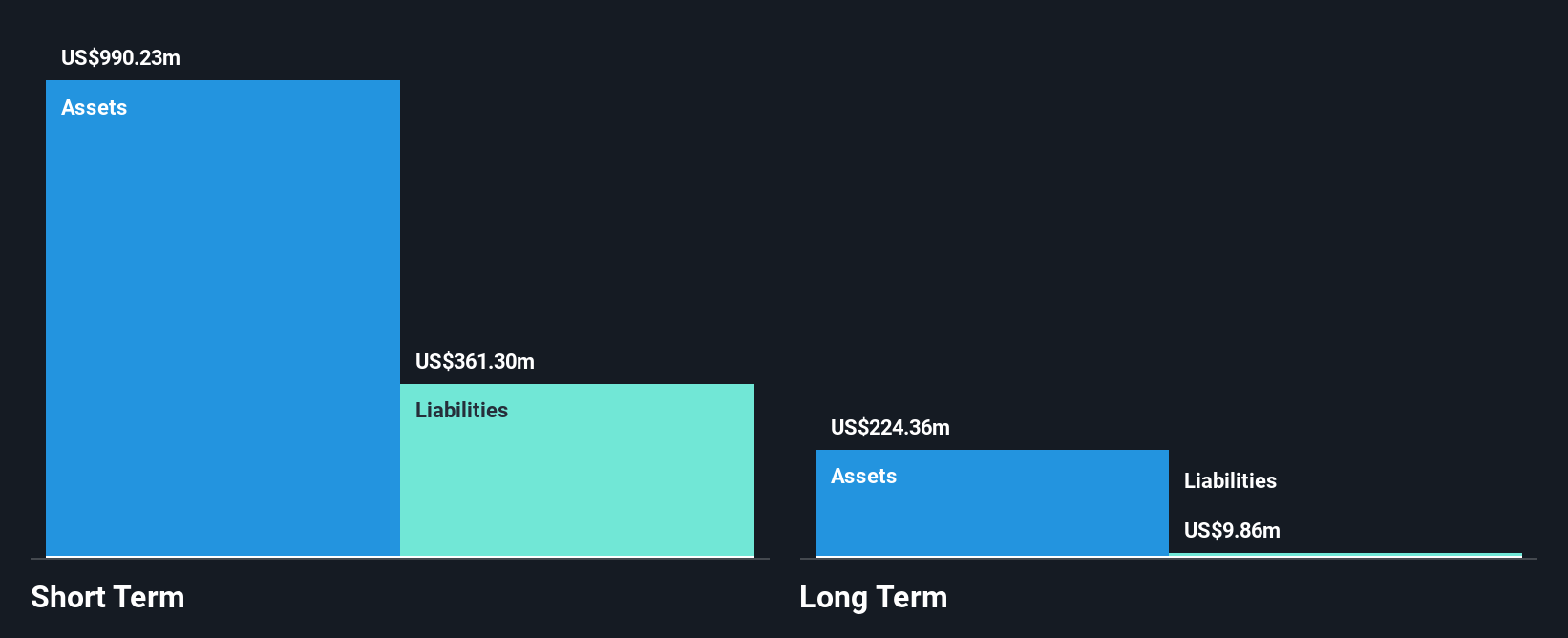

Alpha Teknova, Inc. is navigating the penny stock landscape with a market cap of US$230.18 million and revenue primarily from its Specialty Chemicals segment, totaling US$39.80 million. The company maintains a strong cash position, covering both short and long-term liabilities, while actively seeking acquisitions to enhance growth and profitability prospects. Despite being unprofitable with increasing losses over the past five years, Teknova's recent earnings report showed improved net loss figures compared to the previous year. Revenue is projected to grow 14.25% annually, though volatility remains high relative to most U.S. stocks.

- Take a closer look at Alpha Teknova's potential here in our financial health report.

- Evaluate Alpha Teknova's prospects by accessing our earnings growth report.

Marqeta (MQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Marqeta, Inc. operates a cloud-based open API platform for card issuing and transaction processing services, with a market cap of approximately $2.09 billion.

Operations: The company's revenue is derived from its data processing segment, which generated $588.56 million.

Market Cap: $2.09B

Marqeta, Inc., with a market cap of US$2.09 billion, is navigating the penny stock landscape by leveraging its cloud-based API platform for card issuing and transaction processing. Despite being unprofitable, Marqeta has reduced losses over five years and maintains a solid cash runway exceeding three years due to positive free cash flow. The company recently reported third-quarter sales of US$163.31 million with a net loss significantly reduced from the previous year. Collaborations like the expansion of Klarna's card into 15 European markets highlight Marqeta's strategic partnerships and potential for revenue growth, projected at 22% to 24% in Q4 2025.

