- United States

- /

- Diversified Financial

- /

- NasdaqCM:IMXI

International Money Express (NASDAQ:IMXI) sheds 17% this week, as yearly returns fall more in line with earnings growth

While International Money Express, Inc. (NASDAQ:IMXI) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 28% in the last quarter. But at least the stock is up over the last five years. Unfortunately its return of 52% is below the market return of 102%.

Although International Money Express has shed US$98m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for International Money Express

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

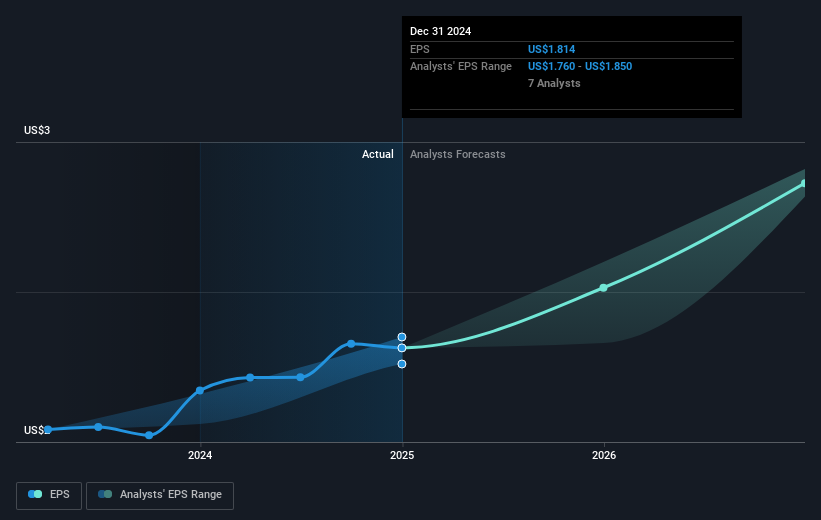

Over half a decade, International Money Express managed to grow its earnings per share at 29% a year. This EPS growth is higher than the 9% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days. This cautious sentiment is reflected in its (fairly low) P/E ratio of 8.07.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on International Money Express' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

International Money Express shareholders are down 22% for the year, but the market itself is up 19%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 9% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before deciding if you like the current share price, check how International Money Express scores on these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade International Money Express, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:IMXI

International Money Express

Operates as an omnichannel money remittance services company in the United States, Latin America, Mexico, Central and South America, the Caribbean, Africa, and Asia.

Very undervalued with flawless balance sheet.