- United States

- /

- Capital Markets

- /

- NasdaqGM:LPRO

Open Lending Corporation's (NASDAQ:LPRO) Stock Retreats 27% But Earnings Haven't Escaped The Attention Of Investors

Open Lending Corporation (NASDAQ:LPRO) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 26% share price drop.

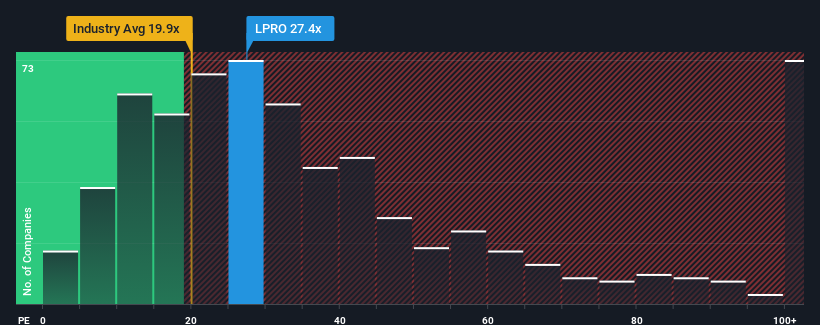

In spite of the heavy fall in price, Open Lending may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 27.4x, since almost half of all companies in the United States have P/E ratios under 16x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Open Lending has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Open Lending

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Open Lending's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 65%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 47% per year as estimated by the nine analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 10% per annum, which is noticeably less attractive.

With this information, we can see why Open Lending is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

A significant share price dive has done very little to deflate Open Lending's very lofty P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Open Lending maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Open Lending that you should be aware of.

Of course, you might also be able to find a better stock than Open Lending. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:LPRO

Open Lending

Provides lending enablement and risk analytics solutions to credit unions, regional banks, finance companies, and captive finance companies of automakers in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success