- Click here to discover the nuances of Marqeta with our detailed analytical financial health report.

- Learn about Marqeta's future growth trajectory here.

Hyliion Holdings (HYLN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hyliion Holdings Corp. designs and develops power generators for stationary and mobile applications, with a market cap of approximately $299.16 million.

Operations: Hyliion Holdings Corp. has not reported any specific revenue segments.

Market Cap: $299.16M

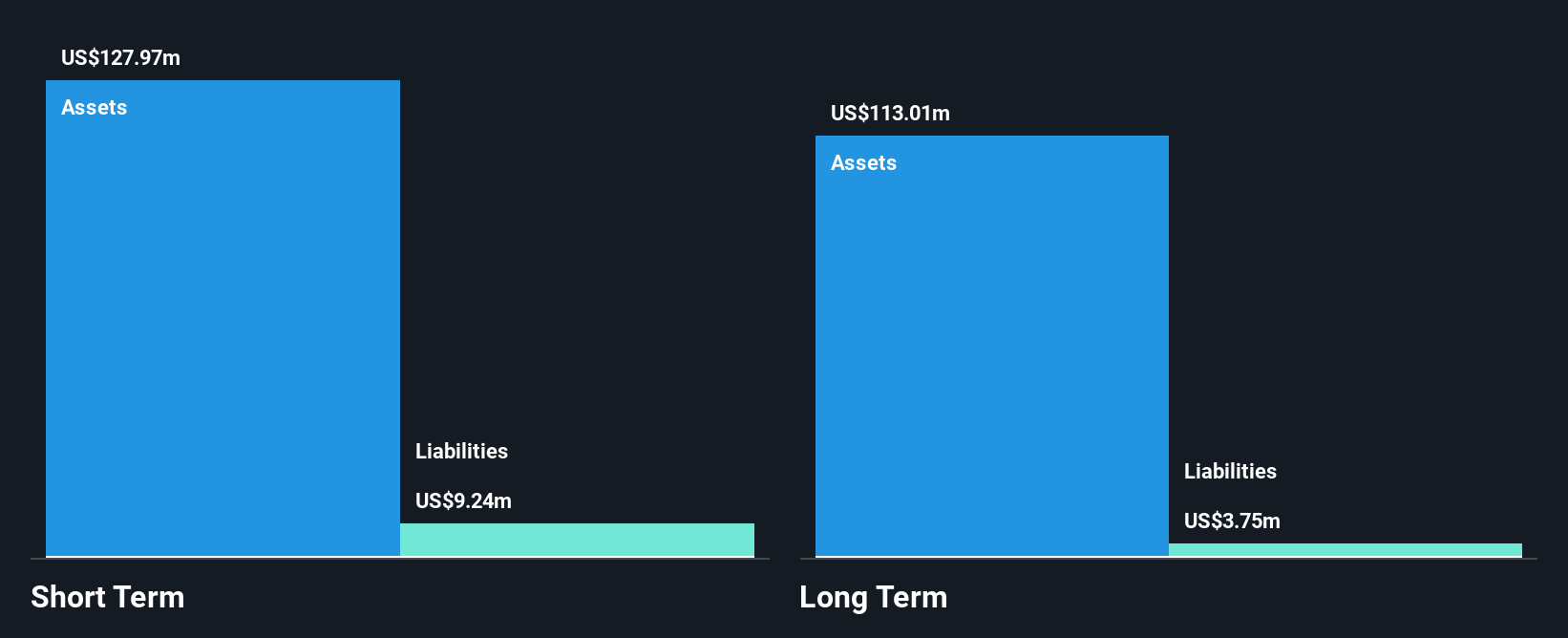

Hyliion Holdings, with a market cap of US$299.16 million, is a pre-revenue company focused on innovative power solutions. Despite being unprofitable and reporting a net loss of US$44.01 million for the first nine months of 2025, it has no debt and maintains sufficient cash runway for over a year. The recent successful emissions testing of its KARNO Power Module positions Hyliion at the forefront of clean energy technology, potentially enhancing its commercial prospects across various sectors. However, its high share price volatility and lack of meaningful revenue highlight the inherent risks associated with investing in such early-stage ventures.

- Navigate through the intricacies of Hyliion Holdings with our comprehensive balance sheet health report here.

- Examine Hyliion Holdings' earnings growth report to understand how analysts expect it to perform.

Next Steps

- Get an in-depth perspective on all 357 US Penny Stocks by using our screener here.

- Want To Explore Some Alternatives? We've found 14 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hyliion Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:HYLN

Hyliion Holdings

Designs and develops power generators for stationary and mobile applications.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.