- United States

- /

- Consumer Finance

- /

- NasdaqGS:LX

Why LexinFintech Holdings (LX) Is Down Sharply Amid Diverging Trends Among North Asian Fintech Peers

Reviewed by Sasha Jovanovic

- In recent trading, LexinFintech Holdings saw a significant share price decline on the US market, a move that stood out among its North Asian fintech peers. Investors are closely watching for further developments amid questions about the factors contributing to this abrupt shift in sentiment.

- The sharp investor reaction underscores sensitivity to any negative signals in the competitive fintech sector, especially when similar companies experience divergent trading patterns.

- With LexinFintech's substantial share price drop in focus, we’ll examine how this could reshape its investment narrative regarding regulatory and market challenges.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

LexinFintech Holdings Investment Narrative Recap

To believe in LexinFintech Holdings, investors need confidence that the growing Chinese middle class and digital adoption will drive loan origination and recurring revenue, underpinned by ongoing risk management improvements. While the recent 14% share price decline stands out, no material new regulatory catalyst has emerged, though the move raises near-term sensitivity to funding cost and risk management concerns.

Of LexinFintech’s announcements, the recently reaffirmed full-year earnings guidance is particularly relevant: it signals management's confidence despite share price volatility and supports the catalyst of expected profit growth, which remains an important focus as investors gauge the fallout from rapid sentiment swings.

By contrast, investors should keep in mind the heightened regulatory risks around lending activity that could affect future results as...

Read the full narrative on LexinFintech Holdings (it's free!)

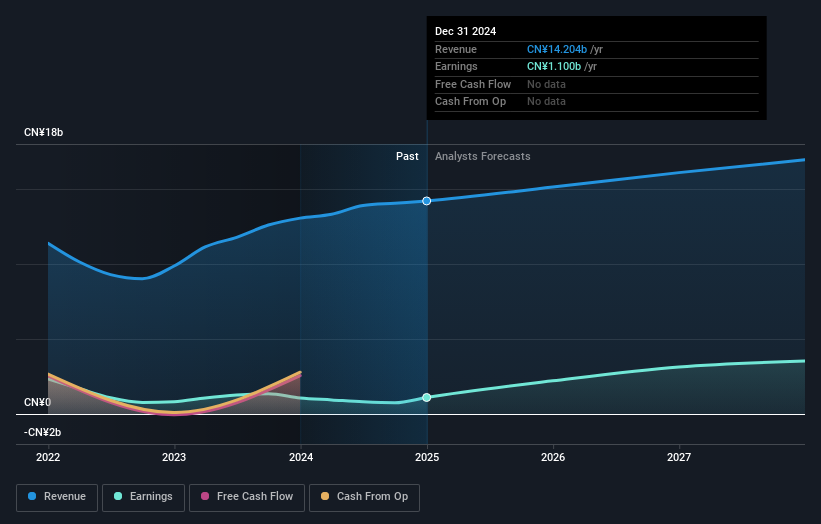

LexinFintech Holdings' narrative projects CN¥20.8 billion in revenue and CN¥4.5 billion in earnings by 2028. This requires 14.1% yearly revenue growth and a CN¥2.9 billion earnings increase from the current earnings of CN¥1.6 billion.

Uncover how LexinFintech Holdings' forecasts yield a $11.50 fair value, a 199% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members put LexinFintech’s fair value between US$5.60 and US$26.09 across eight assessments. Regulatory pressure on lending and funding costs remains a risk that could influence business quality regardless of these differences, so check several viewpoints before forming your opinion.

Explore 8 other fair value estimates on LexinFintech Holdings - why the stock might be worth over 6x more than the current price!

Build Your Own LexinFintech Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LexinFintech Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LexinFintech Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LexinFintech Holdings' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LX

LexinFintech Holdings

Offers online direct sales and online consumer finance services in the People’s Republic of China.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives