- United States

- /

- Insurance

- /

- NasdaqGS:JRVR

Discover July 2025's Undervalued Small Caps With Insider Action

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet it has achieved a 10% increase over the past year with earnings forecasted to grow by 15% annually. In such a dynamic environment, identifying small-cap stocks that show potential through strategic insider actions can provide unique opportunities for investors seeking value.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 1.0x | 29.36% | ★★★★★★ |

| Magnera | NA | 0.2x | 33.50% | ★★★★★☆ |

| Montrose Environmental Group | NA | 1.1x | 33.97% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.9x | 30.49% | ★★★★★☆ |

| Citizens & Northern | 11.3x | 2.8x | 46.36% | ★★★★☆☆ |

| Southside Bancshares | 10.3x | 3.6x | 39.92% | ★★★★☆☆ |

| S&T Bancorp | 11.0x | 3.8x | 41.41% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 36.35% | ★★★★☆☆ |

| Farmland Partners | 8.9x | 9.0x | -8.90% | ★★★☆☆☆ |

| CPI Card Group | 12.9x | 0.5x | -23.92% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

MarketWise (MKTW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: MarketWise operates as an internet information provider, focusing on delivering financial research and education, with a market cap of $0.67 billion.

Operations: MarketWise generates revenue primarily from its Internet Information Providers segment, with a recent figure of $383.22 million. The company's gross profit margin has shown fluctuations, reaching 89.40% in September 2022 before stabilizing around the mid-80s percentage range in subsequent periods. Operating expenses are significantly influenced by sales and marketing costs, which have been consistently high but show a decreasing trend over time, most recently at $147.49 million as of March 2025.

PE: 7.6x

MarketWise, a small cap stock in the United States, recently experienced significant index exclusions but remains noteworthy due to insider confidence and strategic moves. The company repurchased 20,306 shares from February to April 2025 for US$0.02 million, indicating management's belief in its potential. Despite a drop in Q1 revenue to US$83.51 million from the previous year's US$108.99 million, MarketWise declared a quarterly dividend of US$0.20 per share and a special dividend of US$0.10 per share payable on June 25, 2025. With Dr. David Doc Eifrig as CEO since May 2025 and earnings projected to grow by 32% annually, MarketWise holds promise despite recent challenges.

- Click here and access our complete valuation analysis report to understand the dynamics of MarketWise.

Gain insights into MarketWise's past trends and performance with our Past report.

James River Group Holdings (JRVR)

Simply Wall St Value Rating: ★★★☆☆☆

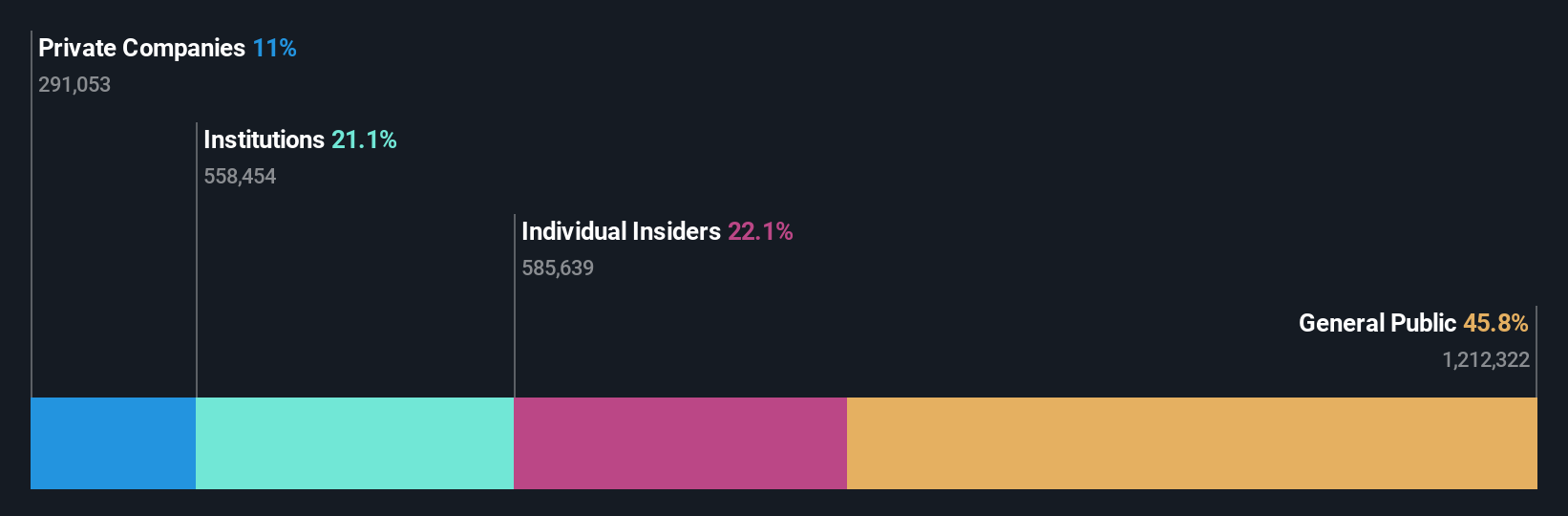

Overview: James River Group Holdings operates as an insurance holding company primarily engaged in providing specialty insurance services through its Excess and Surplus Lines and Specialty Admitted Insurance segments, with a market cap of approximately $1.19 billion.

Operations: Excess and Surplus Lines is the primary revenue stream, followed by Specialty Admitted Insurance. The gross profit margin has experienced fluctuations, peaking at 47.69% in September 2014 and reaching a low of 4.39% in September 2021 before recovering to around 41.29% by June 2024. Operating expenses have varied over time but remain a significant component of the cost structure, impacting net income results across different periods.

PE: -2.4x

James River Group Holdings, a small insurance player in the U.S., has seen recent insider confidence with 100,000 shares purchased by their CEO for US$474,560. This move suggests optimism about future prospects despite being dropped from several Russell 2000 indices in late June 2025. The company recently secured a US$212.5 million unsecured revolving credit facility for corporate needs and forecasts an impressive earnings growth of over 85% annually. Leadership changes include new appointments to key roles, potentially steering strategic direction positively.

Lionsgate Studios (LION)

Simply Wall St Value Rating: ★★★★☆☆

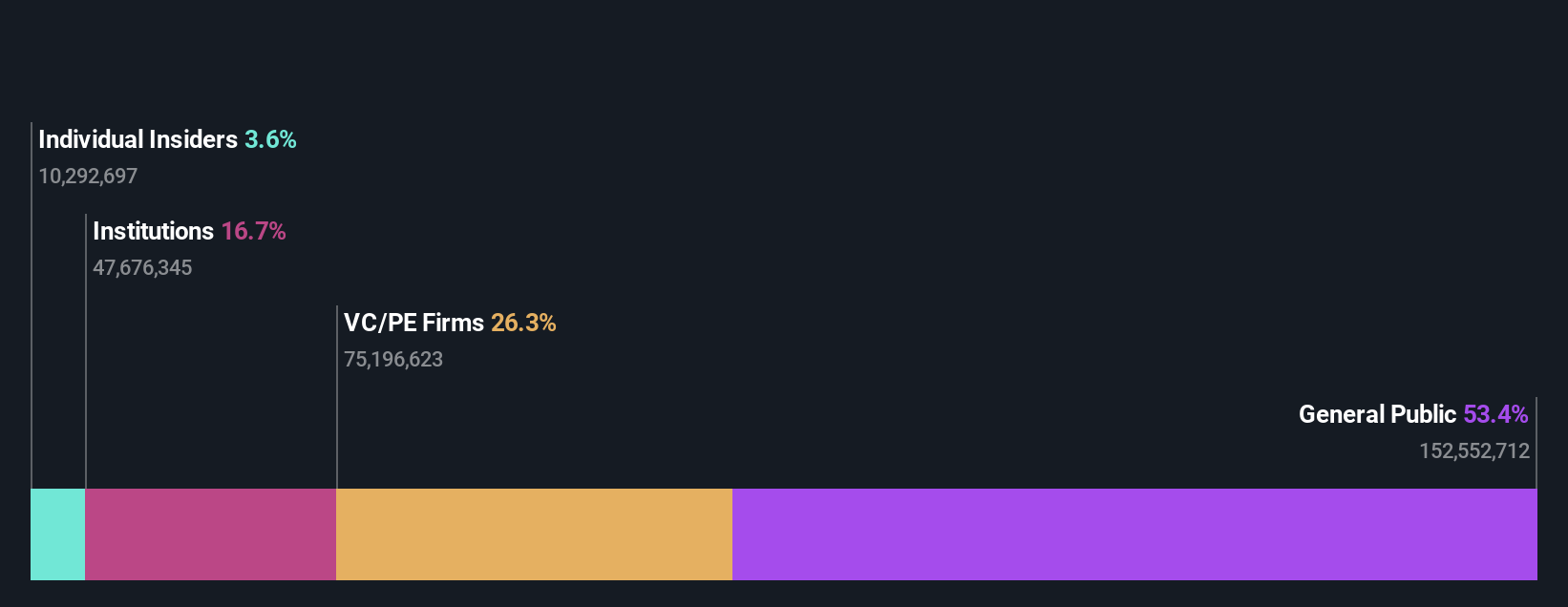

Overview: Lionsgate Studios operates through its media networks, motion picture, and television production segments with a focus on entertainment content creation and distribution, holding a market cap of $1.50 billion.

Operations: Lionsgate Studios generates revenue primarily from Media Networks, Motion Picture, and Television Production segments. The company experienced fluctuations in its net income margin, with a notable decline to -0.29% as of December 2023. Operating expenses are significant, driven by sales and marketing along with general and administrative costs. Gross profit margin reached 47.60% in the latest period ending December 2023, reflecting the company's ability to manage production costs relative to revenue generation effectively.

PE: -5.3x

Lionsgate Studios, a notable player in the entertainment sector, has recently undergone significant changes with its separation from Starz. This move aims to unlock value by focusing on its core film and TV production capabilities. Despite reporting a US$128.5 million net loss for the year ending March 31, 2025, revenue increased to US$3.2 billion from US$3 billion previously. The company is navigating high-risk external funding and limited cash runway but remains attractive with insider confidence shown through share purchases earlier this year. Rumors of a potential takeover by Legendary Entertainment have spurred interest, reflecting market belief in Lionsgate's strategic potential within the industry.

- Navigate through the intricacies of Lionsgate Studios with our comprehensive valuation report here.

Explore historical data to track Lionsgate Studios' performance over time in our Past section.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 72 Undervalued US Small Caps With Insider Buying now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JRVR

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives