- United States

- /

- Capital Markets

- /

- NasdaqGS:LPLA

LPL Financial Holdings (NasdaqGS:LPLA) Unveils WealthVision Essentials For Enhanced Advisor Services

Reviewed by Simply Wall St

LPL Financial Holdings (NasdaqGS:LPLA) has recently made headlines with the launch of WealthVision Essentials, an advanced financial planning tool designed to enhance advisors’ client services. This product introduction, coupled with significant executive promotions and a partnership agreement with First Horizon Bank, may have supported the company's 18% rise in share price last month. In a market environment marked by a slight 2% gain over recent days, these developments align with a broader trend of innovation and strategic alignments within the financial sector, suggesting positive momentum for the company's evolving business initiatives.

Be aware that LPL Financial Holdings is showing 2 possible red flags in our investment analysis.

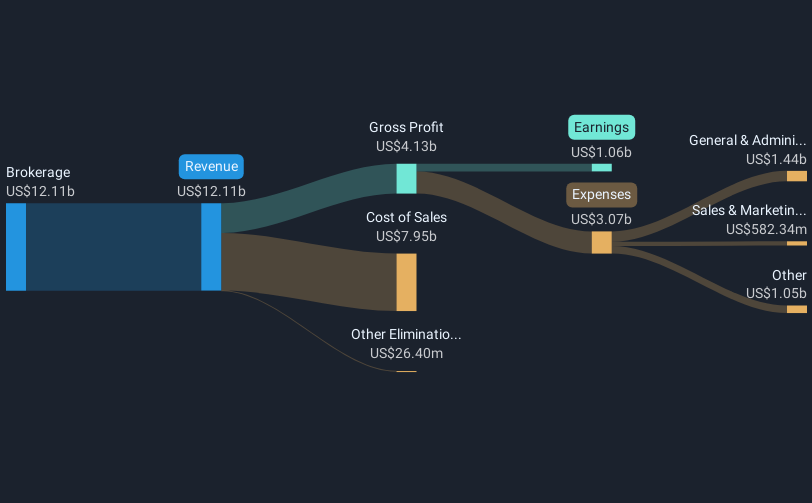

LPL Financial Holdings' recent initiatives, including WealthVision Essentials and collaborations like the one with First Horizon Bank, reflect a focus on enhancing service offerings and expanding market reach. These actions could potentially bolster LPL's asset retention and adviser experience, impacting revenue positively by building on their strategic acquisitions of Atria and Prudential. Analysts forecast a revenue growth of $16.3% annually, which aligns with the company's ongoing emphasis on high asset retention and capability expansion, promising stable revenues and improved margins.

Over a longer-term period of five years, LPL Financial's total shareholder returns, which encompass both share price appreciation and dividends, have reached a very large percentage, underscoring the company's significant performance when compared to its industry peers. In contrast, over the past year, LPL exceeded the broader US Capital Markets industry, which posted a 20% return, highlighting its robust performance in a competitive landscape. This contrasts sharply with the recent short-term share price increase of 18% last month, suggesting a continuation of a positive trend.

The recent price movements in LPL's shares place them at US$319.32, offering a 17.3% discount to the analyst consensus price target of US$386.33, indicating potential upside as per current market valuations. Although analysts project a potential earnings rise to US$2 billion by 2028, risks such as integration challenges from acquisitions and market shifts could affect these forecasts. Maintaining a balance between strengthening market reach and managing operational costs will be crucial to achieving the anticipated earnings and revenue growth.

Learn about LPL Financial Holdings' historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LPLA

LPL Financial Holdings

Provides an integrated platform of brokerage and investment advisory services to independent financial advisors and financial advisors at institutions in the United States.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives