- United States

- /

- Diversified Financial

- /

- NasdaqCM:IMXI

We Think Some Shareholders May Hesitate To Increase International Money Express, Inc.'s (NASDAQ:IMXI) CEO Compensation

Key Insights

- International Money Express to hold its Annual General Meeting on 21st of June

- CEO Bob Lisy's total compensation includes salary of US$1.00m

- Total compensation is 93% above industry average

- Over the past three years, International Money Express' EPS grew by 24% and over the past three years, the total shareholder return was 34%

CEO Bob Lisy has done a decent job of delivering relatively good performance at International Money Express, Inc. (NASDAQ:IMXI) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 21st of June. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

Check out our latest analysis for International Money Express

How Does Total Compensation For Bob Lisy Compare With Other Companies In The Industry?

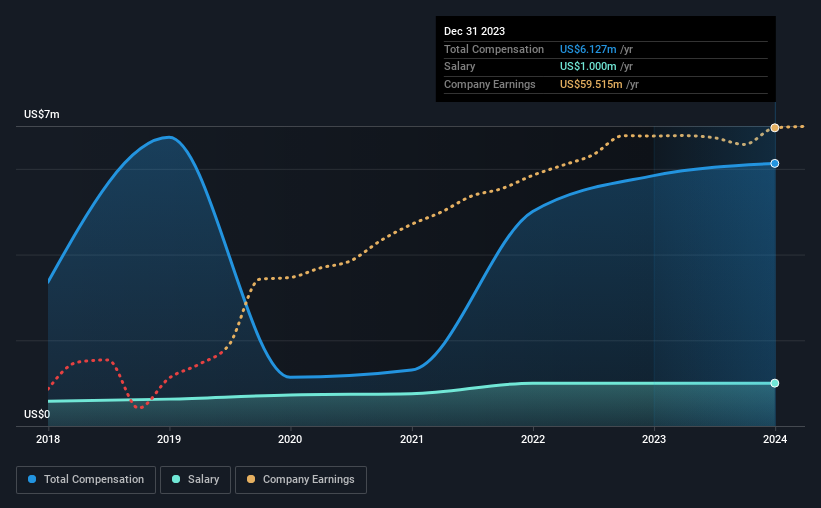

According to our data, International Money Express, Inc. has a market capitalization of US$682m, and paid its CEO total annual compensation worth US$6.1m over the year to December 2023. That's just a smallish increase of 4.9% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$1.0m.

On examining similar-sized companies in the American Diversified Financial industry with market capitalizations between US$400m and US$1.6b, we discovered that the median CEO total compensation of that group was US$3.2m. Hence, we can conclude that Bob Lisy is remunerated higher than the industry median. Furthermore, Bob Lisy directly owns US$21m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$1.0m | US$1.0m | 16% |

| Other | US$5.1m | US$4.8m | 84% |

| Total Compensation | US$6.1m | US$5.8m | 100% |

On an industry level, around 16% of total compensation represents salary and 84% is other remuneration. There isn't a significant difference between International Money Express and the broader market, in terms of salary allocation in the overall compensation package. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at International Money Express, Inc.'s Growth Numbers

Over the past three years, International Money Express, Inc. has seen its earnings per share (EPS) grow by 24% per year. In the last year, its revenue is up 15%.

This demonstrates that the company has been improving recently and is good news for the shareholders. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has International Money Express, Inc. Been A Good Investment?

We think that the total shareholder return of 34%, over three years, would leave most International Money Express, Inc. shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at International Money Express.

Switching gears from International Money Express, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:IMXI

International Money Express

Operates as an omnichannel money remittance services company in the United States, Latin America, Mexico, Central and South America, the Caribbean, Africa, and Asia.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026