- United States

- /

- Capital Markets

- /

- NasdaqGS:LPLA

LPL Financial (LPLA) Valuation in Focus After Major Shareholder Exit and Lawsuit Spark New Concerns

Reviewed by Kshitija Bhandaru

Two major developments have put LPL Financial Holdings (LPLA) in the spotlight this week. Artisan Mid Cap Fund exited its position in the company, raising concerns over recent slowdowns in growth and profitability. At the same time, LPL Financial is facing a lawsuit from First Tech Federal Credit Union regarding alleged misappropriation of client information as well as a sizable loss of assets.

See our latest analysis for LPL Financial Holdings.

LPL Financial’s share price has remained resilient despite this turbulence, with a 1-year total shareholder return of 32.3% and a five-year total return topping 328%. While the company's year-to-date price gain is a modest 3%, recent headlines have drawn investors’ attention to rising near-term risks. This suggests that momentum may be fading after a strong multiyear run.

If this week’s developments have you rethinking your strategy, it might be the perfect opportunity to discover fast growing stocks with high insider ownership.

Yet with this backdrop of heightened uncertainty, LPL Financial’s shares still trade at a sizable discount to analyst targets. Does this mean markets are overlooking a genuine buying opportunity, or is future growth already factored in?

Most Popular Narrative: 20.4% Undervalued

LPL Financial Holdings is trading well below the narrative’s fair value estimate, with a last close of $337.94 versus the consensus valuation of $424.79. This big gap has fueled debate over whether the stock’s upside is fully realized. This sets up a critical look at what is driving future expectations.

Strategic investments in proprietary technology platforms and automation are driving ongoing operational efficiencies and leading to improved operating leverage and sustainable gains in net margins. These developments are reflected in enhanced margin guidance and cost discipline initiatives that are ahead of schedule.

Want to know how these technology bets translate into future profits? The narrative’s bold financial projections hinge on assumptions about outpacing competitors and about margin expansion not seen in recent years. Which growth triggers are baked into this price? Dive in to uncover the numbers behind the valuation.

Result: Fair Value of $424.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing advisor recruitment or a sudden drop in interest rates could quickly challenge the upbeat outlook that underpins current bullish projections.

Find out about the key risks to this LPL Financial Holdings narrative.

Another View: Market Ratios Tell a Different Story

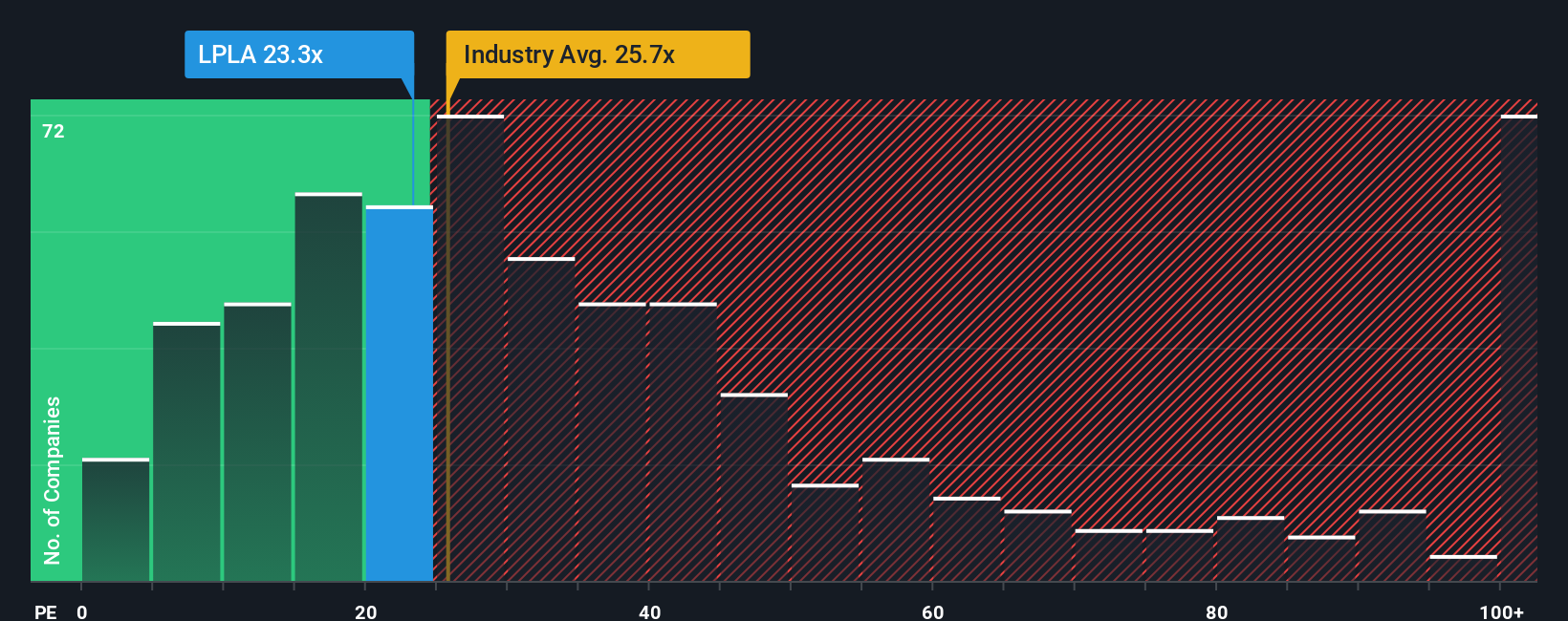

Looking at where LPL Financial trades on price-to-earnings, its 24.2x ratio is a touch above peer averages of 24.1x and well above the fair ratio of 19.7x, especially given the current industry trend of 25.9x. This could mean the stock’s valuation risk is higher than it appears from fair value models. Has the market already priced in much of the optimism, or is there more upside left for patient investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LPL Financial Holdings Narrative

If the current outlook does not quite fit your view, or you would rather dig into the data firsthand, you can shape your own perspective in just a few minutes with Do it your way.

A great starting point for your LPL Financial Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Stock Moves?

Don't let a single portfolio idea define your strategy. Uncover fresh opportunities beyond LPL Financial for your watchlist. Your next big winner could be waiting. Take control and act now before these trends leave you behind.

- Take advantage of high-yield opportunities by checking out these 18 dividend stocks with yields > 3% with proven track records for strong income and stability.

- Spot tomorrow’s breakthroughs by following these 24 AI penny stocks capitalizing on artificial intelligence and machine learning innovation across industries.

- Stay ahead of the curve with these 871 undervalued stocks based on cash flows and find stocks trading below their intrinsic value before the market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LPLA

LPL Financial Holdings

Provides an integrated platform of brokerage and investment advisory services to independent financial advisors and financial advisors at institutions in the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives