- United States

- /

- Capital Markets

- /

- NasdaqGM:MAAS

3 US Penny Stocks With At Least $80M Market Cap

Reviewed by Simply Wall St

As the United States market experiences a tech rally led by chip stocks, with indices like the S&P 500 and Nasdaq showing gains, investors are keenly watching for opportunities in various segments. Penny stocks, though an older term, continue to represent smaller or less-established companies that might offer significant value. By focusing on those with strong financial fundamentals and potential growth trajectories, investors can uncover promising opportunities among these often-overlooked stocks.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.80 | $5.97M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.22 | $1.76B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $102.23M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.90 | $10.89M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.3021 | $12.01M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.755 | $43.66M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.77 | $47.54M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.86 | $24.83M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.04 | $88.55M | ★★★★★☆ |

Click here to see the full list of 720 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Highest Performances Holdings (NasdaqGM:HPH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Highest Performances Holdings Inc. provides financial technology services in China and has a market cap of $88.51 million.

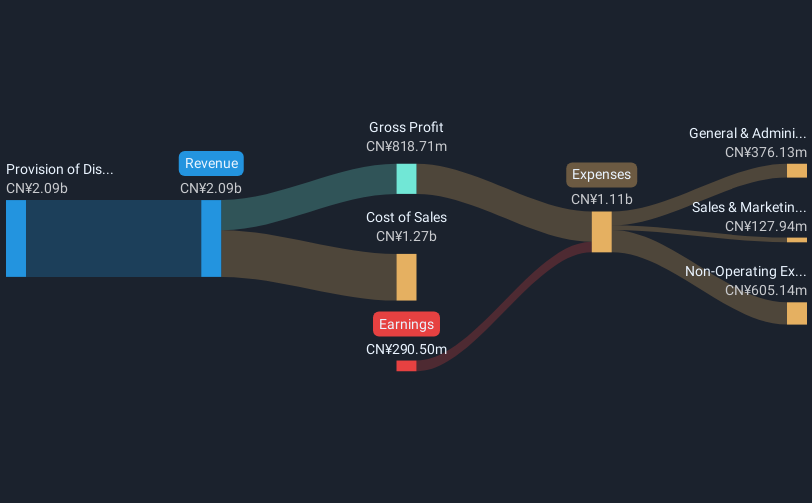

Operations: The company generates CN¥2.09 billion from its distribution and management of wealth management services segment.

Market Cap: $88.51M

Highest Performances Holdings Inc., with a market cap of US$88.51 million, faces challenges despite generating CN¥2.09 billion in revenue from its wealth management services. The company is unprofitable and has seen increased losses over the past five years. It recently received a Nasdaq notification for non-compliance with the minimum bid price requirement, providing until May 2025 to rectify this or risk delisting. While it maintains a stable cash runway exceeding three years, its board lacks experience and recent executive changes may impact strategic direction. Despite these hurdles, it has not diluted shareholders significantly in the past year.

- Jump into the full analysis health report here for a deeper understanding of Highest Performances Holdings.

- Examine Highest Performances Holdings' past performance report to understand how it has performed in prior years.

MacroGenics (NasdaqGS:MGNX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MacroGenics, Inc. is a biopharmaceutical company focused on developing, manufacturing, and commercializing antibody-based cancer therapeutics in the United States, with a market cap of $217.16 million.

Operations: The company generates revenue of $141.33 million from its operations in developing and commercializing monoclonal antibody-based therapeutics.

Market Cap: $217.16M

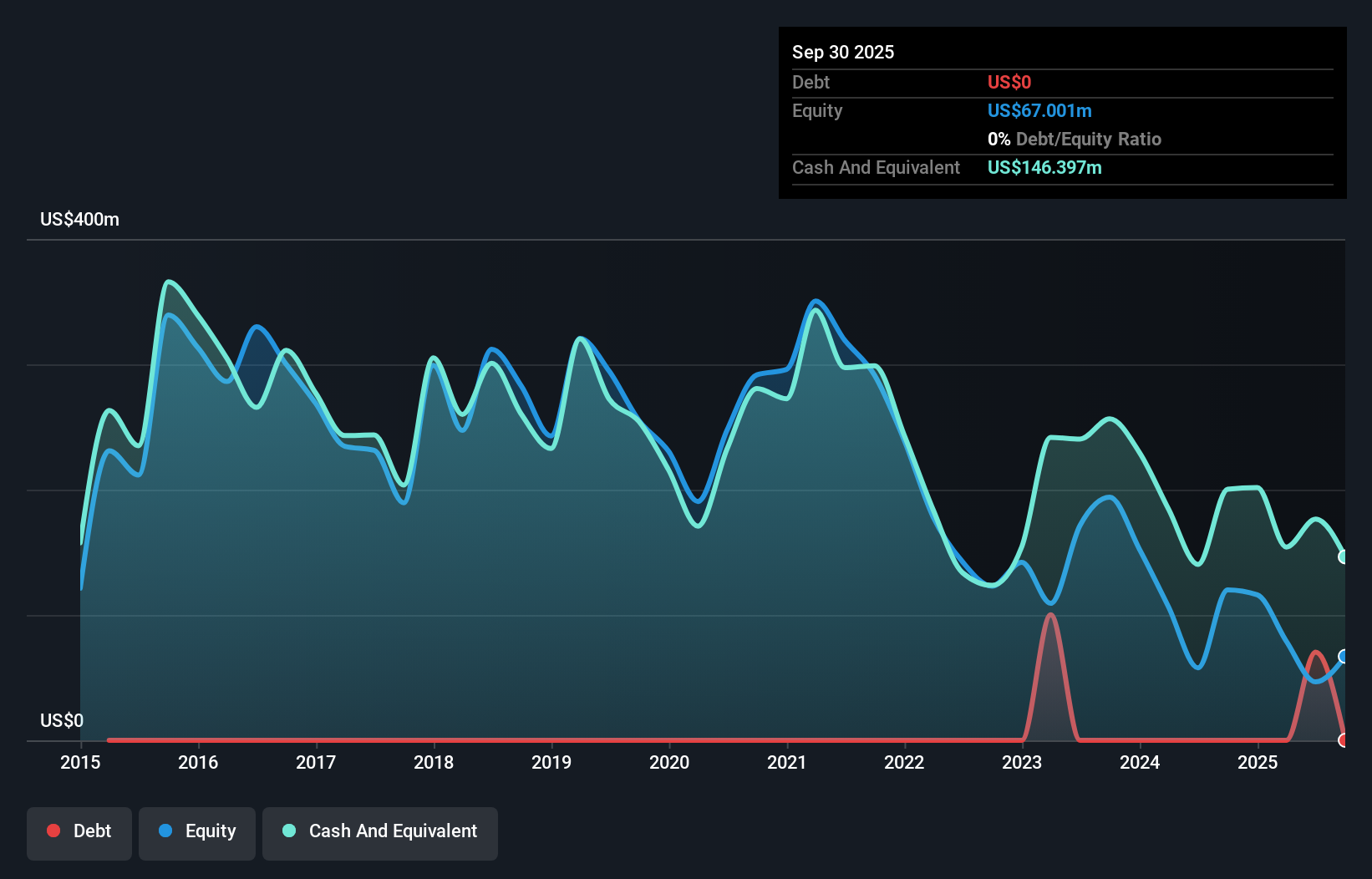

MacroGenics, Inc., with a market cap of US$217.16 million, is navigating the challenges typical of penny stocks while focusing on antibody-based cancer therapeutics. Despite being unprofitable and having a negative return on equity, it has successfully reduced losses over the past five years and maintains a solid cash runway for more than three years. Recent earnings reports show significant revenue growth to US$110.71 million in Q3 2024, though net income fluctuated year-over-year. Leadership changes are underway as CEO Scott Koenig plans to step down in early 2025, potentially impacting future strategic direction.

- Get an in-depth perspective on MacroGenics' performance by reading our balance sheet health report here.

- Learn about MacroGenics' future growth trajectory here.

3D Systems (NYSE:DDD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 3D Systems Corporation offers 3D printing and digital manufacturing solutions across various regions including the Americas, Europe, the Middle East, North Africa, the Asia Pacific, and Oceania with a market cap of approximately $459.75 million.

Operations: The company generates revenue through its Healthcare segment, which accounts for $200.56 million, and its Industrial segment, contributing $243.39 million.

Market Cap: $459.75M

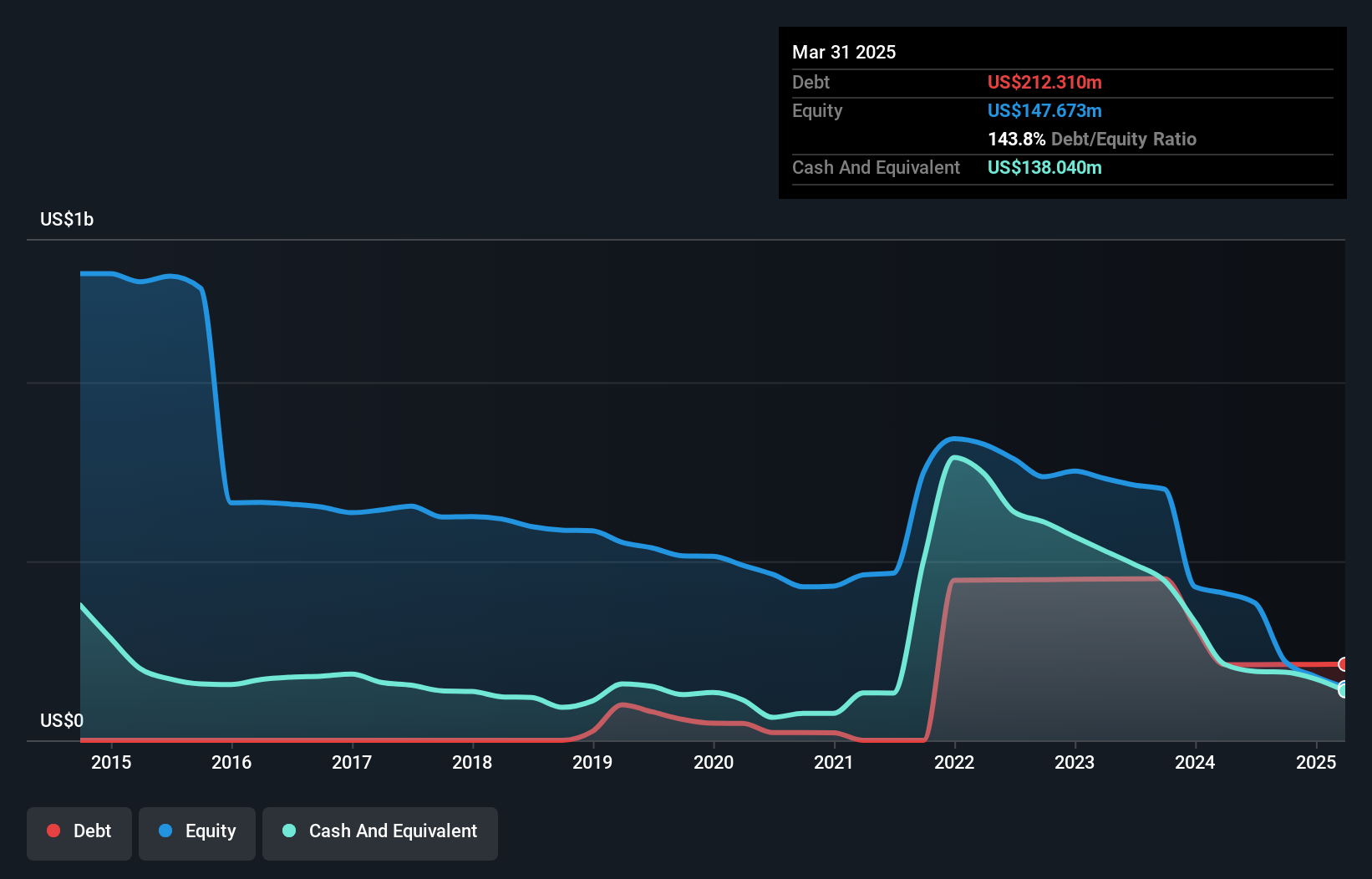

3D Systems Corporation, with a market cap of US$459.75 million, faces the volatility typical of penny stocks while offering 3D printing solutions globally. Despite its unprofitability and negative return on equity, the company maintains adequate short-term asset coverage over liabilities and has a satisfactory net debt to equity ratio. Recent earnings revealed a decline in revenue to US$112.94 million for Q3 2024 alongside significant impairment charges, leading to increased net losses. However, collaborations like that with Sauber Motorsports highlight potential growth avenues in automotive applications despite ongoing macroeconomic challenges impacting hardware sales.

- Click to explore a detailed breakdown of our findings in 3D Systems' financial health report.

- Understand 3D Systems' earnings outlook by examining our growth report.

Next Steps

- Explore the 720 names from our US Penny Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Highest Performances Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MAAS

Highest Performances Holdings

Engages in the provision of financial technology services in China.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives