- United States

- /

- Consumer Finance

- /

- NasdaqGS:KSPI

Will Goldman’s Upgrade of Kaspi.kz (KSPI) Mark a Turning Point in Its Global Expansion Strategy?

Reviewed by Sasha Jovanovic

- Goldman Sachs recently upgraded Kaspi.kz to a buy rating, reflecting increased analyst confidence in the company's business outlook ahead of its upcoming Q3 and nine-month financial results announcement scheduled for November 10, 2025.

- This upgrade follows Kaspi.kz's earlier acquisition of a majority stake in Turkish e-commerce leader Hepsiburada, reflecting ongoing expansion in the e-commerce sector and the company's commitment to scaling its super-app platform internationally.

- We'll explore how analyst sentiment, bolstered by the recent upgrade, may influence Kaspi.kz's investment narrative and growth ambitions.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Kaspi.kz Investment Narrative Recap

To be a Kaspi.kz shareholder today, you need confidence in the company’s ability to leverage its super-app model and recent expansion into Turkey to drive sustained long-term growth, while managing both local and international competitive and regulatory risks. Goldman Sachs’ recent upgrade may increase short-term sentiment, but the upcoming Q3 results remain the primary near-term catalyst; the greatest immediate risk continues to be execution uncertainty as Kaspi.kz integrates Hepsiburada, though the news itself does not materially alter this risk landscape.

The January 2025 acquisition of a majority stake in Hepsiburada stands out, as it directly ties Kaspi.kz’s ambitions for international growth to tangible results that will likely shape near-term earnings and market expectations. Investors will be closely watching the Q3 update to assess organic growth in core Kazakhstan markets and early signals from Turkey.

However, some investors might overlook the potential operational and regulatory hurdles in new markets that could create headwinds for margin expansion...

Read the full narrative on Kaspi.kz (it's free!)

Kaspi.kz's outlook anticipates KZT 5,094.9 billion in revenue and KZT 1,669.2 billion in earnings by 2028. This projection is based on a 17.0% annual revenue growth rate and an increase in earnings of KZT 578.2 billion from the current KZT 1,091.0 billion.

Uncover how Kaspi.kz's forecasts yield a $111.40 fair value, a 51% upside to its current price.

Exploring Other Perspectives

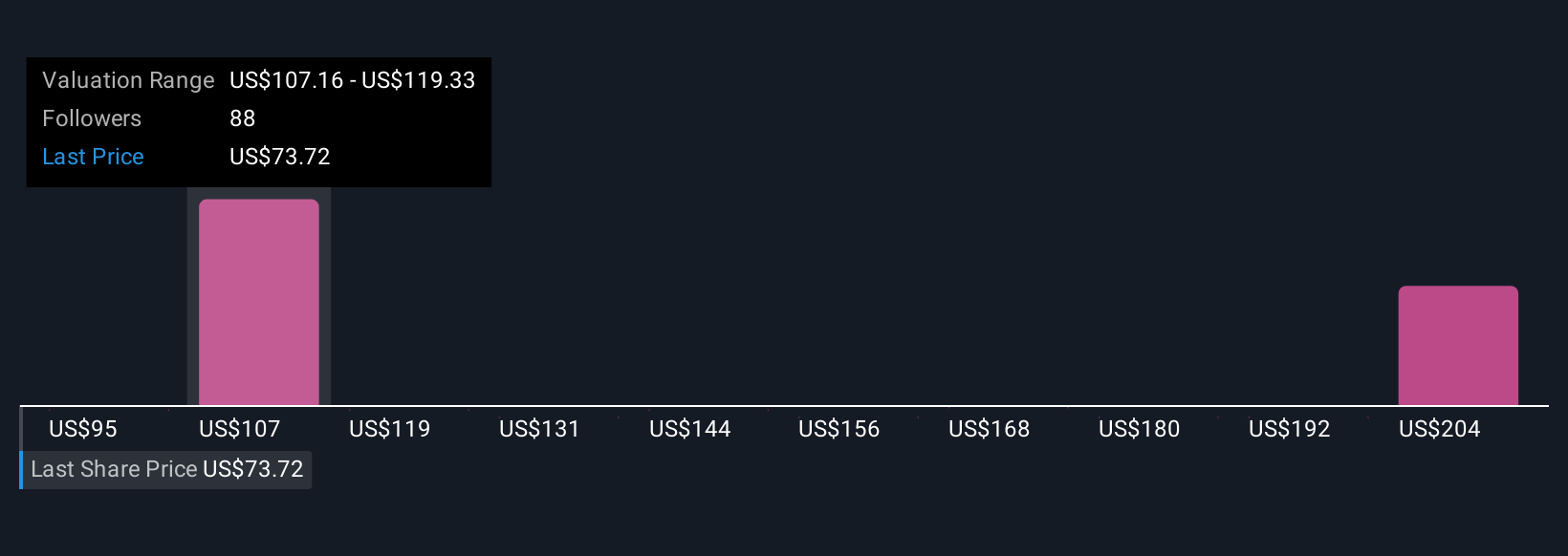

Seventeen individual fair value estimates from the Simply Wall St Community span from US$95 to US$214, offering views across a wide valuation spectrum. While many see upside, the risk of integration setbacks in Turkey may weigh on confidence and outcome, as always, it pays to consider several perspectives.

Explore 17 other fair value estimates on Kaspi.kz - why the stock might be worth over 2x more than the current price!

Build Your Own Kaspi.kz Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kaspi.kz research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Kaspi.kz research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kaspi.kz's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaspi.kz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KSPI

Kaspi.kz

Provides payments, marketplace, and fintech solutions for consumers and merchants in Kazakhstan, Azerbaijan, and Ukraine.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives