- United States

- /

- Capital Markets

- /

- NasdaqGS:LPLA

Evaluating LPL Financial (LPLA): Is the Recent Share Price Weakness an Opportunity or Fair Value Signal?

Reviewed by Kshitija Bhandaru

LPL Financial Holdings (LPLA) has caught some investor attention as its stock edged down 1% today, continuing a soft streak over the past month. Performance trends may have some shareholders considering the underlying business and future prospects.

See our latest analysis for LPL Financial Holdings.

LPL Financial Holdings has seen its share price soften in recent weeks, reflecting some hesitation as investors weigh both growth potential and emerging risks across the sector. While short-term share price returns have recently drifted lower, the company has still managed a modest one-year total shareholder return of 0.33%, hinting at steady, if not spectacular, performance that keeps it in the conversation for long-term portfolios.

If you’re in the market for new opportunities beyond the usual suspects, this could be a great moment to broaden your search and discover fast growing stocks with high insider ownership

Given recent price weakness and a notable gap between current share value and analyst targets, investors may wonder whether LPL Financial Holdings is trading below its intrinsic worth or if the market is already accounting for the company’s future growth prospects.

Most Popular Narrative: 29.3% Undervalued

With the narrative fair value of $442.38 standing significantly above LPL Financial Holdings' last close of $312.89, the current valuation signals a sharp gap between market expectations and analyst consensus on future growth drivers.

The demographic shift toward an aging population and rising demand for financial advisory services is expanding the addressable market for LPL, as evidenced by record total assets of $1.9 trillion and strong organic net new asset growth. This supports long-term revenue growth.

Want to know what powers this bullish narrative? Analysts are betting on a profit surge and further margin boosts, supported by ambitious growth assumptions rarely seen in this sector. What projections set this target? The details just might surprise you.

Result: Fair Value of $442.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could shift quickly if interest rate volatility affects earnings or if integration challenges from recent acquisitions impact margins and growth.

Find out about the key risks to this LPL Financial Holdings narrative.

Another View: What Do Multiples Say?

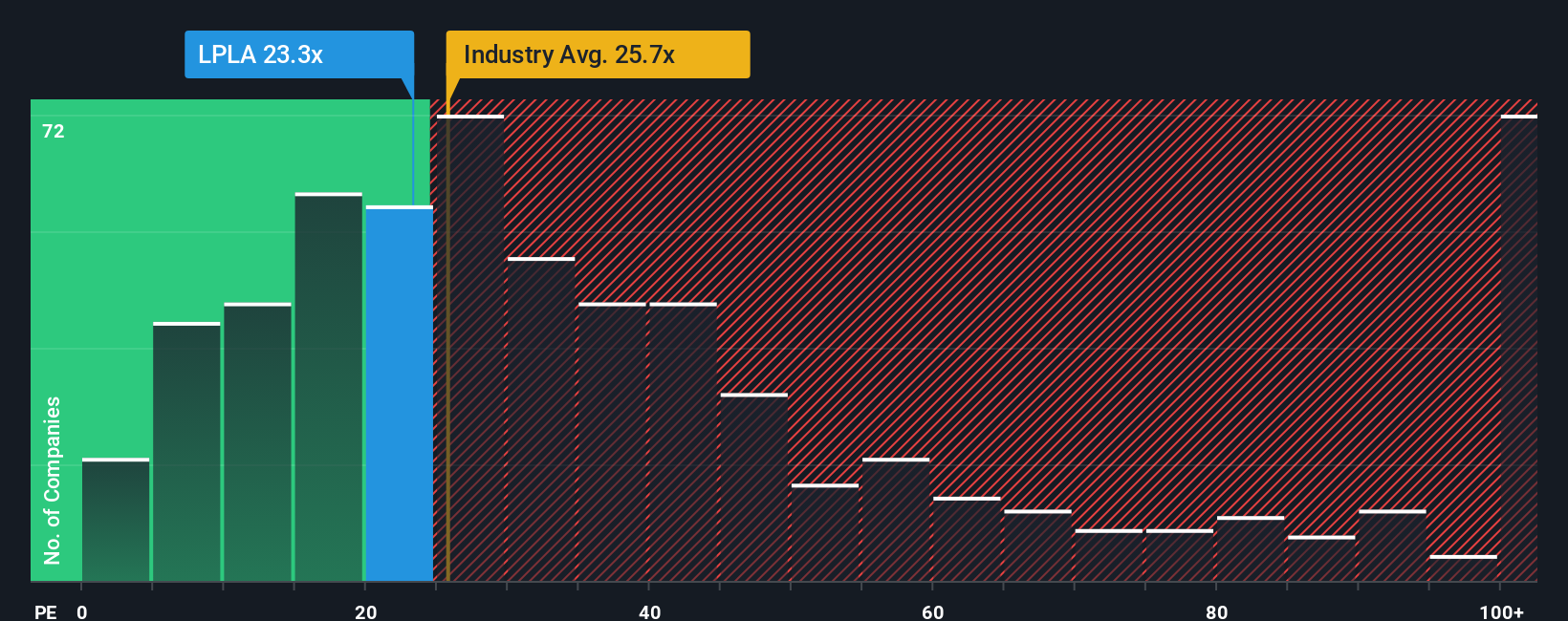

While analysts see a significant upside based on future earnings growth, the current price-to-earnings ratio offers a different perspective. LPL Financial trades at 22.4 times earnings, which is lower than the industry average of 26.3 and the peer average of 23.3, but remains above its fair ratio of 19.6. This gap suggests the market is pricing in higher growth or lower risk than the numbers might indicate. Could this suggest additional reward or potential risk for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LPL Financial Holdings Narrative

If you have a different perspective or want to dig into the numbers yourself, you can piece together your own view in just a few minutes with our tools. So why not Do it your way

A great starting point for your LPL Financial Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that timing and selection matter. Stay ahead of the crowd and don’t let great opportunities slip by right when momentum is building.

- Capitalize on breakthrough tech by checking out these 24 AI penny stocks, which are driving innovation in artificial intelligence and data-driven solutions across industries.

- Maximize your cash flow potential when you tap into these 19 dividend stocks with yields > 3%, which offers robust yields and reliable income streams for your portfolio.

- Seize value opportunities with these 907 undervalued stocks based on cash flows, featuring stocks trading below intrinsic worth before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LPLA

LPL Financial Holdings

Provides an integrated platform of brokerage and investment advisory services to independent financial advisors and financial advisors at institutions in the United States.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives