- United States

- /

- Consumer Finance

- /

- NasdaqGS:LX

LexinFintech Holdings And 2 Other Growth Stocks Insiders Are Backing

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape shaped by geopolitical tensions and anticipation of the Federal Reserve's interest rate decision, investors are keenly observing how these factors influence market volatility and economic projections. In such an environment, growth companies with high insider ownership can be particularly appealing, as insider confidence often signals strong potential for long-term value creation despite external uncertainties.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 16.2% | 39.1% |

| Ryan Specialty Holdings (RYAN) | 15.5% | 91% |

| Prairie Operating (PROP) | 34.5% | 75.7% |

| FTC Solar (FTCI) | 27.7% | 62.5% |

| Enovix (ENVX) | 12.1% | 58.4% |

| Eagle Financial Services (EFSI) | 15.9% | 82.8% |

| Credo Technology Group Holding (CRDO) | 12.1% | 45% |

| Atour Lifestyle Holdings (ATAT) | 22.6% | 24.1% |

| Astera Labs (ALAB) | 14.8% | 44.4% |

| Antalpha Platform Holding (ANTA) | 18.4% | 40.4% |

Let's explore several standout options from the results in the screener.

LexinFintech Holdings (LX)

Simply Wall St Growth Rating: ★★★★☆☆

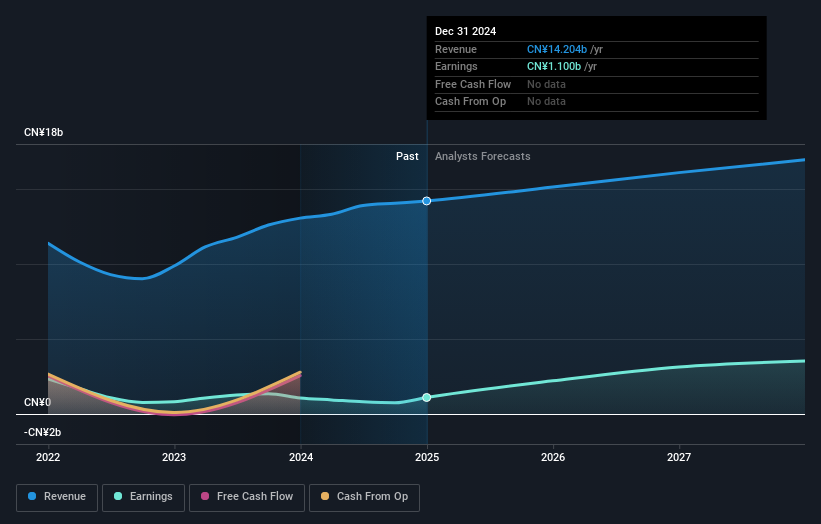

Overview: LexinFintech Holdings Ltd. operates in the People’s Republic of China, providing online direct sales and consumer finance services, with a market cap of approximately $1.21 billion.

Operations: LexinFintech Holdings Ltd. generates revenue primarily through its online retailers segment, which accounts for CN¥14.07 billion.

Insider Ownership: 35%

LexinFintech Holdings demonstrates potential as a growth company with significant insider ownership. Despite revenue forecasted to grow slower than the US market, earnings are expected to increase substantially at 34.9% annually, surpassing market averages. Recent earnings reports show net income improvements, and the board has approved an increased dividend payout ratio from 25% to 30%. The stock trades at a substantial discount below its estimated fair value, offering attractive valuation compared to peers.

- Unlock comprehensive insights into our analysis of LexinFintech Holdings stock in this growth report.

- Our comprehensive valuation report raises the possibility that LexinFintech Holdings is priced lower than what may be justified by its financials.

loanDepot (LDI)

Simply Wall St Growth Rating: ★★★★☆☆

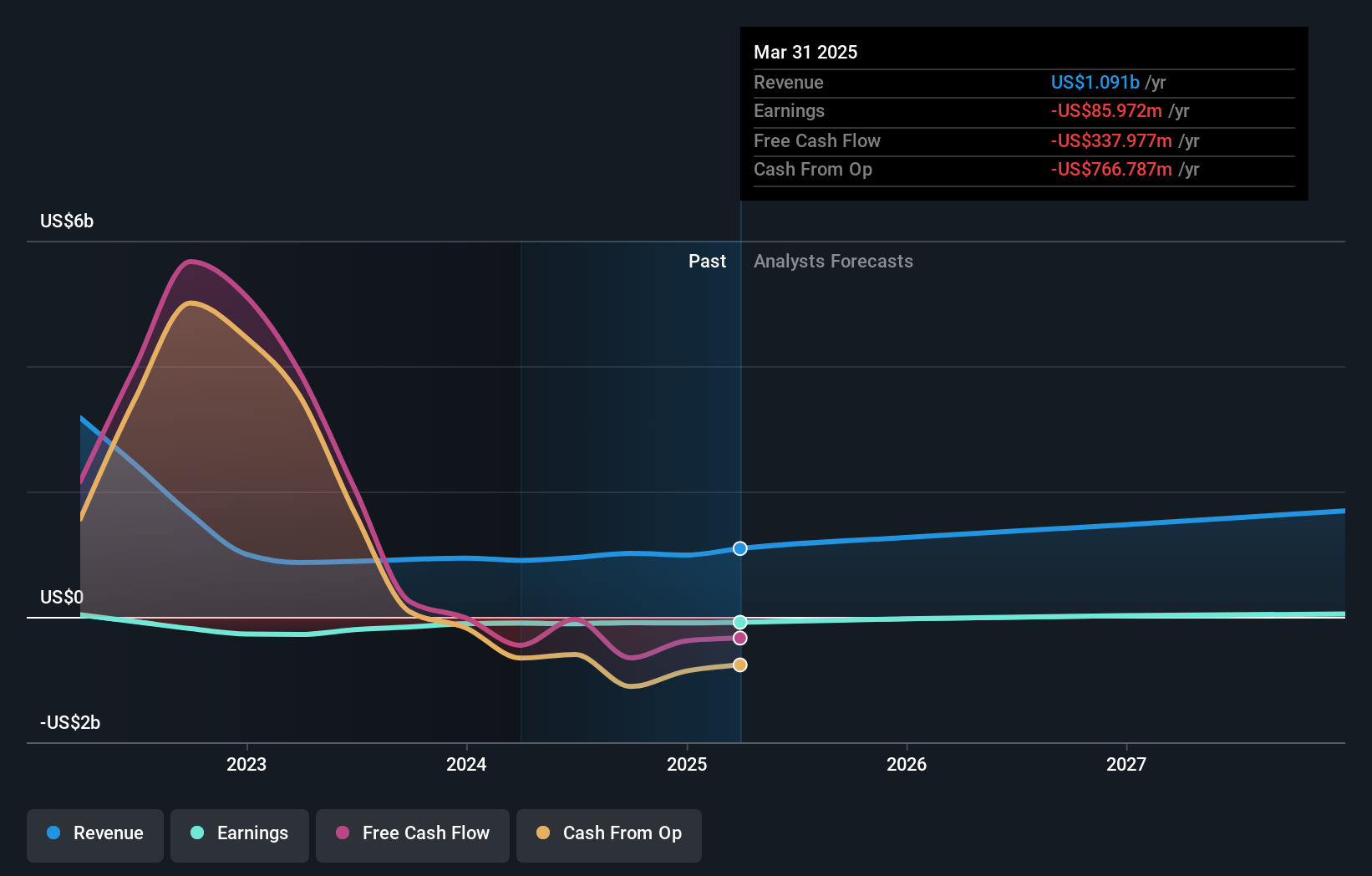

Overview: loanDepot, Inc. operates in the United States by originating, financing, selling, and servicing residential mortgage loans with a market cap of approximately $465.17 million.

Operations: The company's revenue primarily comes from the originating, financing, and selling of mortgage loans, amounting to $1.09 billion.

Insider Ownership: 17.3%

loanDepot shows potential for growth with substantial insider ownership, although its revenue is projected to grow at 15.7% annually, which is slower than some high-growth peers but faster than the overall US market. The company reported a reduced net loss of US$21.9 million in Q1 2025 compared to the previous year. Despite current losses, earnings are expected to grow significantly at over 100% annually and become profitable within three years.

- Take a closer look at loanDepot's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of loanDepot shares in the market.

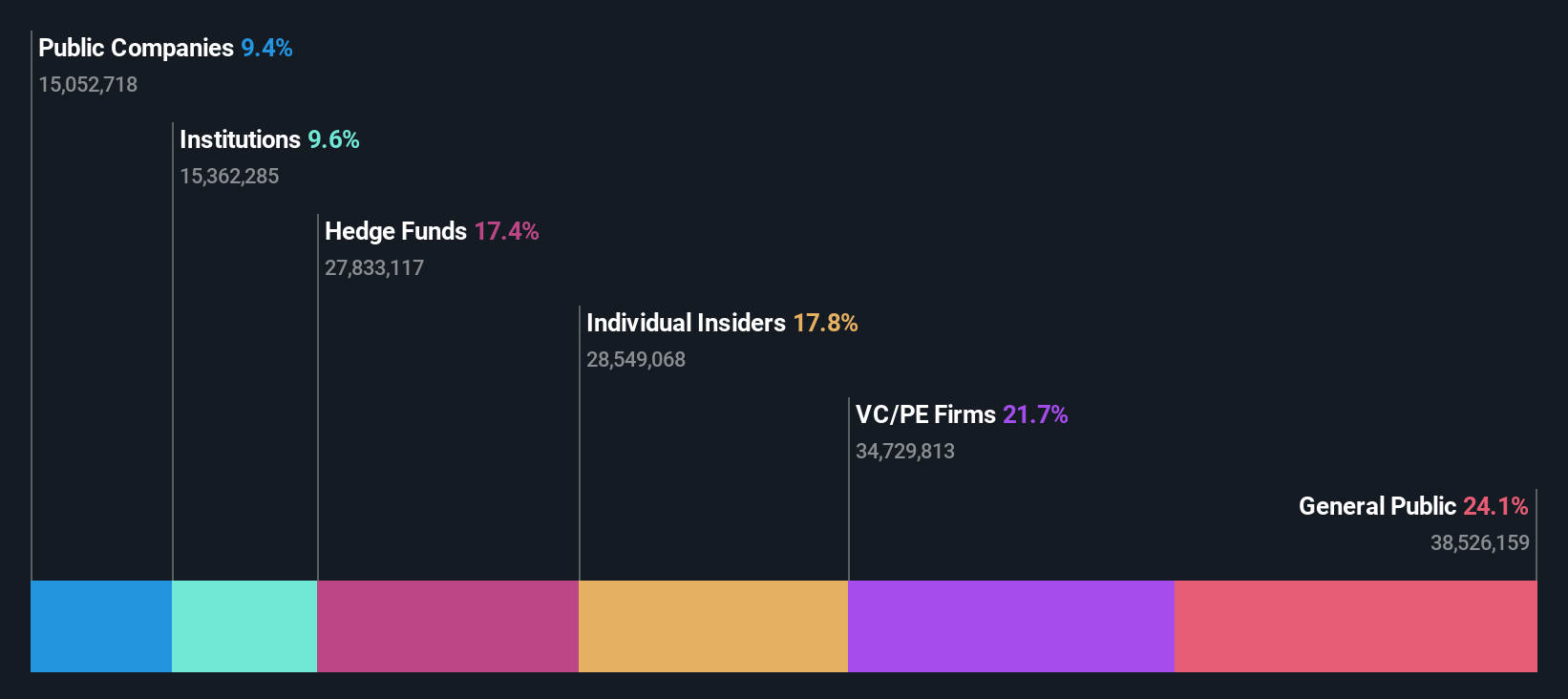

ZKH Group (ZKH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ZKH Group Limited operates a trading and service platform for MRO products, including spare parts and office supplies, in China with a market cap of approximately $496.16 million.

Operations: The company's revenue is primarily derived from its Business-To-Business Trading and Services of Industrial Products segment, which generated CN¥8.84 billion.

Insider Ownership: 17.8%

ZKH Group, with significant insider ownership, is poised for growth as it integrates R&D and production at its new Taicang facility. The company's revenue is projected to grow 11.1% annually, outpacing the US market. Recent earnings show a reduced net loss of CNY 66.72 million in Q1 2025 compared to last year. ZKH's strategic share repurchase program worth US$50 million reflects confidence in its valuation, trading significantly below estimated fair value.

- Click here and access our complete growth analysis report to understand the dynamics of ZKH Group.

- The valuation report we've compiled suggests that ZKH Group's current price could be quite moderate.

Taking Advantage

- Discover the full array of 191 Fast Growing US Companies With High Insider Ownership right here.

- Contemplating Other Strategies? These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LX

LexinFintech Holdings

Offers online direct sales and online consumer finance services in the People’s Republic of China.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives